AT&T Wireless 2008 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2008 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements (continued)

Dollars in millions except per share amounts

68

| AT&T Annual Report 2008

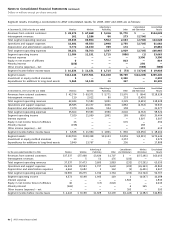

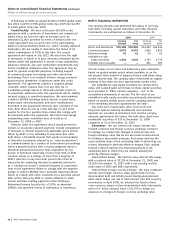

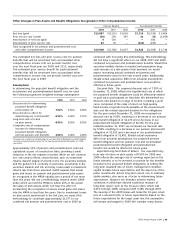

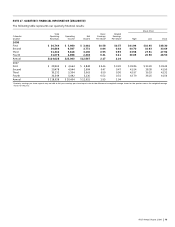

The following table presents the change in the value of plan assets for the years ended December 31 and the plans’ funded

status at December 31:

Pension Benefits Postretirement Benefits

2008 2007 2008 2007

Fair value of plan assets at beginning of year $ 70,810 $69,284 $ 16,999 $ 17,145

Actual return on plan assets (18,190) 6,833 (4,688) 1,209

Benefits paid1 (5,795) (5,312) (2,301) (1,694)

Contributions — — 165 255

Other 3 5 — 84

Fair value of plan assets at end of year $ 46,828 $70,810 $ 10,175 $ 16,999

Funded (unfunded) status at end of year2 $ (3,994) $17,288 $(27,356) $(23,386)

1 At our discretion, certain postretirement benefits are paid from AT&T cash accounts and do not reduce Voluntary Employee Beneficiary Association (VEBA) assets. Future benefit

payments may be made from VEBA trusts and thus reduce those asset balances.

2 Funded status is not indicative of our ability to pay ongoing pension benefits nor of our obligation to fund retirement trusts. Required pension funding is determined in accordance

with ERISA regulations.

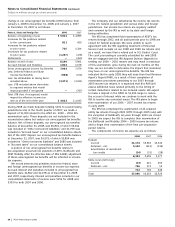

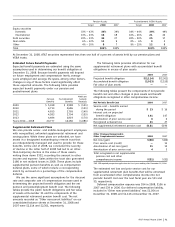

Amounts recognized on our consolidated balance sheets at

December 31 are listed below:

Pension Benefits Postretirement Benefits

2008 2007 2008 2007

Postemployment

benefit $ — $17,288 $ — $ —

Current portion of

employee benefit

obligation1 — — (729) (249)

Employee benefit

obligation2 (3,994) — (26,627) (23,137)

Net amount recognized $(3,994) $17,288 $(27,356) $(23,386)

1Included in “Accounts payable and accrued liabilities.”

2Included in “Postemployment benefit obligation.”

Amounts included in our accumulated other comprehensive

income that have not yet been recognized in net periodic

benefit cost at December 31 are listed below:

Pension Benefits Postretirement Benefits

2008 2007 2008 2007

Net loss $23,004 $ 661 $ 3,695 $ 1,125

Prior service cost

(benefit) 562 722 (1,999) (2,355)

Total $23,566 $1,383 $ 1,696 $(1,230)

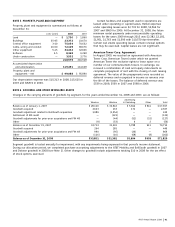

The accumulated benefit obligation for our pension plans

represents the actuarial present value of benefits based on

employee service and compensation as of a certain date and

does not include an assumption about future compensation

levels. The accumulated benefit obligation for our pension

plans was $48,618 at December 31, 2008, and $51,357 at

December 31, 2007.

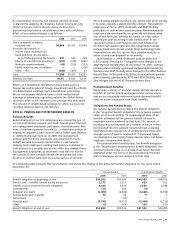

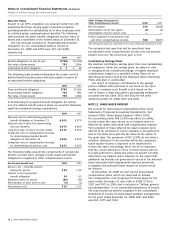

Net Periodic Benefit Cost and Other Amounts Recognized in Other Comprehensive Income

Our combined net pension and postretirement cost recognized in our consolidated statements of income was $324, $1,078 and

$1,635 for the years ended December 31, 2008, 2007 and 2006.

The following tables present the components of net periodic benefit obligation cost and other changes in plan assets and

benefit obligations recognized in other comprehensive income:

Net Periodic Benefit Cost

Pension Benefits Postretirement Benefits

2008 2007 2006 2008 2007 2006

Service cost – benefits earned during the period $ 1,173 $ 1,257 $ 1,050 $ 429 $ 511 $ 435

Interest cost on projected benefit obligation 3,319 3,220 2,507 2,550 2,588 1,943

Expected return on plan assets (5,602) (5,468) (3,989) (1,327) (1,348) (935)

Amortization of prior service cost (benefit) and transition asset 133 142 149 (360) (359) (359)

Recognized actuarial loss 10 241 361 (1) 294 473

Net pension and postretirement cost (benefit)1 $ (967) $ (608) $ 78 $ 1,291 $ 1,686 $1,557

1 During 2008, 2007 and 2006, the Medicare Prescription Drug, Improvement and Modernization Act of 2003 reduced postretirement benefit cost by $263, $342 and $349.

This effect is included in several line items above.