AT&T Wireless 2008 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2008 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management’s Discussion and Analysis of Financial Condition and Results of Operations (continued)

Dollars in millions except per share amounts

44

| AT&T Annual Report 2008

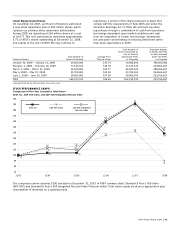

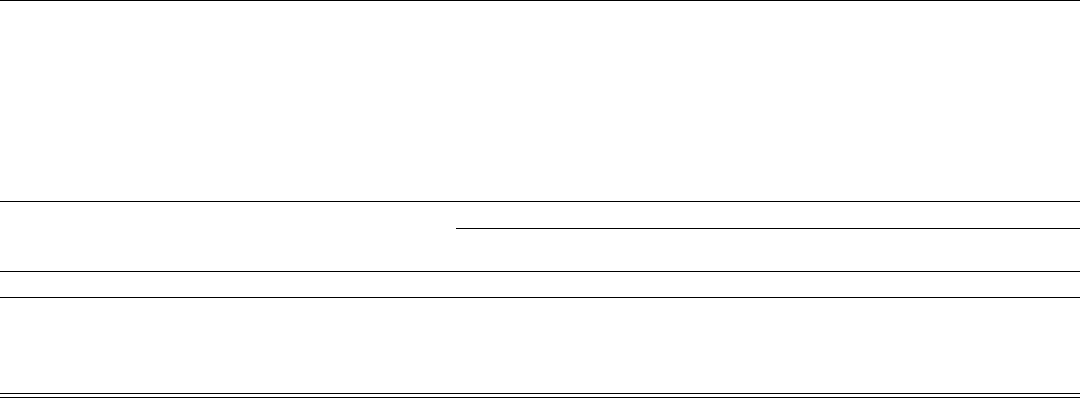

Interest Rate Sensitivity The principal amounts by

expected maturity, average interest rate and fair value of our

liabilities that are exposed to interest rate risk are described

in Notes 8 and 9. Following are our interest rate derivatives,

subject to interest rate risk as of December 31, 2008.

The interest rates illustrated in the interest rate swaps section

of the table below refer to the average expected rates we

would receive and the average expected rates we would pay

based on the contracts. The notional amount is the principal

amount of the debt subject to the interest rate swap

contracts. The net fair value asset (liability) represents the

amount we would receive or pay if we had exited the

contracts as of December 31, 2008.

Maturity

After Fair Value

2009 2010 2011 2012 2013 2013 Total 12/31/08

Interest Rate Derivatives

Interest Rate Swaps:

Receive Fixed/Pay Variable Notional Amount — — $1,250 $1,750 $1,750 $1,000 $5,750 $564

Variable Rate Payable1 2.8% 2.4% 3.4% 3.6% 4.0% 4.1%

Weighted-Average Fixed Rate Receivable 5.6% 5.6% 5.5% 5.3% 5.6% 5.6%

1Interest payable based on current and implied forward rates for Three or Six Month LIBOR plus a spread ranging between approximately 36 and 175 basis points.

We had fair value interest rate swaps with a notional value

of $5,750 with a net carrying and fair value asset of $564 at

December 31, 2008. At December 31, 2007, we had notional

value of $3,250 with an asset of $88.

Foreign Exchange Forward Contracts The fair value of

foreign exchange contracts is subject to changes in foreign

currency exchange rates. For the purpose of assessing specific

risks, we use a sensitivity analysis to determine the effects

that market risk exposures may have on the fair value of our

financial instruments and results of operations. To perform the

sensitivity analysis, we assess the risk of loss in fair values

from the effect of a hypothetical 10% change in the value

of foreign currencies (negative change in the value of the

U.S. dollar), assuming no change in interest rates. See Note 9

to the consolidated financial statements for additional

information relating to notional amounts and fair values

of financial instruments.

For foreign exchange forward contracts outstanding at

December31, 2008, assuming a hypothetical 10% depreciation

of the U.S. dollar against foreign currencies from the prevailing

foreign currency exchange rates, the fair value of the foreign

exchange forward contracts (net liability) would have

decreased approximately $13. Because our foreign exchange

contracts are entered into for hedging purposes, we believe

that these losses would be largely offset by gains on the

underlying transactions.

The risk of loss in fair values of all other financial

instruments resulting from a hypothetical 10% change in

market prices was not significant as of December31, 2008.

QUALITATI V E I N FORMAT I ON ABOUT MARKET RI S K

Foreign Exchange Risk From time to time, we make

investments in businesses in foreign countries, receive

dividends and proceeds from sales or borrow funds in

foreign currency. Before making an investment, or in

anticipation of a foreign currency receipt, we often will

enter into forward foreign exchange contracts. The contracts

are used to provide currency at a fixed rate. Our policy is

to measure the risk of adverse currency fluctuations by

calculating the potential dollar losses resulting from changes

in exchange rates that have a reasonable probability of

occurring. We cover the exposure that results from changes

that exceed acceptable amounts. We do not speculate in

foreign exchange markets.

Interest Rate Risk We issue debt in fixed and floating

rate instruments. Interest rate swaps are used for the purpose

of controlling interest expense by managing the mix of fixed

and floating rate debt. Interest rate forward contracts are

utilized to hedge interest expense related to debt financing.

We do not seek to make a profit from changes in interest

rates. We manage interest rate sensitivity by measuring

potential increases in interest expense that would result from

a probable change in interest rates. When the potential

increase in interest expense exceeds an acceptable amount,

we reduce risk through the issuance of fixed-rate (in lieu of

variable-rate) instruments and the purchase of derivatives.