AT&T Wireless 2008 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2008 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

AT&T Annual Report 2008

| 63

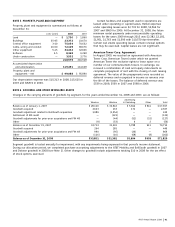

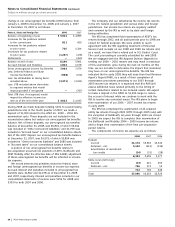

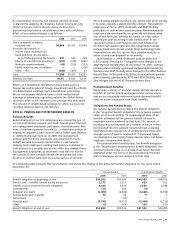

Beginning in May 2009, our $500 zero-coupon puttable

note may be presented for redemption by the holder at

specified dates, but not more frequently than annually,

excluding 2011. If the note is held to maturity in 2022,

the redemption amount will be $1,030.

As of December 31, 2008 and 2007, we were in compliance

with all covenants and conditions of instruments governing

our debt. Substantially all of our outstanding long-term debt

is unsecured. Excluding capitalized leases and the effect of

interest rate swaps, the aggregate principal amounts of

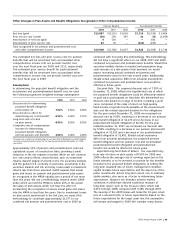

long-term debt and the corresponding weighted-average

interest rate scheduled for repayment are as follows:

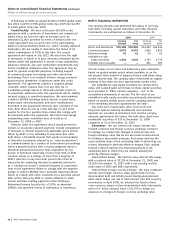

There-

2009 2010 2011 2012 2013 after

Debt

repayments $9,504 $3,767 $7,536 $4,896 $5,825 $36,916

Weighted-

average

interest rate 4.3% 5.2% 7.1% 6.6% 5.6% 6.5%

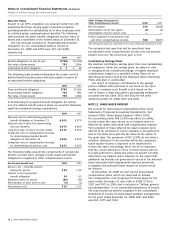

Financing Activities

Debt During 2008, debt repayments totaled $4,010 and

consisted of:

• $3,915relatedtodebtrepaymentswithaweighted-

average interest rate of 3.98%.

• $66relatedtorepaymentsofEdgeWirelesstermloan.

• $29relatedtoscheduledprincipalpaymentsonother

debt and repayments of other borrowings.

During 2008, we received net proceeds of $12,416 from

the issuance of $12,475 in long-term debt. Debt proceeds

were used for general corporate purposes and parts of the

proceeds were used for repurchases of our common stock.

Long-term debt issuances consisted of:

• $2,500of5.5%globalnotesduein2018.

• $2,000offloatingratenotesdue2010inaprivate

offering, which can be redeemed by the holder early

(which is classified as debt maturing in one year).

• €1,250of6.125%globalnotesdue2015(equivalent

to approximately $1,975 when issued).

• $1,500of4.95%globalnotesduein2013.

• $1,250of6.4%globalnotesdue2038.

• $1,000of5.6%globalnotesdue2018.

• $750of6.3%globalnotesduein2038.

• $1,500of6.7%globalnotesduein2013.

Debt maturing within one year consists of the following

at December 31:

2008 2007

Commercial paper $ 4,575 $1,859

Current maturities of long-term debt 9,503 4,939

Bank borrowings1 41 62

Total $14,119 $6,860

1 Primarily represents borrowings, the availability of which is contingent on the level of

cash held by some of our foreign subsidiaries.

The weighted-average interest rate on commercial paper

debt at December31, 2008 and 2007 was 1.1% and 4.2%,

respectively.

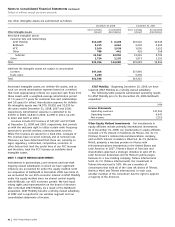

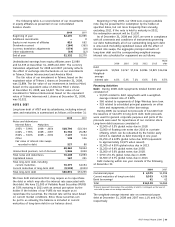

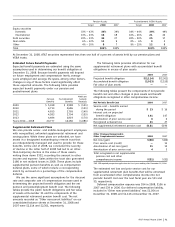

The following table is a reconciliation of our investments

in equity affiliates as presented on our consolidated

balance sheets:

2008 2007

Beginning of year $2,270 $1,995

Additional investments — 8

Equity in net income of affiliates 819 692

Dividends received (164) (395)

Currency translation adjustments (574) (18)

Other adjustments (19) (12)

End of year $2,332 $2,270

Undistributed earnings from equity affiliates were $2,989

and $2,335 at December31, 2008 and 2007. The currency

translation adjustment for 2008 and 2007 primarily reflects

the effect of exchange rate fluctuations on our investments

in Telmex, Telmex Internacional and América Móvil.

The fair value of our investment in Telmex, based on the

equivalent value of Telmex L shares at December 31, 2008,

was $1,884. The fair value of our investment in América Móvil,

based on the equivalent value of América Móvil L shares

at December 31, 2008, was $4,447. The fair value of our

investment in Telmex Internacional, based on the equivalent

value of Telmex Internacional L shares at December 31, 2008,

was $1,022.

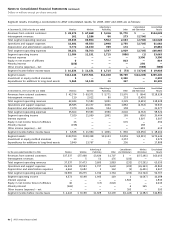

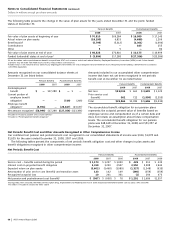

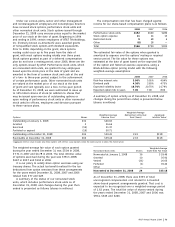

NOTE 8. DEBT

Long-term debt of AT&T and its subsidiaries, including interest

rates and maturities, is summarized as follows at December31:

2008 2007

Notes and debentures

Interest Rates Maturities

2.95% – 5.99% 2008 – 2054 $28,796 $23,324

6.00% – 7.99% 2008 – 2097 31,794 29,282

8.00% – 9.10% 2008 – 2031 7,107 7,114

Other 138 136

Fair value of interest rate swaps

recorded in debt 527 88

68,362 59,944

Unamortized premium, net of discount 1,846 2,049

Total notes and debentures 70,208 61,993

Capitalized leases 167 201

Total long-term debt, including

current maturities 70,375 62,194

Current maturities of long-term debt (9,503) (4,939)

Total long-term debt $60,872 $57,255

We have debt instruments that may require us to repurchase

the debt or which may alter the interest rate associated with

that debt. We have $1,000 of Puttable Reset Securities (PURS)

at 5.0% maturing in 2021 with an annual put option by the

holder. If the holders of our PURS do not require us to

repurchase the securities, the interest rate will be reset based

on current market conditions. Since these securities can

be put to us annually, the balance is included in current

maturities of long-term debt in our balance sheet.