AT&T Wireless 2008 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2008 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

AT&T Annual Report 2008

| 43

Substantially all of our purchase obligations are in our

wireline and wireless segments. The table does not include

the fair value of our interest rate swaps. Our capital lease

obligations have been excluded from the table due to the

immaterial value at December 31, 2008. Many of our other

noncurrent liabilities have been excluded from the following

table due to the uncertainty of the timing of payments,

combined with the absence of historical trending to be used

as a predictor of such payments. Additionally, certain other

long-term liabilities have been excluded since settlement of

such liabilities will not require the use of cash. However, we

have included in the following table obligations which

primarily relate to benefit funding and severance due to the

certainty of the timing of these future payments. Our other

long-term liabilities are: deferred income taxes (see Note 10)

of $19,196; postemployment benefit obligations (see Note 11)

of $31,930; and other noncurrent liabilities of $14,610, which

included deferred lease revenue from our agreement with

American Tower of $539 (see Note 5).

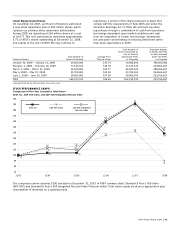

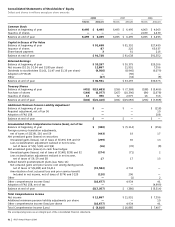

Contractual Obligations

Payments Due By Period

Less than 1-3 3-5 More than

Total 1 Year Years Years 5 Years

Long-term debt obligations1 $ 68,444 $ 9,504 $11,303 $10,721 $36,916

Interest payments on long-term debt 57,593 4,091 7,075 5,543 40,884

Commercial paper obligations 4,575 4,575 — — —

Other short-term borrowings 41 41 — — —

Operating lease obligations 20,444 2,382 4,133 3,359 10,570

Unrecognized tax benefits2 6,801 1,759 — — 5,042

Purchase obligations3,4 9,911 3,112 4,398 1,885 516

Other long-term obligations5 475 175 148 66 86

Total Contractual Obligations $168,284 $25,639 $27,057 $21,574 $94,014

1 The impact of premiums/discounts and derivative instruments included in debt amounts on the balance sheet are excluded from the table.

2 The non-current portion of the unrecognized tax benefits is included in the “More than 5 Years” column as we cannot reasonably estimate the timing or amounts of additional

cash payments, if any, at this time. See Note 10 for additional information.

3 We have contractual obligations to utilize network facilities from local exchange carriers with terms greater than one year. Since the contracts have no minimum volume

requirements and are based on an interrelationship of volumes and discounted rates, we assessed our minimum commitment based on penalties to exit the contracts, assuming

that we had exited the contracts on December 31, 2008. At December 31, 2008, the termination fees we would have incurred to exit all of these contracts would have been

$213. These termination fees could be $167 in 2009, $45 in the aggregate for 2010 and 2011 and $1 for 2012, assuming that all contracts are exited. These termination fees are

excluded from the above table as the fees would not be paid every year and the timing of such payments, if any, is uncertain.

4 We calculated the minimum obligation for certain agreements to purchase goods or services based on termination fees that can be paid to exit the contract. If we elect to exit

these contracts, termination fees for all such contracts in the year of termination could be approximately $368 in 2009, $418 in the aggregate for 2010 and 2011, $185 in the

aggregate for 2012 and 2013 and $35 in the aggregate, thereafter. Certain termination fees are excluded from the above table as the fees would not be paid every year and the

timing of such payments, if any, is uncertain.

5 Other long-term obligations include commitments with local exchange carriers for dedicated leased lines.

MARKET RISK

We are exposed to market risks primarily from changes in

interest rates and foreign currency exchange rates. In managing

exposure to these fluctuations, we may engage in various

hedging transactions that have been authorized according to

documented policies and procedures. On a limited basis, we

use certain derivative financial instruments, including foreign

currency exchange contracts and combined interest rate

foreign currency contracts, to manage these risks. We do not

use derivatives for trading purposes, to generate income or to

engage in speculative activity. Our capital costs are directly

linked to financial and business risks. We seek to manage the

potential negative effects from market volatility and market

risk. The majority of our financial instruments are medium-

and long-term fixed rate notes and debentures. Fluctuations

in market interest rates can lead to significant fluctuations in

the fair value of these notes and debentures. It is our policy

to manage our debt structure and foreign exchange exposure

in order to manage capital costs, control financial risks and

maintain financial flexibility over the long term. Where

appropriate, we will take actions to limit the negative effect

of interest and foreign exchange rates, liquidity and

counterparty risks on stockholder value.

We enter into foreign currency contracts to minimize our

exposure to risk of adverse changes in currency exchange

rates. We are subject to foreign exchange risk for foreign

currency-denominated transactions, such as debt issued,

recognized payables and receivables and forecasted

transactions. At December 31, 2008, our foreign currency

exposures were principally Mexican pesos, Euros, Danish

krone, Swedish krona and Canadian dollars.

QUANTITAT I V E INFO R MATIO N A B O UT MARKET RISK

In order to determine the changes in fair value of our various

financial instruments, we use certain financial modeling

techniques. We apply rate-sensitivity changes directly to our

interest rate swap transactions and forward rate sensitivity

to our foreign currency-forward contracts.

The changes in fair value, as discussed below, assume the

occurrence of certain market conditions, which could have

an adverse financial impact on AT&T and do not represent

projected gains or losses in fair value that we expect to incur.

Future impacts would be based on actual developments in

global financial markets. We do not foresee any significant

changes in the strategies used to manage interest rate risk,

foreign currency rate risk or equity price risk in the near future.