AT&T Wireless 2008 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2008 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

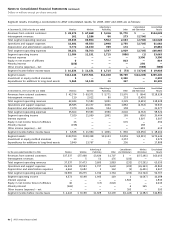

Notes to Consolidated Financial Statements (continued)

Dollars in millions except per share amounts

54

| AT&T Annual Report 2008

EITF 08-7 In November 2008, the EITF reached a

consensus on EITF 08-7, “Accounting for Defensive Intangible

Assets.” EITF 08-7 provides that intangible assets that an

acquirer intends to use as defensive assets, intangible assets

acquired in a business combination or an asset acquisition

that an entity does not intend to actively use but does intend

to prevent others from using, are a separate unit of account

from the existing intangible assets of the acquirer. It also states

that a defensive intangible asset should be amortized over

the period that the fair value of the defensive intangible asset

diminishes. EITF 08-7 is effective on a prospective basis for

transactions occurring in fiscal years, and interim periods within

those fiscal years, beginning on or after December 15, 2008.

This EITF will require AT&T to recognize at fair value certain

assets associated with trademarks for the non-surviving

companies of acquisitions and amortize these trademarks

over the period they are expected to contribute directly or

indirectly to the entity’s future cash flows.

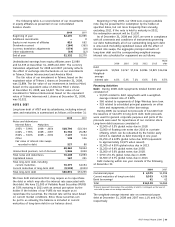

Valuation and Other Adjustments Included in the current

liabilities reported on our consolidated balance sheet are

accruals established under EITF 95-3, “Recognition of Liabilities

in Connection with a Purchase Business Combination” (EITF

95-3). The liabilities include accruals for severance, lease

terminations and equipment removal costs associated with our

acquisitions of AT&T Corp., BellSouth Corporation (BellSouth)

and Dobson Communications Corporation. Following is a

summary of the accruals recorded under EITF 95-3 at

December 31, 2007, cash payments made during 2008 and

the adjustments thereto.

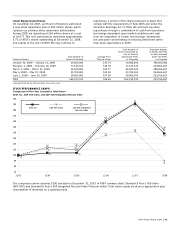

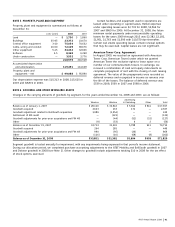

12/31/07 Cash Adjustments 12/31/08

Balance Payments and Accruals Balance

Severance accruals

paid from:

Company funds $ 540 $(321) $(79) $140

Pension and

postemployment

benefit plans 129 (26) — 103

Lease terminations 425 (110) 72 387

Equipment removal

and other

related costs 161 (62) (11) 88

Total $1,255 $(519) $(18) $718

Split-Dollar Life Insurance In 2007, the EITF ratified

the consensus on EITF 06-4, “Accounting for Deferred

Compensation and Postretirement Benefit Aspects of

Endorsement Split-Dollar Life Insurance Arrangements”

(EITF 06-4) and EITF 06-10 “Accounting for Collateral

Assignment Split-Dollar Life Insurance Arrangements”

(EITF 06-10). EITF 06-4 and EITF 06-10 cover split-dollar

life insurance arrangements (where the company owns and

controls the policy) and provides that an employer should

recognize a liability for future benefits in accordance with

Statement of Financial Accounting Standards No. 106,

“Employers’ Accounting for Postretirement Benefits Other

Than Pensions” (FAS 106). These are effective for fiscal years

beginning after December 15, 2007. We adopted EITF 06-4

and EITF 06-10 on January 1, 2008, recording additional

postretirement liabilities of $101 and a decrease to retained

earnings of $63.

Reclassifications We have reclassified certain amounts

in prior-period financial statements to conform to the current

period’s presentation.

Income Taxes We adopted Financial Accounting

Standards Board Interpretation No. 48 “Accounting for

Uncertainty in Income Taxes” (FIN 48) on January 1, 2007.

With our adoption of FIN 48, we provide deferred income

taxes for temporary differences between the carrying

amounts of assets and liabilities for financial reporting

purposes and the tax basis of assets and liabilities

computed pursuant to FIN 48. Under FIN 48, the tax bases

of assets and liabilities are based on amounts that meet

the FIN 48 recognition threshold and are measured

pursuant to the measurement requirement in FIN 48.

To the extent allowed by GAAP, we provide valuation

allowances against the deferred tax assets for which the

realization is uncertain. We review these items regularly

in light of changes in federal and state tax laws and

changes in our business.

Investment tax credits earned prior to their repeal by the

Tax Reform Act of 1986 are amortized as reductions in income

tax expense over the lives of the assets, which gave rise to

the credits. Additionally, we report taxes imposed by govern-

mental authorities on revenue-producing transactions between

us and our customers in the income statement on a net basis.

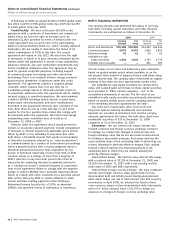

Cash Equivalents Cash and cash equivalents include all

highly-liquid investments with original maturities of three

months or less and the carrying amounts’ approximate fair

value. At December 31, 2008, we held $958 in cash and

$834 in money market funds and other cash equivalents.

Investment Securities Investments in securities principally

consist of available-for-sale instruments. Short-term and

long-term investments in money market securities are carried as

held-to-maturity securities. Available-for-sale securities consist

of various debt and equity securities that are long term in

nature. Unrealized gains and losses, net of tax, on available-

for-sale securities are recorded in accumulated other compre-

hensive income. Our investment securities maturing within

one year are recorded in “Other current assets” and instruments

with maturities of more than one year are recorded in “Other

Assets” on the consolidated balance sheets. Unrealized losses

that are considered other than temporary are recorded in Other

Income (Expense) with the corresponding reduction to the

carrying basis of the investment (see Note 11).

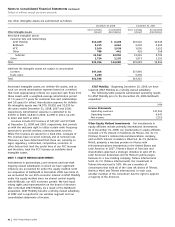

Statement of Financial Accounting Standards No.157,

“Fair Value Measurements” (FAS 157) requires disclosures for

financial assets and liabilities that are remeasured at fair value

at least annually. FAS 157 establishes a three-tier fair value

hierarchy, which prioritizes the inputs used in measuring fair

value. These tiers include: Level 1, defined as observable

inputs such as quoted prices in active markets; Level 2,