Audi 2015 Annual Report Download - page 146

Download and view the complete annual report

Please find page 146 of the 2015 Audi annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ECONOMIC REPORT

BUSINESS AND UNDERLYING SITUATION

146 >>

As the clear market leader, we systematically geared our activi-

ties in China towards qualitative sales management. In the

United States, we exceeded the threshold of 200,000 unit

sales for the first time in our company history and achieved

growth of 11.1 percent. We voluntarily suspended sales of

vehicles with V6 3.0 TDI technology there in November 2015

in response to the diesel issue.

In the course of the positive overall development in volume

and as a result of favorable exchange rates, the Audi Group

increased its revenue to EUR 58,420 (53,787) million. With

further increases in upfront expenditures for new models and

innovative technologies as well as for the continuing expansion

of our worldwide production network, the operating profit

of the Audi Group came to EUR 4,836 (5,150) million. Before

special items, we achieved an operating profit of EUR 5,134

(5,150) million. To build on our strong brand position, we

made preparations for and carried out the gradual market

introduction of a large number of volume models in the past

fiscal year. These make up around 40 percent of deliveries

worldwide. Further process and cost optimization measures

along the entire value chain had a positive impact on profit

performance. The operating return on sales for 2015 reached

8.3 (9.6) percent and was therefore within the strategic target

corridor of 8 to 10 percent. Revenue, operating profit and the

operating return on sales consequently met our expectations

from the start of 2015. The return on investment was also in

line with our forecast at 19.4 (23.2) percent.

Thanks to our financial strength, we were able to complete an

extensive strategic investment with the HERE transaction,

alongside our planned investment program. The cash portion

of the purchase price attributable to the Audi Group was

EUR 668 million. As forecast in the Third Quarter Report 2015,

this transaction has a corresponding impact on the net cash

flow of the Audi Group, which amounted to EUR 1,627 (2,970)

million in the past fiscal year. In the 2014 Annual Report, we

had anticipated a net cash flow in excess of EUR 2 billion,

which is also below the previous year’s level. Adjusted for

the HERE transaction, we achieved a net cash flow of

EUR 2,295 million, in line with our plans.

The past fiscal year saw the Audi Group again invest substantial

amounts in the customer-oriented enlargement and updating

of its product portfolio, in the expansion of the worldwide

production capacities necessary for this and in pioneering

technologies. The ratio of capex (investments in property,

plant and equipment, investment property and other intangi-

ble assets, without capitalized development costs) of 6.0 (5.5)

percent in the 2015 fiscal year was therefore slightly above

our strategic target corridor of 5.0 to 5.5 percent. In the 2014

Annual Report we had anticipated a ratio of capex that was

moderately higher than the target corridor, but had adjusted

the forecast in the Interim Financial Report to a slight increase

in light of the shift in exchange rates.

Further information on the development of the key

p

erformance indicators of the Audi Group can be

found under “Deliveries and distribution” on pages

160 ff. and “Financial performance indicators” on

p

ages 165 ff.

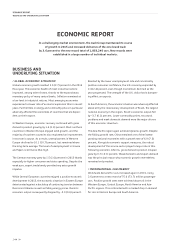

Forecast/actual comparison Audi Group

Actual 2014 Forecast for 2015 Actual 2015

Deliveries of cars of the Audi brand to customers 1,741,129 significant increase 1) 1,803,246

Revenue in EUR million 53,787 moderate increase 58,420

Operating profit in EUR million 5,150 within the strategic target corridor of 8 to 10 percent 4,836

Operating return on sales in percent 9.6 8.3

Return on investment (ROI) in percent

23.2

with more than 18 percent significantly above the

minimum rate of return of 9 percent 19.4

Net cash flow in EUR million 2,970 more than EUR 2 billion and below previous year’s level 2) 1,627

Ratio of capex in percent

5.5

moderately above the strategic target corridor of 5.0 to

5.5 percent 3) 6.0

1) Updated in the 2015 Interim Financial Report to a moderate rise

2) We indicated potential effects on the net cash flow from the completion of the HERE transaction in the Third Quarter Report 2015

3) Updated in the 2015 Interim Financial Report to slightly above the target corridor of 5.0 to 5.5 percent