AT&T Wireless 2008 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2008 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

AT&T Annual Report 2008

| 69

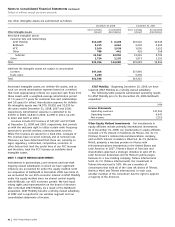

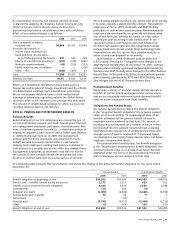

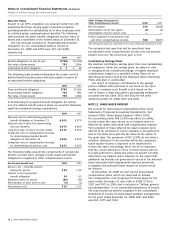

The estimated net loss and prior service cost for pension

benefits that will be amortized from accumulated other

comprehensive income into net periodic benefit cost

over the next fiscal year are $665 and $111, respectively.

The estimated prior service benefit for postretirement

benefits that will be amortized from accumulated other

comprehensive income into net periodic benefit cost over

the next fiscal year is $360.

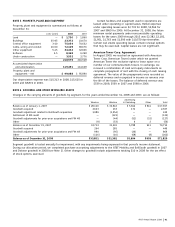

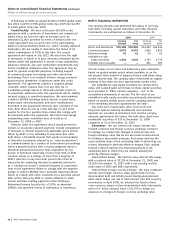

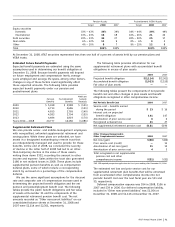

Assumptions

In determining the projected benefit obligation and the

net pension and postemployment benefit cost, we used

the following significant weighted-average assumptions:

2008 2007 2006

Discount rate for determining

projected benefit obligation

at December 31 7.00% 6.50% 6.00%

Discount rate in effect for

determining net cost (benefit)1 6.50% 6.00% 5.75%

Long-term rate of return

on plan assets 8.50% 8.50% 8.50%

Composite rate of compensation

increase for determining

projected benefit obligation

and net pension cost (benefit) 4.00% 4.00% 4.00%

1

Discount rate in effect for determining net cost (benefit) of BellSouth and AT&T Mobility

pension and postretirement plans for the two-day period ended December 31, 2006,

was 6.00%.

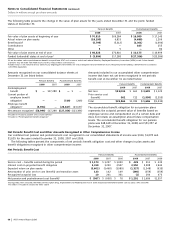

Approximately 10% of pension and postretirement costs are

capitalized as part of construction labor, providing a small

reduction in the net expense recorded. While we will continue

our cost-control efforts, certain factors, such as investment

returns, depend largely on trends in the U.S. securities markets

and the general U.S. economy. In particular, uncertainty in the

securities markets and U.S. economy could result in investment

returns less than those assumed. GAAP requires that actual

gains and losses on pension and postretirement plan assets

be recognized in the MRVA equally over a period of not more

than five years. We use a methodology, allowed under GAAP,

under which we hold the MRVA to within 20% of the actual

fair value of plan assets, which can have the effect of

accelerating the recognition of excess actual gains and losses

into the MRVA to less than five years. Due to investment losses

on plan assets experienced in the last year, we expect this

methodology to contribute approximately $1,577 to our

combined net pension and postretirement cost in 2009 as

compared with not using this methodology. This methodology

did not have a significant effect on our 2008, 2007 and 2006

combined net pension and postretirement benefits. Should the

securities markets decline or medical and prescription drug

costs increase at a rate greater than assumed, we would

expect increasing annual combined net pension and

postretirement costs for the next several years. Additionally,

should actual experience differ from actuarial assumptions,

combined net pension and postretirement cost would be

affected in future years.

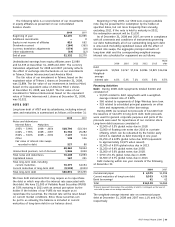

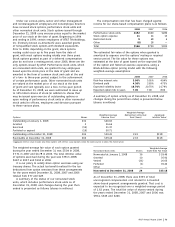

Discount Rate Our assumed discount rate of 7.00% at

December 31, 2008, reflects the hypothetical rate at which

the projected benefit obligations could be effectively settled

or paid out to participants on that date. We determined our

discount rate based on a range of factors, including a yield

curve comprised of the rates of return on high-quality,

fixed-income corporate bonds available at the measurement

date and the related expected duration for the obligations.

For the year ended December 31, 2008, we increased our

discount rate by 0.50%, resulting in a decrease in our pension

plan benefit obligation of $2,176 and a decrease in our

postretirement benefit obligation of $2,154. For the year

ended December 31, 2007, we increased our discount rate

by 0.50%, resulting in a decrease in our pension plan benefit

obligation of $2,353 and a decrease in our postretirement

benefit obligation of $2,492. Should actual experience

differ from actuarial assumptions, the projected pension

benefit obligation and net pension cost and accumulated

postretirement benefit obligation and postretirement

benefit cost would be affected in future years.

Expected Long-Term Rate of Return Our expected long-

term rate of return on plan assets of 8.50% for 2009 and

2008 reflects the average rate of earnings expected on the

funds invested, or to be invested, to provide for the benefits

included in the projected benefit obligations. In setting the

long-term assumed rate of return, management considers

capital markets future expectations and the asset mix of the

plans’ investments. Actual long-term return can, in relatively

stable markets, also serve as a factor in determining future

expectations. However, the dramatic adverse market

conditions in 2008 have skewed traditional measure of

long-term return, such as the 10-year return, which was

4.21% through 2008, compared with 9.18% through 2007.

The severity of the 2008 losses will make the 10-year return

less of a relevant factor in future expectations. Based on the

future expectations for the target asset mix, this assumption

will remain unchanged for 2009. We consider many factors

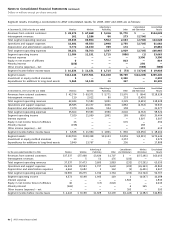

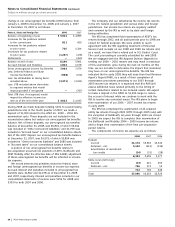

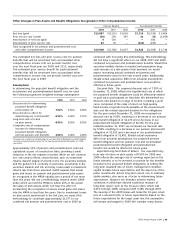

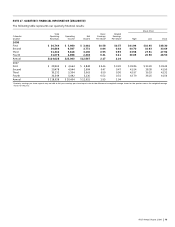

Other Changes in Plan Assets and Benefit Obligations Recognized in Other Comprehensive Income

Pension Benefits Postretirement Benefits

2008 2007 2006 2008 2007 2006

Net loss (gain) $13,857 $(2,131) $2,650 $1,716 $(2,525) $ 3,404

Prior service cost (credit) (16) 139 387 32 (28) (1,655)

Amortization of net loss (gain) 4 154 — — 181 —

Amortization of prior service cost 83 78 — (222) (223) —

Total recognized in net pension and postretirement cost

and other comprehensive income $13,928 $(1,760) $3,037 $1,526 $(2,595) $ 1,749