AT&T Wireless 2008 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2008 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements (continued)

Dollars in millions except per share amounts

56

| AT&T Annual Report 2008

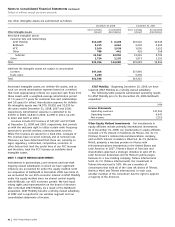

depreciation methodology; accordingly, when a portion of

their depreciable property, plant and equipment is retired

in the ordinary course of business, the gross book value is

reclassified to accumulated depreciation; no gain or loss is

recognized on the disposition of this plant.

Property, plant and equipment is reviewed for recoverability

whenever events or changes in circumstances indicate that

the carrying amount may not be recoverable. An impairment

loss shall be recognized only if the carrying amount of a

long-lived asset is not recoverable and exceeds its fair value.

The carrying amount of a long-lived asset is not recoverable

if it exceeds the sum of the undiscounted cash flows expected

to result from the use and eventual disposition of the asset.

The fair value of a liability for an asset retirement

obligation is recorded in the period in which it is incurred

if a reasonable estimate of fair value can be made. In periods

subsequent to initial measurement, period-to-period changes

in the liability for an asset retirement obligation resulting

from the passage of time and revisions to either the timing

or the amount of the original estimate of undiscounted cash

flows are recognized. The increase in the carrying value of

the associated long-lived asset is depreciated over the

corresponding estimated economic life.

Software Costs It is our policy to capitalize certain costs

incurred in connection with developing or obtaining internal-

use software. Capitalized software costs are included in

“Property, Plant and Equipment” on our consolidated balance

sheets and are primarily amortized over a three-year period.

Software costs that do not meet capitalization criteria are

expensed immediately.

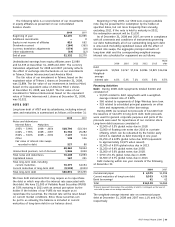

Goodwill and Other Intangible Assets Goodwill represents

the excess of consideration paid over the fair value of net

assets acquired in business combinations. Goodwill and other

indefinite-lived intangible assets are not amortized but are

tested at least annually for impairment. We have completed

our annual impairment testing for 2008 and determined

that no impairment exists.

Intangible assets that have finite useful lives are amortized

over their useful lives, a weighted average of 7.4 years.

Customer relationships are amortized using primarily the

sum-of-the-months-digits method of amortization over the

expected period in which those relationships are expected to

contribute to our future cash flows based in such a way as to

allocate it as equitably as possible to periods during which we

expect to benefit from those relationships.

A significant portion of intangible assets in our wireless

segment are Federal Communications Commission (FCC)

licenses that provide us with the exclusive right to utilize certain

radio frequency spectrum to provide wireless communications

services. While FCC licenses are issued for a fixed time, renewals

of FCC licenses have occurred routinely and at nominal cost.

Moreover, we have determined that there are currently no legal,

regulatory, contractual, competitive, economic or other factors

that limit the useful lives of our FCC licenses, and therefore

the FCC licenses are an indefinite-lived intangible asset under

the provisions of Statement of Financial Accounting Standards

No. 142, “Goodwill and Other Intangible Assets.”

In accordance with EITF No. 02-7, “Unit of Accounting

for Testing Impairment of Indefinite-Lived Intangible Assets,”

we test FCC licenses for impairment on an aggregate basis,

consistent with the management of the business on a national

scope. During the fourth quarter of 2008, we completed

the annual impairment tests for indefinite-lived FCC licenses.

These annual impairment tests resulted in no impairment

of indefinite-lived FCC licenses.

Advertising Costs Advertising costs for advertising

products and services or for promoting our corporate image

are expensed as incurred.

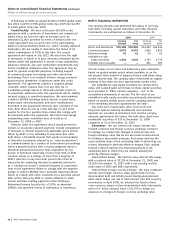

Foreign Currency Translation Our foreign investments

and foreign subsidiaries generally report their earnings in

their local currencies. We translate our share of their foreign

assets and liabilities at exchange rates in effect at the balance

sheet dates. We translate our share of their revenues and

expenses using average rates during the year. The resulting

foreign currency translation adjustments are recorded as a

separate component of accumulated other comprehensive

income in the accompanying consolidated balance sheets.

Gains and losses resulting from exchange-rate changes on

transactions denominated in a currency other than the local

currency are included in earnings as incurred.

We have also entered into foreign currency contracts to

minimize our exposure to risk of adverse changes in currency

exchange rates. We are subject to foreign exchange risk for

foreign currency-denominated transactions, such as debt

issued, recognized payables and receivables and forecasted

transactions. At December 31, 2008, our foreign currency

exposures were principally Mexican pesos, Euros, Danish

krone, Swedish krona and Canadian dollars.

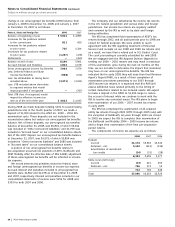

Derivative Financial Instruments We record derivatives

on the balance sheet at fair value. We do not invest in

derivatives for trading purposes. We use derivatives from

time to time as part of our strategy to manage risks

associated with our contractual commitments. These

derivatives are designated as either a hedge of the fair

value of a recognized asset or liability or of an unrecognized

firm commitment (fair value hedge), or a hedge of a

forecasted transaction or of the variability of cash flows

to be received or paid related to a recognized asset

or liability (cash flow hedge). Our derivative financial

instruments primarily include interest rate swap agreements

and foreign currency exchange contracts. For example,

we use interest rate swaps to manage our exposure to

changes in interest rates on our debt obligations (see

Note 9). We account for our interest rate swaps using

mark-to-market accounting and include gains or losses

from interest rate swaps when paid or received in interest

expense in our consolidated statements of income.

Amounts paid or received on interest rate forward

contracts are amortized over the period of the related

interest payments.

All other derivatives are not formally designated for

accounting purposes (undesignated). These derivatives,

although undesignated for accounting purposes, are entered

into to hedge economic risks.