AT&T Wireless 2008 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2008 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

AT&T Annual Report 2008

| 67

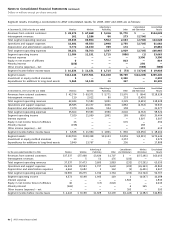

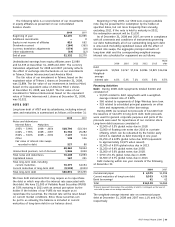

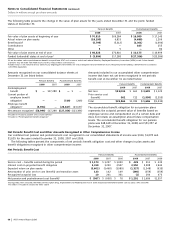

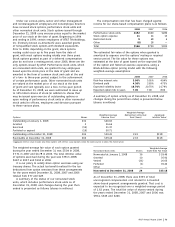

A reconciliation of income tax expense and the amount

computed by applying the statutory federal income tax rate

(35%) to income before income taxes, income from

discontinued operations, extraordinary items and cumulative

effect of accounting changes is as follows:

2008 2007 2006

Taxes computed at federal

statutory rate $6,966 $6,371 $3,809

Increases (decreases) in

income taxes resulting from:

State and local income taxes –

net of federal income tax benefit 497 549 234

Effects of international operations (157) (178) (200)

Medicare reimbursements (90) (120) (123)

Equity in net income of affiliates — — (218)

Other – net (180) (369) 23

Total $7,036 $6,253 $3,525

Effective Tax Rate 35.4% 34.4% 32.4%

Effects of international operations include items such as

foreign tax credits, sales of foreign investments and the effects

of undistributed earnings from international operations.

We do not provide deferred taxes on the undistributed

earnings of subsidiaries operating outside the United States

that have been or are intended to be permanently reinvested.

The amount of undistributed earnings for which we have not

recorded deferred taxes is not material.

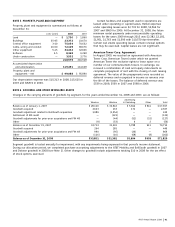

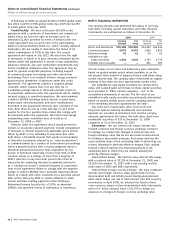

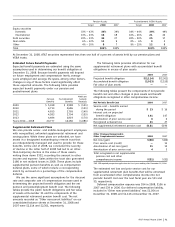

NOTE 11. PENSION AND POSTRETIREMENT BENEFITS

Pension Benefits

Substantially all of our U.S. employees are covered by one of

our noncontributory pension and death benefit plans. Many of

our management employees participate in pension plans that

have a traditional pension formula (i.e., a stated percentage of

employees’ adjusted career income) and a frozen cash balance

or defined lump sum formula. In 2005, the management

pension plan for those employees was amended to freeze

benefit accruals previously earned under a cash balance

formula. Each employee’s existing cash balance continues to

earn interest at a variable annual rate. After this change, those

management employees, at retirement, may elect to receive

the portion of their pension benefit derived under the cash

balance or defined lump sum as a lump sum or an annuity.

The remaining pension benefit, if any, will be paid as an annuity

if its value exceeds a stated monthly amount. Management

employees of former ATTC, BellSouth and AT&T Mobility

participate in cash balance pension plans. Nonmanagement

employees’ pension benefits are generally calculated using

one of two formulas: benefits are based on a flat dollar

amount per year according to job classification or are

calculated under a cash balance plan that is based on

an initial cash balance amount and a negotiated annual

pension band and interest credits. Most nonmanagement

employees can elect to receive their pension benefits in

either a lump sum payment or an annuity.

At November 1, 2008, BellSouth pension plans and

U.S. Domestic Participant T bargained were merged in the

AT&T Pension Benefit Plan. At December 31, 2007, defined

pension plans formerly sponsored by Ameritech Publishing

Ventures and AT&T Mobility were merged in the AT&T Pension

Benefit Plan. At December 31, 2006, certain defined pension

plans formerly sponsored by ATTC and AT&T Mobility were

also merged into the AT&T Pension Benefit Plan.

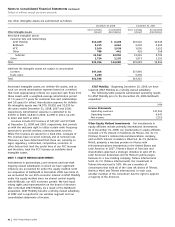

Postretirement Benefits

We provide a variety of medical, dental and life insurance

benefits to certain retired employees under various plans

and accrue actuarially-determined postretirement benefit

costs as active employees earn these benefits.

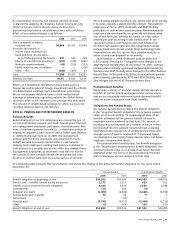

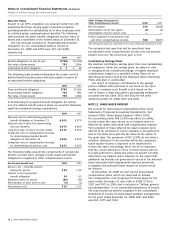

Obligations and Funded Status

For defined benefit pension plans, the benefit obligation

is the “projected benefit obligation,” the actuarial present

value, as of our December 31 measurement date, of all

benefits attributed by the pension benefit formula to

employee service rendered to that date. The amount of

benefit to be paid depends on a number of future events

incorporated into the pension benefit formula, including

estimates of the average life of employees/survivors and

average years of service rendered. It is measured based

on assumptions concerning future interest rates and future

employee compensation levels.

For postretirement benefit plans, the benefit obligation

is the “accumulated postretirement benefit obligation,” the

actuarial present value as of a date of all future benefits

attributed under the terms of the postretirement benefit

plan to employee service rendered to that date.

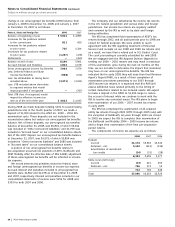

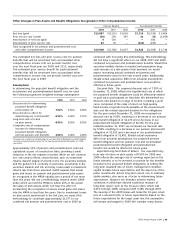

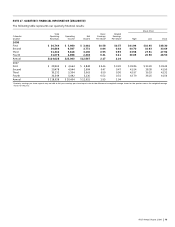

The following table presents this reconciliation and shows the change in the projected benefit obligation for the years ended

December 31:

Pension Benefits Postretirement Benefits

2008 2007 2008 2007

Benefit obligation at beginning of year $53,522 $55,949 $40,385 $44,137

Service cost – benefits earned during the period 1,173 1,257 429 511

Interest cost on projected benefit obligation 3,319 3,220 2,550 2,588

Amendments (15) 246 (4) —

Actuarial loss (gain) (1,450) (2,044) (3,406) (4,752)

Special termination benefits 70 56 5 7

Settlements — (15) — —

Benefits paid (5,795) (5,312) (2,548) (2,316)

Other (2) 165 120 210

Benefit obligation at end of year $50,822 $53,522 $37,531 $40,385