Audi 2015 Annual Report Download - page 231

Download and view the complete annual report

Please find page 231 of the 2015 Audi annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

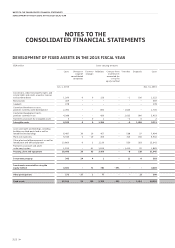

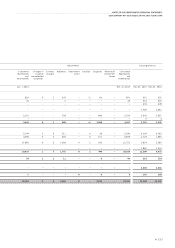

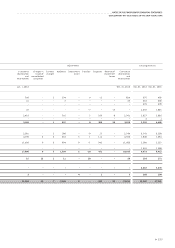

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

GENERAL INFORMATION

>> 231

to identifiable groups of assets (cash-generating units) which

should benefit from the synergies of the acquisition. Goodwill

at this level is regularly subject to impairment testing as of the

balance sheet date, with an impairment loss being recognized

if necessary.

Within the Audi Group, the predecessor method is applied in

relation to common control transactions. Under this method,

the assets and liabilities of the acquired company or business

operations are measured at the gross carrying amounts of the

previous parent company. The predecessor method thus means

that no adjustment to the fair value of the acquired assets and

liabilities is performed at the time of acquisition; any differ-

ence arising during initial consolidation is adjusted against

equity, without affecting profit or loss.

Receivables and liabilities between consolidated companies

are netted, and expenses and income eliminated. Interim

profits and losses are eliminated from Group inventories and

fixed assets. Consolidation processes affecting profit or loss

are subject to deferrals of income taxes; deferred tax assets

and liabilities are offset where the term and tax creditor are

the same.

The same recognition and measurement principles for deter-

mining the pro rata equity as applied to subsidiaries are, as a

general rule, applied to Audi Group companies accounted for

using the equity method. This is done on the basis of the last

set of audited financial statements of the company in ques-

tion. Any investments in companies accounted for using the

equity method and acquired in conjunction with a common

control transaction are also included using the predecessor

method. There is therefore no adjustment to the fair values at

the time of acquisition. Any difference between the purchase

price and share of equity is adjusted against equity, without

affecting profit or loss.

/FOREIGN CURRENCY TRANSLATION

The currency of the Audi Group is the euro (EUR). Foreign cur-

rency transactions in the separate financial statements of

AUDI AG and the subsidiaries are translated at the prevailing

exchange rate at the time of the transaction in each case.

Monetary items in foreign currencies are translated at the

exchange rate applicable on the balance sheet date. Exchange

differences are recognized in the income statements of the

respective Group companies.

The foreign companies belonging to the Audi Group are inde-

pendent entities and prepare their financial statements in

their local currency. Only AUDI HUNGARIA MOTOR Kft., Győr

(Hungary), AUDI HUNGARIA SERVICES Zrt., Győr (Hungary),

AUDI MÉXICO S.A. de C.V., San José Chiapa (Mexico), and AUDI

VOLKSWAGEN MIDDLE EAST FZE, Dubai (United Arab Emirates),

issue their annual financial statements in EUR or USD rather

than in their national currencies. The concept of the “functional

currency” is applied when translating financial statements

prepared in a foreign currency. Assets and liabilities, with the

exception of equity, are translated at the closing rate. The

effects of foreign currency translation on equity are reported in

the reserve for currency translation differences with no effect

on profit or loss. The items in the Income Statement are trans-

lated using weighted average monthly rates. Currency transla-

tion differences arising from the varying exchange rates used

in the Balance Sheet and Income Statement are recognized in

equity, without affecting profit or loss, until the disposal of the

subsidiary.

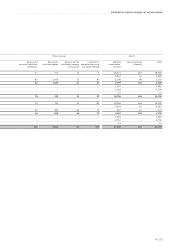

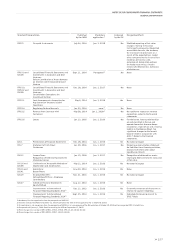

// DEVELOPMENT OF THE EXCHANGE RATES SERVING AS THE BASIS FOR CURRENCY TRANSLATION

1 EUR in foreign currency Year-end exchange rate Average exchange rate

Dec. 31, 2015 Dec. 31, 2014 2015 2014

Australia AUD 1.4897 1.4829 1.4777 1.4719

Brazil BRL 4.3117 3.2207 3.7004 3.1211

United Kingdom GBP 0.7340 0.7789 0.7259 0.8061

Japan JPY 131.0700 145.2300 134.3140 140.3061

Canada CAD 1.5116 1.4063 1.4186 1.4661

Mexico MXN 18.9145 17.8679 17.6161 17.6550

Switzerland CHF 1.0835 1.2024 1.0679 1.2146

Singapore SGD 1.5417 1.6058 1.5255 1.6824

South Korea KRW 1,280.7800 1,324.8000 1,256.5444 1,398.1424

Taiwan TWD 35.8543 38.4259 35.2497 40.2518

Thailand THB 39.2480 39.9100 38.0278 43.1469

USA USD 1.0887 1.2141 1.1095 1.3285

People’s Republic of China CNY 7.0608 7.5358 6.9733 8.1858