AT&T Wireless 2008 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2008 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

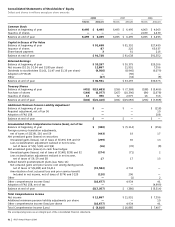

Notes to Consolidated Financial Statements (continued)

Dollars in millions except per share amounts

62

| AT&T Annual Report 2008

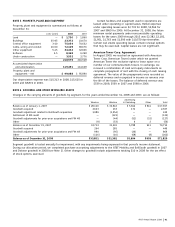

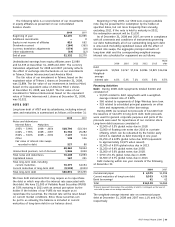

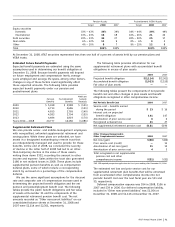

AT&T Mobility Beginning December 29, 2006, we have

reported AT&T Mobility as a wholly-owned subsidiary.

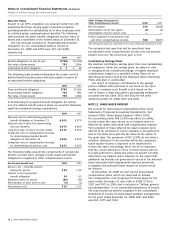

The following table presents summarized operating results

for AT&T Mobility prior to the December 29, 2006 BellSouth

acquisition:

2006

Income Statements

Operating revenues $37,291

Operating income 4,547

Net income 2,513

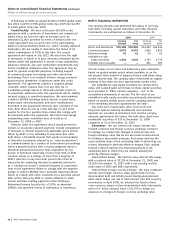

Other Equity Method Investments Our investments in

equity affiliates include primarily international investments.

As of December 31, 2008, our investments in equity affiliates

included a 9.7% interest in Teléfonos de México, S.A. de C.V.

(Telmex), Mexico’s national telecommunications company,

and an 8.6% interest in América Móvil S.A. de C.V. (América

Móvil), primarily a wireless provider in Mexico with

telecommunications investments in the United States and

Latin America. In 2007, Telmex’s Board of Directors and

shareholders approved a strategic initiative to split off its

Latin American businesses and its Mexican yellow pages

business to a new holding company, Telmex Internacional

S.A.B. de C.V. (Telmex Internacional). Our investment in

Telmex Internacional is 9.8%. We are a member of

consortiums that hold all of the class AA shares of Telmex,

América Móvil and Telmex Internacional. In each case,

another member of the consortium has the right to appoint

a majority of the directors.

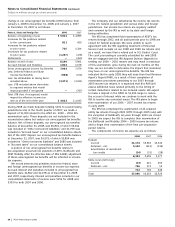

Amortized intangible assets are definite-life assets, and as

such, we record amortization expense based on a method

that most appropriately reflects our expected cash flows from

these assets with a weighted-average amortization period

of 7.4 years (7.3 years for customer lists and relationships

and 9.6 years for other). Amortization expense for definite-

life intangible assets was $4,570, $5,952 and $1,033 for

the years ended December 31, 2008, 2007 and 2006,

respectively. Amortization expense is estimated to be

$3,670 in 2009, $2,840 in 2010, $1,890 in 2011, $1,230

in 2012 and $670 in 2013.

Licenses include FCC licenses of $47,267 and $37,948

at December 31, 2008 and 2007, respectively, that provide

us with the exclusive right to utilize certain radio frequency

spectrum to provide wireless communications services.

While FCC licenses are issued for a fixed time, renewals of

FCC licenses have occurred routinely and at nominal cost.

Moreover, we have determined that there are currently no

legal, regulatory, contractual, competitive, economic or

other factors that limit the useful lives of our FCC licenses

and therefore, treat the FCC licenses as indefinite-lived

intangible assets.

NOTE 7. EQUITY METHOD INVESTMENTS

Investments in partnerships, joint ventures and less-than

majority-owned subsidiaries in which we have significant

influence are accounted for under the equity method. Until

our acquisition of BellSouth in December 2006 (see Note 2),

we accounted for our 60% economic interest in AT&T Mobility

under the equity method since we shared control equally

with BellSouth, our 40% economic partner. We had equal

voting rights and representation on the board of directors

that controlled AT&T Mobility. As a result of the BellSouth

acquisition, AT&T Mobility became a wholly-owned subsidiary

of AT&T and is reported in our wireless segment and our

consolidated statements of income.

