AT&T Wireless 2008 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 2008 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

AT&T Annual Report 2008

| 23

For ease of reading, AT&T Inc. is referred to as “we,” “AT&T” or the “Company” throughout this document and the names of the

particular subsidiaries and affiliates providing the services generally have been omitted. AT&T is a holding company whose

subsidiaries and affiliates operate in the communications services industry both in the United States and internationally providing

wireless and wireline telecommunications services and equipment as well as directory advertising and publishing services.

You should read this discussion in conjunction with the consolidated financial statements and accompanying notes. A reference

to a “Note” in this section refers to the accompanying Notes to Consolidated Financial Statements. In the tables throughout this

section, percentage increases and decreases that equal or exceed 100% are not considered meaningful and are denoted with a dash.

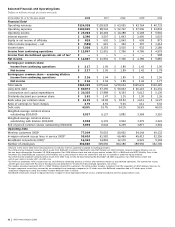

RESU LTS OF OPERAT I ONS

Consolidated Results Our financial results are summarized in the table below. We then discuss factors affecting our overall

results for the past three years. These factors are discussed in more detail in our “Segment Results” section. We also discuss our

expected revenue and expense trends for 2009 in the “Operating Environment and Trends of the Business” section.

We completed our acquisition of BellSouth Corporation (BellSouth) on December 29, 2006. We thereby acquired BellSouth’s

40% economic interest in AT&T Mobility LLC (AT&T Mobility), formerly Cingular Wireless LLC (Cingular), resulting in 100% ownership

of AT&T Mobility. Our consolidated results in 2006 include BellSouth’s and AT&T Mobility’s operational results for the final

two days of the year. Prior to the acquisition, we reported the income from our 60% share of AT&T Mobility as equity in net

income. In accordance with U.S. generally accepted accounting principles (GAAP), operating results from BellSouth and

AT&T Mobility prior to their respective acquisition dates are excluded.

Percent Change

2008 vs. 2007 vs.

2008 2007 2006 2007 2006

Operating revenues $124,028 $118,928 $63,055 4.3% 88.6%

Operating expenses 100,965 98,524 52,767 2.5 86.7

Operating income 23,063 20,404 10,288 13.0 98.3

Income before income taxes 19,903 18,204 10,881 9.3 67.3

Net income 12,867 11,951 7,356 7.7 62.5

Diluted earnings per share 2.16 1.94 1.89 11.3 2.6

Overview

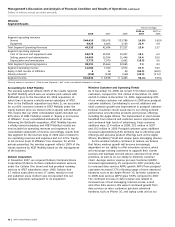

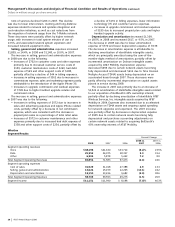

Operating income As noted above, 2007 revenues and

expenses reflect the addition of BellSouth’s and AT&T Mobility’s

results while our 2006 results only include two days of their

results. Accordingly, the following discussion of changes in our

revenues and expenses is affected by these acquisitions.

Our operating income increased $2,659, or 13.0%, in 2008

and $10,116, or 98.3%, in 2007. Our operating income margin

increased from 16.3% in 2006 to 17.2% in 2007 and to 18.6%

in 2008. Operating income in 2008 increased primarily due

to continued growth in wireless service and data revenues

along with a decrease in the amortization of merger-related

intangibles and increased in 2007 primarily due to the

acquisition of BellSouth. Reported results in 2008 include

directory revenue and expenses from directories published by

BellSouth subsidiaries. In accordance with GAAP, our reported

results in 2007 did not include deferred revenue of $964 and

expenses of $308 from BellSouth directories published during

the 12-month period ending with the December 29, 2006 date

we acquired BellSouth. Had our 2007 directory results included

this deferred revenue and expenses, operating income would

have increased $2,003 for 2008, as compared to 2007.

Operating revenues increased $5,100, or 4.3%, in 2008

and $55,873, or 88.6%, in 2007. Revenues in 2008 reflect an

increase in wireless subscribers and data revenues, primarily

related to Internet Protocol (IP) data, partially offset by the

continued decline in voice revenues. Increases in 2007 were

primarily due to our acquisitions and to continuing growth in

wireless subscribers. As discussed above, purchase accounting

treatment for directories published 12 months prior to the

BellSouth acquisition also increased revenues in 2008 when

compared to 2007.

Our operating revenues also reflect the continued decline

of our retail access lines due to the dramatically declining

overall economy and increased competition, as customers

continued to disconnect both primary and additional lines and

switched to wireless, Voice over Internet Protocol (VoIP) and

cable offerings for voice and data. While we lose the wireline

voice revenues, we have the opportunity to increase wireless

service revenue should customers choose AT&T Mobility as

their alternative provider.

Operating expenses increased $2,441, or 2.5%, in 2008

and $45,757, or 86.7%, in 2007. The increase in 2008 was

primarily due to higher equipment costs related to the

successful launch of the Apple iPhone 3G and increased

sales of PDA devices, while the increase in 2007 was primarily

due to merger integration costs and amortization expense

on intangible assets identified at the time of acquisition.

Also increasing 2008 expenses were higher commissions and

residuals from the growth in wireless, severance associated

with announced workforce reductions as well as hurricane-

related expenses affecting both the wireless and wireline

segments. Partially offsetting these increases were merger

integration costs recognized in 2007 and not in 2008, and

lower amortization expense on intangible assets in 2008.

Interest expense decreased $117, or 3.3%, in 2008 and

increased $1,664, or 90.3%, in 2007. Interest expense remained

relatively unchanged during 2008 with a decrease in our

weighted average interest rate and increases in interest

charged during construction, offset by an increase in our

average debt balances. Future interest expense will continue

to reflect increased interest during construction related to

Management’s Discussion and Analysis of Financial Condition and Results of Operations

Dollars in millions except per share amounts