AT&T Wireless 2008 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2008 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

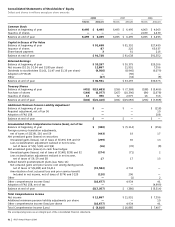

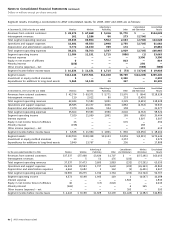

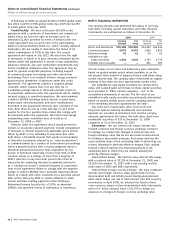

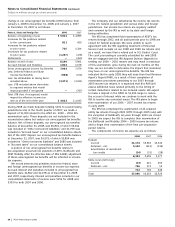

Notes to Consolidated Financial Statements (continued)

Dollars in millions except per share amounts

58

| AT&T Annual Report 2008

respective consolidated statements of income and reporting

the ownership percentage of AT&T Mobility’s net assets as

“Investments in and Advances to AT&T Mobility” and the

ownership percentage of YPC’s net assets as “Investments

in Equity Affiliates” on the respective consolidated balance

sheets. After the BellSouth acquisition, BellSouth, AT&T

Mobility and YPC became wholly-owned subsidiaries of AT&T,

and the operational results of these companies have been

included in our consolidated financial statements since the

December 29, 2006 acquisition date.

Under the purchase method of accounting, the transaction

was valued, for accounting purposes, at approximately $66,800

and the assets and liabilities of BellSouth were recorded at

their respective fair value at the date of acquisition.

Other Acquisitions During 2008, we acquired

Easterbrooke Cellular Corporation, Windstream Wireless,

Wayport Inc. and the remaining 64% of Edge Wireless

for a combined $663, recording $449 in goodwill.

The acquisitions of these companies are designed to

expand our wireless and Wi-Fi coverage area.

During 2007, we acquired Interwise®, a global provider

of voice, Web and video conferencing services to businesses,

for $122 and Ingenio®, a provider of Pay Per Call® technology

for directory and local search business, for $195, net of cash.

We recorded $304 of goodwill related to these acquisitions.

During 2006, we acquired Comergent Technologies,

Nistevo Corporation and USinternetworking, Inc., for a

combined $500, recording $333 in goodwill. The acquisitions

of these companies are designed to enhance our service

offerings for Web hosting and application management.

Dispositions

In April 2008, we sold to Local Insight Regatta Holdings, Inc.,

the parent company of Local Insight Yellow Pages, the

Independent Line of Business segment of the L.M. Berry

Company for $230.

In May 2007, we sold to Clearwire Corporation (Clearwire),

a national provider of wireless broadband Internet access,

education broadband service spectrum and broadband

radio service spectrum valued at $300. Sale of this spectrum

was required as a condition to the approval of our acquisition

of BellSouth.

Other Adjustments

As ATTC and BellSouth stock options that were converted at

the time of the respective acquisitions are exercised, the tax

effect on those options may further reduce goodwill. During

2008, we recorded $1 in related goodwill reductions for ATTC

and $9 for BellSouth.

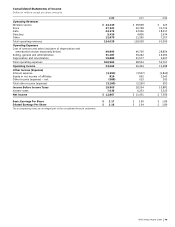

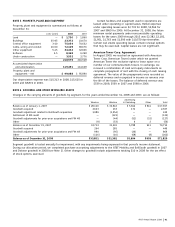

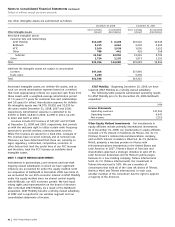

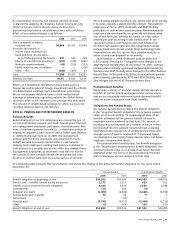

NOTE 3. EARNINGS PER SHARE

A reconciliation of the numerators and denominators of

basic earnings per share and diluted earnings per share for

the years ended December 31, 2008, 2007 and 2006 are

shown in the table below:

Year Ended December 31, 2008 2007 2006

Numerators

Numerator for basic earnings

per share:

Net Income $12,867 $11,951 $7,356

Dilutive potential common shares:

Other share-based payment 9 8 7

Numerator for diluted

earnings per share $12,876 $11,959 $7,363

Denominators (000,000)

Denominator for basic earnings

per share:

Weighted-average number

of common shares outstanding 5,927 6,127 3,882

Dilutive potential common shares:

Stock options 9 24 4

Other share-based payment 22 19 16

Denominator for diluted

earnings per share 5,958 6,170 3,902

Basic earnings per share $ 2.17 $ 1.95 $ 1.89

Diluted earnings per share $ 2.16 $ 1.94 $ 1.89

At December 31, 2008, 2007 and 2006, we had issued and

outstanding options to purchase approximately 204 million,

231 million and 309 million shares of AT&T common stock.

The exercise prices of options to purchase a weighted-average

of 144 million, 93 million and 201 million shares in 2008, 2007

and 2006 exceeded the average market price of AT&T stock.

Accordingly, we did not include these amounts in determining

the dilutive potential common shares for the respective periods.

At December 31, 2008, the exercise price of 20 million share

options was below market price.

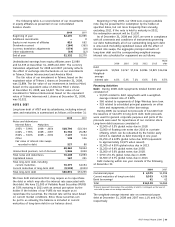

NOTE 4. SEGMENT INFORMATION

Our segments are strategic business units that offer different

products and services and are managed accordingly.

We analyze our various operating segments based on

segment income before income taxes. Interest expense,

interest income and other income (expense) – net are

managed only on a total company basis and are, accordingly,

reflected only in consolidated results. The wireless segment