AT&T Wireless 2008 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2008 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

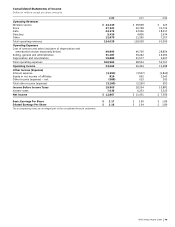

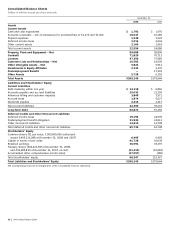

Management’s Discussion and Analysis of Financial Condition and Results of Operations (continued)

Dollars in millions except per share amounts

40

| AT&T Annual Report 2008

We and the U.S. Government filed interlocutory appeals.

The case was argued before a panel of the U.S. Court of

Appeals for the Ninth Circuit in August 2007. In August 2008,

the court remanded the case to the district court without

deciding the issue in light of the passage of the FISA

Amendments Act discussed below.

In July 2008, the President signed into law, the FISA

(Foreign Intelligence Surveillance Act) Amendments Act of

2008 (the Act), a provision of which addresses the allegations

in these pending lawsuits (immunity provision). The immunity

provision requires the pending lawsuits to be dismissed if

the Attorney General certifies to the court either that the

alleged assistance was undertaken by court order,

certification, directive, or written request or that the telecom

entity did not provide the alleged assistance. In September

2008, the Attorney General filed his certification and asked

the court to dismiss all of the lawsuits pending against

the telecommunications companies. In October 2008, the

plaintiffs filed an opposition to the certification and motion

to dismiss arguing that the Act is unconstitutional and,

alternatively, that the Government failed to meet its burden

of justifying dismissal. The court heard argument on the

Government’s motion to dismiss on December 2, 2008.

We are awaiting the court’s decision. We believe that the

immunity provision is constitutional, that the Government

has met its burden of proof, and that the lawsuits pending

against us will eventually be dismissed.

In addition, a lawsuit seeking to enjoin the immunity

provision’s application on grounds that it is unconstitutional

was filed the day after the Act was signed by the President.

That case has been referred to the Joint Panel on Multidistrict

Litigation (MDL), which has conditionally transferred the case

to the Northern District of California, the court referred to

above that is considering the Attorney General’s certification

and motion to dismiss. On January 6, 2009, the transfer order

was filed in the MDL docket, giving the Northern District of

California jurisdiction over the case.

Management believes these actions are without merit and

intends to defend these matters vigorously.

Prepaid Calling Card Patent Litigation In September 2007,

a jury in Texas found that ATTC willfully infringed two patents

owned by TGIP Inc. (TGIP) relating to point-of-sale prepaid

cards sold by ATTC and awarded TGIP $156 in damages.

(TGIP Inc. v. AT&T Corp. et al., U.S. District Court for the

Eastern District of Texas). AT&T filed a motion requesting that

the court overturn the jury’s verdict as a matter of law.

In October 2007, the court overturned the jury’s finding of

infringement, the jury’s $156 award of damages and the jury’s

finding of willfulness. TGIP appealed the court’s decision.

In April 2008, the parties settled the litigation resulting in

no additional expense accrual.

Broadcom Patent Dispute A number of our handsets,

as well as those provided by other wireless carriers, were

subject to a patent dispute at the U.S. International Trade

Commission (ITC) between Broadcom Corporation and

Qualcomm Incorporated (Qualcomm). In October 2008,

the Court of Appeals for the Federal Circuit vacated and

remanded the ITC’s finding that Qualcomm had infringed a

Broadcom patent and vacated the ITC’s limited exclusion

order applicable to certain handsets containing Qualcomm

technology. The court held that the ITC did not have authority

to issue a limited exclusion order affecting handset suppliers

and retailers, such as AT&T, unless those parties were also

named in the lawsuit. While this ruling would allow us to

continue to sell to our customers handsets using the disputed

Qualcomm chips, we do not currently offer any such handsets.

DIRECTV Agreement In September 2008, we announced

an agreement to market and sell DIRECTV’s service as a

co-branded satellite television service after January 31, 2009.

We did offer, market and sell co-branded AT&T|DISHNetwork

services through January 31, 2009. After that date, existing

AT&T|DISHNetwork customers will continue to receive

DISH Network service under the existing AT&T|DISHNetwork

agreement.

Centennial Communications Acquisition In

November 2008, we agreed to acquire Centennial

Communications, Corp., a regional provider of wireless

and wired communications services with 1.1 million

customers, for $944 plus net debt of approximately $2,000.

The acquisition is subject to regulatory approval and is

expected to close by mid-year 2009.

Environmental We aresubject from time to time to

judicial and administrative proceedings brought by various

governmental authorities under federal, state or local

environmental laws.Althoughwearerequired to reference

in our Forms 10-Q and 10-Kany of these proceedings that

could result in monetary sanctions (exclusive of interest and

costs) of one hundred thousand dollars or more, we do

notbelieve that any of them currently pending will have

a material adverse effect on our results of operations.

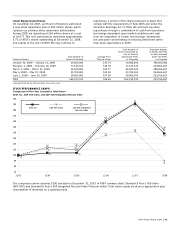

LIQUI D I T Y AND CAPITA L RE S O URCES

We had $1,792 in cash and cash equivalents available at

December 31, 2008. Cash and cash equivalents included cash

of $958 and money market funds and other cash equivalents

of $834. Cash and cash equivalents decreased $178 since

December 31, 2007. During 2008, cash inflow was primarily

provided by cash receipts from operations, the issuance of

long-term debt, net cash received from dispositions of

non-strategic real estate and the sale of marketable securities

and other assets. These inflows were offset by cash used to

meet the needs of the business including, but not limited to,

payment of operating expenses, funding capital expenditures,

acquisition of wireless spectrum, repurchase of common

shares, repayment of debt, dividends to stockholders and

payment of interest on debt. We discuss many of these

factors in detail below.

Cash Provided by or Used in Operating Activities

During 2008, cash provided by operating activities was

$33,656 compared to $34,242 in 2007. Operating cash flows

decreased primarily due to increased tax payments of $1,294

partially offset by improvement in operating income excluding

depreciation. During 2008, tax payments were higher primarily

due to increased income. The timing of cash payments for

income taxes, which is governed by the IRS and other taxing

jurisdictions, will differ from the timing of recording tax

expense and deferred income taxes, which are reported in

accordance with GAAP.