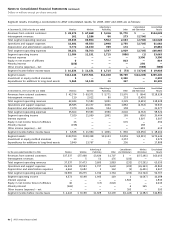

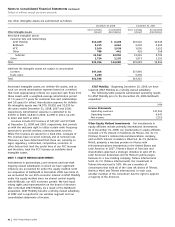

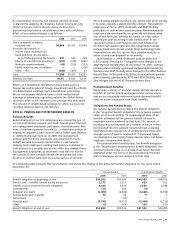

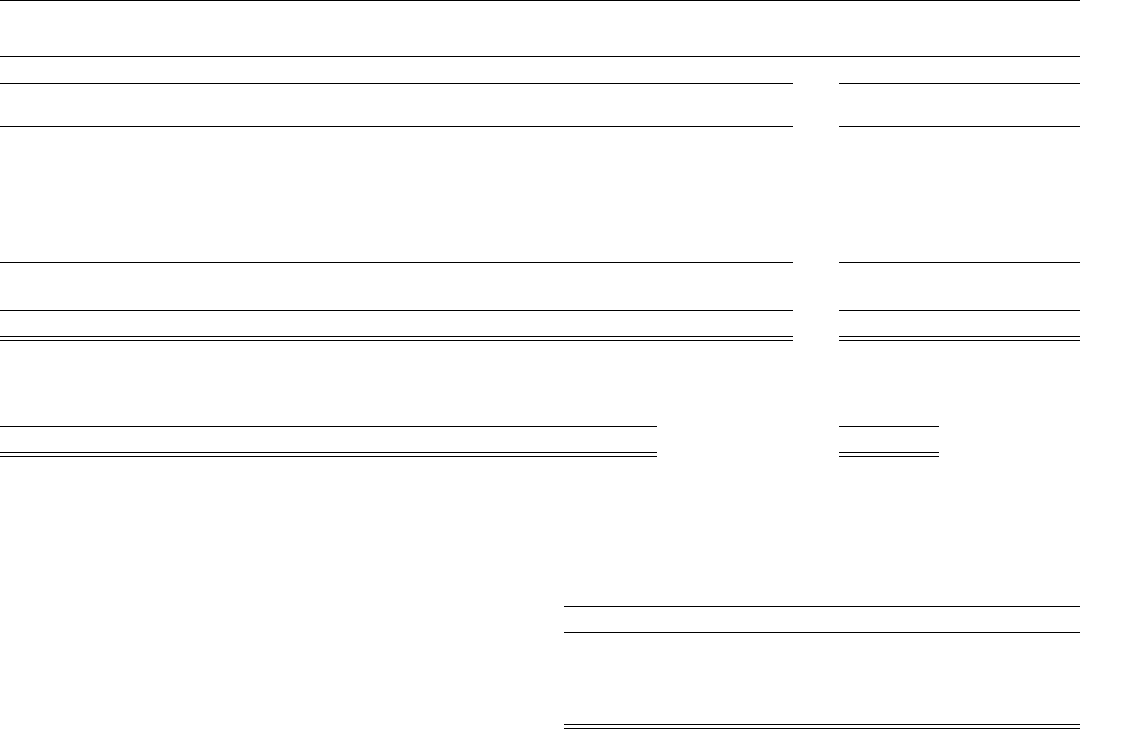

Our other intangible assets are summarized as follows:

December 31, 2008 December 31, 2007

Gross Carrying Accumulated Gross Carrying Accumulated

Other Intangible Assets Amount Amortization Amount Amortization

Amortized intangible assets:

Customer lists and relationships:

AT&T Mobility $10,429 $ 6,409 $10,526 $4,549

BellSouth 9,215 4,062 9,205 2,205

ATTC 3,100 2,038 3,050 1,653

Other 788 441 429 298

Subtotal 23,532 12,950 23,210 8,705

Other 1,724 1,130 1,873 1,191

Total $25,256 $14,080 $25,083 $9,896

Indefinite life intangible assets not subject to amortization:

Licenses $47,306 $37,985

Trade name 5,230 5,230

Total $52,536 $43,215