AT&T Wireless 2008 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2008 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

52

| AT&T Annual Report 2008

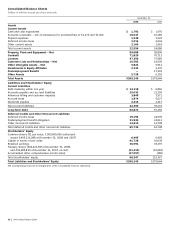

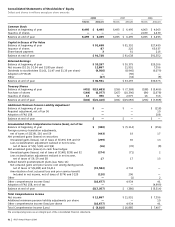

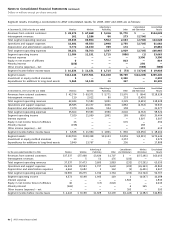

Consolidated Statements of Stockholders’ Equity

Dollars and shares in millions except per share amounts

2008 2007 2006

Shares Amount Shares Amount Shares Amount

Common Stock

Balance at beginning of year 6,495 $ 6,495 6,495 $ 6,495 4,065 $ 4,065

Issuance of shares — — — — 2,430 2,430

Balance at end of year 6,495 $ 6,495 6,495 $ 6,495 6,495 $ 6,495

Capital in Excess of Par Value

Balance at beginning of year $ 91,638 $ 91,352 $27,499

Issuance of shares 87 225 63,637

Share-based payment 3 61 216

Balance at end of year $ 91,728 $ 91,638 $91,352

Retained Earnings

Balance at beginning of year $ 33,297 $ 30,375 $29,106

Net income ($2.16, $1.94 and $1.89 per share) 12,867 11,951 7,356

Dividends to stockholders ($1.61, $1.47 and $1.35 per share) (9,506) (8,945) (6,079)

Adoption of FIN 48 — (50) —

Other (67) (34) (8)

Balance at end of year $ 36,591 $ 33,297 $30,375

Treasury Shares

Balance at beginning of year (451) $(15,683) (256) $ (7,368) (188) $ (5,406)

Purchase of shares (164) (6,077) (267) (10,390) (84) (2,678)

Issuance of shares 13 350 72 2,075 16 716

Balance at end of year (602) $(21,410) (451) $(15,683) (256) $ (7,368)

Additional Minimum Pension Liability Adjustment

Balance at beginning of year $ — $ — $ (218)

Required adjustment, net of tax $6 — — 10

Adoption of FAS 158 — — 208

Balance at end of year $ — $ — $ —

Accumulated Other Comprehensive Income (Loss), net of tax

Balance at beginning of year $ (380) $ (5,314) $ (356)

Foreign currency translation adjustments,

net of taxes of $(239), $10 and $9 (443) 19 17

Net unrealized gains (losses) on securities:

Unrealized gains (losses), net of taxes of $(139), $35 and $7 (259) 65 13

Less reclassification adjustment realized in net income,

net of taxes of $(9), $(19) and $(4) (16) (35) (8)

Net unrealized gains (losses) on cash flow hedges:

Unrealized gains (losses), net of taxes of $(148), $(38) and $2 (274) (71) 2

Less reclassification adjustment realized in net income,

net of taxes of $9, $9 and $8 17 17 15

Defined benefit postretirement plans (see Note 11):

Net actuarial gains and prior service cost arising during period,

net of taxes of $(9,298) and $3,411 (15,582) 4,734 —

Amortization of net actuarial loss and prior service benefit

Included in net income, net of taxes of $(74) and $125 (120) 206 —

Other — (1) 2

Other comprehensive income (loss) (16,677) 4,934 41

Adoption of FAS 158, net of tax — — (4,999)

Balance at end of year $(17,057) $ (380) $ (5,314)

Total Comprehensive Income

Net income $ 12,867 $ 11,951 $ 7,356

Additional minimum pension liability adjustments per above — — 10

Other comprehensive income (loss) per above (16,677) 4,934 41

Total Comprehensive Income (Loss) $ (3,810) $ 16,885 $ 7,407

The accompanying notes are an integral part of the consolidated financial statements.