AT&T Wireless 2008 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2008 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

72

| AT&T Annual Report 2008

Notes to Consolidated Financial Statements (continued)

Dollars in millions except per share amounts

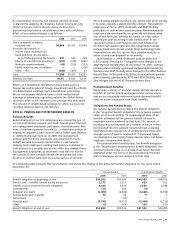

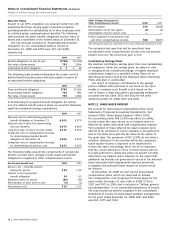

Non-U.S. Plans

As part of our ATTC acquisition, we acquired certain non-U.S.

operations that have varying types of pension programs

providing benefits for substantially all of their employees and,

to a limited group, postemployment benefits. The following

table provides the plans’ benefit obligations and fair value of

assets and a statement of the funded status at December 31.

The net amounts recorded as “Postemployment benefit

obligation” on our consolidated balance sheets at

December 31, 2008 and 2007 were $(7) and $(48),

respectively.

2008 2007

Benefit obligations at end of year $(786) $(1,016)

Fair value of plan assets 793 1,064

(Unfunded) benefit obligation $ 7 $ 48

The following table provides information for certain non-U.S.

defined-benefit pension plans with plan assets in excess of

accumulated benefit obligations:

2008 2007

Projected benefit obligation $785 $1,015

Accumulated benefit obligation 700 892

Fair value of plan assets 793 1,064

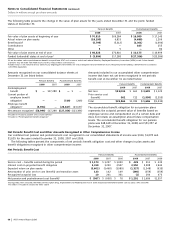

In determining the projected benefit obligation for certain

non-U.S. defined-benefit pension plans, we used the following

significant weighted-average assumptions:

2008 2007

Discount rate for determining projected

benefit obligation at December 31 6.20% 5.57%

Discount rate in effect for determining

net cost (benefit) 5.57% 4.86%

Long-term rate of return on plan assets 6.13% 6.15%

Composite rate of compensation increase

for determining projected benefit

obligation at December 31 4.06% 4.25%

Composite rate of compensation increase

for determining net pension cost 4.25% 4.36%

The following tables present the components of net periodic

benefit cost and other changes in plan assets and benefit

obligations recognized in other comprehensive income:

Net Periodic Benefit Cost 2008 2007

Service cost – benefits earned

during the period $ 25 $ 25

Interest cost on projected

benefit obligation 54 52

Expected return on assets (60) (54)

Amortization of prior service cost (5) (1)

Net pension cost $ 14 $ 22

Other Changes Recognized in

Other Comprehensive Income1 2008 2007

Net loss (gain) $70 $(105)

Amortization of net loss (gain) (2) (2)

Amortization of prior service cost — —

Total recognized in net pension cost

and other comprehensive income $68 $(107)

1FAS 158 required prospective application for fiscal years ending after December 15, 2006.

The estimated net gain that will be amortized from

accumulated other comprehensive income into net periodic

benefit cost over the next fiscal year is $13.

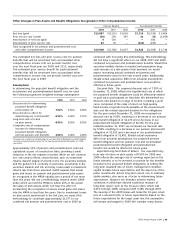

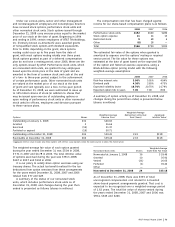

Contributory Savings Plans

We maintain contributory savings plans that cover substantially

all employees. Under the savings plans, we match in cash

or company stock a stated percentage of eligible employee

contributions, subject to a specified ceiling. There are no

debt-financed shares held by the Employee Stock Ownership

Plans, allocated or unallocated.

Our match of employee contributions to the savings

plans is fulfilled with purchases of our stock on the open

market or company cash. Benefit cost is based on the

cost of shares or units allocated to participating employees’

accounts and was $664, $633 and $412 for the years

ended December31,2008, 2007 and 2006.

NOTE 12. SHARE-BASED PAYMENT

We account for share-based compensation plans using

Statement of Financial Accounting Standards No. 123

(revised 2004) “Share-Based Payment” (FAS 123(R)).

Our accounting under FAS123(R) may affect our ability

to fully realize the value shown on our balance sheet of

deferred tax assets associated with compensation expense.

Full realization of these deferred tax assets requires stock

options to be exercised at a price equaling or exceeding the

sum of the strike price plus the fair value of the option at

the grant date. The provisions of FAS123(R) do not allow a

valuation allowance to be recorded unless the company’s

future taxable income is expected to be insufficient to

recover the asset. Accordingly, there can be no assurance

that the current stock price of our common shares will rise

to levels sufficient to realize the entire tax benefit currently

reflected in our balance sheet. However, to the extent that

additional tax benefits are generated in excess of the deferred

taxes associated with compensation expense previously

recognized, the potential future impact on income would

be reduced.

At December 31, 2008, we had various share-based

compensation plans, which are described as follows.

The compensation cost recognized for those plans for the

years ended December 31 was $166 in 2008, $720 in

2007 and $301 in 2006 and is included in “Selling, general

and administrative” in our consolidated statements of income.

The total income tax benefit recognized in the consolidated

statements of income for share-based payment arrangements

for the years ended December 31, 2008, 2007 and 2006

was $63, $275 and $116.