AT&T Wireless 2008 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2008 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

AT&T Annual Report 2008

| 53

Notes to Consolidated Financial Statements

Dollars in millions except per share amounts

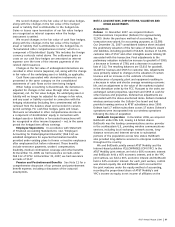

NOTE 1. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Basis of Presentation Throughout this document,

AT&T Inc. is referred to as “AT&T,” “we” or the “Company.”

The consolidated financial statements include the accounts

of the Company and our majority-owned subsidiaries

and affiliates. Our subsidiaries and affiliates operate in

the communications services industry throughout the

U.S. and internationally, providing wireless and wireline

telecommunications services and equipment as well as

directory advertising and publishing services.

All significant intercompany transactions are eliminated in

the consolidation process. Investments in partnerships, joint

ventures, and less-than-majority-owned subsidiaries where

we have significant influence are accounted for under

the equity method. Earnings from certain foreign equity

investments accounted for using the equity method are

included for periods ended within up to one month of

our year end (see Note 7).

The preparation of financial statements in conformity with

U.S. generally accepted accounting principles (GAAP) requires

management to make estimates and assumptions that affect

the amounts reported in the financial statements and accom-

panying notes, including estimates of probable losses and

expenses. Actual results could differ from those estimates.

FAS 160 In December 2007, the Financial Accounting

Standards Board (FASB) issued Statement of Financial

Accounting Standards No. 160, “Noncontrolling Interests in

Consolidated Financial Statements — an amendment of ARB

No. 51” (FAS 160). FAS 160 requires noncontrolling interests

held by parties other than the parent in subsidiaries to be

clearly identified, labeled, and presented in the consolidated

statement of financial position within equity, but separate

from the parent’s equity. FAS 160 is effective for fiscal years

beginning after December 15, 2008. At December 31, 2008,

we had $375 of noncontrolling interests to be reclassified.

FAS 141(R) In December 2007, the FASB issued

Statement of Financial Accounting Standards No. 141 (revised

2007), “Business Combinations” (FAS 141(R)). FAS 141(R) is a

revision of FAS 141 and requires that costs incurred to effect

the acquisition (i.e., acquisition-related costs) be recognized

separately from the acquisition. In addition, in accordance

with Statement of Financial Accounting Standards No. 141,

“Business Combinations” (FAS 141), restructuring costs that

the acquirer expected but was not obligated to incur, which

included changes to benefit plans, were recognized as if they

were a liability assumed at the acquisition date. FAS 141(R)

requires the acquirer to recognize those costs separately

from the business combination. FAS 141(R) is effective for

us in 2009, and its impact will vary with each acquisition.

FAS 161 In March 2008, the FASB issued Statement of

Financial Accounting Standards No. 161, “Disclosures about

Derivative Instruments and Hedging Activities, an amendment

of FASBStatement No. 133” (FAS 161). FAS 161 requires

enhanced disclosures about an entity’s derivative and hedging

activities to improve the transparency of financial reporting.

It is effective for financial statements issued for fiscal years

and interim periods beginning after November 15, 2008.

FAS 161 is expected to increase quarterly and annual

disclosures but will not have an impact on our financial

position and results of operations.

FSP 157-3 In October 2008, the FASB issued FASB Staff

Position 157-3, “Determining the Fair Value of a Financial

Asset When the Market of that Asset is not Active” (FSP

157-3). FSP 157-3 provides an example that clarifies and

reiterates certain provisions of the existing fair value standard,

including basing fair value on orderly transactions and usage

of management and broker inputs. FSP 157-3 is effective

immediately but is not expected to have a material impact

on our financial position or results of operations.

FSP FAS 142-3 In April 2008, the FASB issued FASB Staff

Position FAS 142-3, “Determination of the Useful Life of

Intangible Assets” (FSP FAS 142-3). FSP FAS 142-3 amends

the factors that should be considered in developing renewal

or extension assumptions used to determine the useful life of

a recognized intangible asset under FASB Statement No. 142,

“Goodwill and Other Intangible Assets.” FSP FAS 142-3 is

effective for financial statements issued for fiscal years

beginning after December 15, 2008, and interim periods

within those fiscal years. We are currently evaluating the

impact that FSP FAS 142-3 will have on our accounting for

intangible assets.

FSP FAS 132(R)-1 In December 2008, the FASB issued

FASB Staff Position FAS 132(R)-1, “Employers’ Disclosures

about Postretirement Benefit Plan Assets” (FSP FAS 132(R)-1).

FSP FAS 132(R)-1 amends FASB Statement No. 132(R),

“Employers’ Disclosures about Pensions and Other

Postretirement Benefit” (FAS 132(R)). This FASB Staff Position

replaces the requirement to disclose the percentage of fair

value of total plan assets with a requirement to disclose the

fair value of each major asset category. It also amends

FASB Statement No. 157, “Fair Value Measurements”

(FAS 157), to clarify that defined benefit pension or other

postretirement plan assets are not subject to FAS 157’s

disclosure requirements. FSP FAS 132(R)-1 is effective for

fiscal years ending after December 2009. This FSP will

significantly increase the amount of disclosures for plan

assets in our 2009 Annual Report.

EITF 08-6 In November 2008, the Emerging Issues Task

Force (EITF) reached a consensus on EITF 08-6, “Equity

Method Investment Accounting Considerations.” EITF 08-6

provides guidance on the application of the equity method.

It states equity-method investments should be recognized

using a cost accumulation model. Also, it requires that equity

method investments as a whole be assessed for other-

than-temporary impairment in accordance with Accounting

Principles Board Opinion No. 18. EITF 08-6 is effective on

a prospective basis for transactions in an investee’s shares

occurring or impairments recognized in fiscal years, and

interim periods within those fiscal years, beginning on or

after December 15, 2008. This EITF will not have a material

impact on our financial position and results of operations.