AT&T Wireless 2008 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2008 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

AT&T Annual Report 2008

| 71

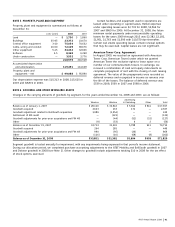

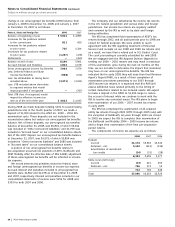

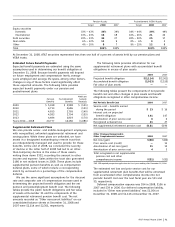

The following table provides information for our

supplemental retirement plans with accumulated benefit

obligations in excess of plan assets:

2008 2007

Projected benefit obligation $(2,114) $(2,301)

Accumulated benefit obligation (2,023) (2,155)

Fair value of plan assets — —

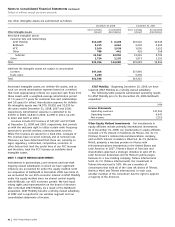

The following tables present the components of net periodic

benefit cost and other changes in plan assets and benefit

obligations recognized in other comprehensive income:

Net Periodic Benefit Cost 2008 2007

Service cost – benefits earned

during the period $ 13 $ 16

Interest cost on projected

benefit obligation 141 147

Amortization of prior service cost 6 6

Recognized actuarial loss 21 27

Net supplemental retirement pension cost $181 $196

Other Changes Recognized in

Other Comprehensive Income1 2008 2007

Net loss (gain) $(66) $(60)

Prior service cost (credit) — 11

Amortization of net loss (gain) 11 15

Amortization of prior service cost 4 3

Total recognized in net supplemental

pension cost and other

comprehensive income $(51) $(31)

1FAS 158 required prospective application for fiscal years ending after December 15, 2006.

The estimated net loss and prior service cost for our

supplemental retirement plan benefits that will be amortized

from accumulated other comprehensive income into net

periodic benefit cost over the next fiscal year are $11 and

$5, respectively.

Deferred compensation expense was $54 in 2008, $106 in

2007 and $39 in 2006. Our deferred compensation liability,

included in “Other noncurrent liabilities,” was $1,054 at

December 31, 2008, and $1,116 at December 31, 2007.

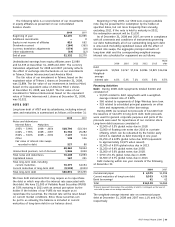

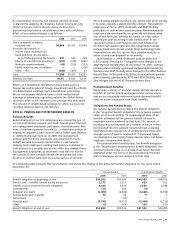

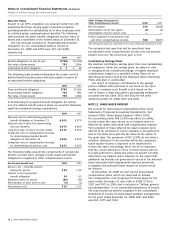

Estimated Future Benefit Payments

Expected benefit payments are estimated using the same

assumptions used in determining our benefit obligation at

December 31, 2008. Because benefit payments will depend

on future employment and compensation levels, average

years employed and average life spans, among other factors,

changes in any of these factors could significantly affect

these expected amounts. The following table provides

expected benefit payments under our pension and

postretirement plans:

Medicare

Pension Postretirement Subsidy

Benefits Benefits Receipts

2009 $ 5,018 $ 2,588 $ (121)

2010 4,713 2,686 (131)

2011 4,655 2,769 (140)

2012 4,583 2,794 (155)

2013 4,484 2,819 (170)

Years 2014 – 2018 20,777 14,180 (1,086)

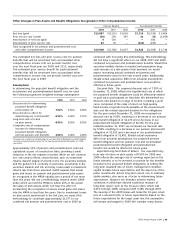

Supplemental Retirement Plans

We also provide senior- and middle-management employees

with nonqualified, unfunded supplemental retirement and

savings plans. While these plans are unfunded, we have

assets in a designated nonbankruptcy remote trust that

are independently managed and used to provide for these

benefits. At the end of 2008, we concluded the severity

of decline in the latter half of 2008 had led to an other-

than-temporary decline in the value of these assets,

writing them down $332, recording the amount in other

income and expense. Sales within the trust also generated

$180 in net realized losses in 2008. These plans include

supplemental pension benefits as well as compensation

deferral plans, some of which include a corresponding

match by us based on a percentage of the compensation

deferral.

We use the same significant assumptions for the discount

rate and composite rate of compensation increase used in

determining the projected benefit obligation and the net

pension and postemployment benefit cost. The following

tables provide the plans’ benefit obligations and fair value

of assets at December 31 and the components of the

supplemental retirement pension benefit cost. The net

amounts recorded as “Other noncurrent liabilities” on our

consolidated balance sheets at December31, 2008 and

2007 were $2,114 and $2,301, respectively.

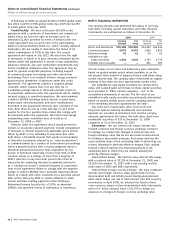

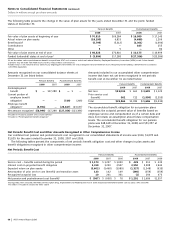

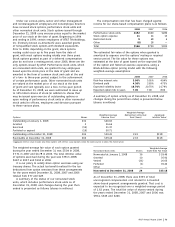

Pension Assets Postretirement (VEBA) Assets

Target 2008 2007 Target 2008 2007

Equity securities

Domestic 33% – 43% 34% 39% 34% – 44% 39% 49%

International 13% – 23% 16 18 16% – 26% 21 24

Debt securities 23% – 33% 30 27 20% – 30% 25 17

Real estate 6% – 12% 11 9 0% – 6% 3 2

Other 4% – 10% 9 7 9% – 15% 12 8

Total 100% 100% 100% 100%

At December 31, 2008, AT&T securities represented less than one half of a percent of assets held by our pension plans and

VEBA trusts.