AT&T Wireless 2008 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2008 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

AT&T Annual Report 2008

| 41

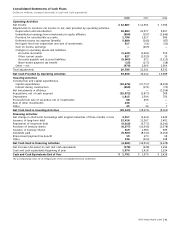

During 2007, our primary source of funds was cash from

operating activities of $34,242 compared to $15,688 in 2006.

Operating cash flows increased primarily due to an increase

of more than $4,500 in operating income reflecting additional

cash provided by the BellSouth acquisition and our success

in achieving merger synergies and operational efficiencies,

partially offset by increased interest payments of approximately

$1,800 and tax payments of $1,200. Tax payments were

higher due primarily to a $1,000 deposit related to the IRS

examination of our 2000 – 2002 income tax returns.

Cash Used in or Provided by Investing Activities

During 2008, cash used in investing activities consisted of:

• $19,676incapitalexpenditures,excludinginterest

during construction.

• $659ininterestduringconstruction.

• $9,497forthepurchaseofspectrumlicensesincluding

the 700 MHz Band wireless spectrum auction and the

acquisition of licenses from Aloha Partners, L.P.

• $350relatedtoacustomerlistacquisition.

• $697relatedtovariouswireless-relatedacquisitions.

• $275fortheacquisitionofWayport.

• $153relatedtootheracquisitions.

During 2008, cash provided by investing activities

consisted of:

• $1,501fromdispositionsofnon-strategicassets.

• $436fromEchoStarfromaninvestmentmadein2003.

• $114fromthesaleofmarketableandequitysecurities.

• $113relatedtootheractivities.

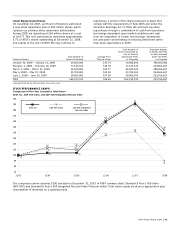

Our capital expenditures are primarily for our wireless and

wireline subsidiaries’ networks, our U-verse services, and

support systems for our communications services. Capital

spending (excluding interest during construction) in our

wireless segment increased 42.1% in 2008, primarily for

network capacity expansion, integration and upgrades to our

Universal Mobile Telecommunications System/High-Speed

Packet Access network, as well as for IT and other support

systems for our wireless service. Capital expenditures in the

wireline segment, which represented 69.4% of our capital

expenditures, increased 2.5% in 2008, primarily due to the

continued deployment of our U-verse services.

The other segment capital expenditures were less than 2%

of total capital expenditures for 2008. Included in the other

segment are equity investments, which should be self-funding

as they are not direct AT&T operations; as well as corporate,

diversified business and Sterling operations, which we expect

to fund using cash from operations. We expect to fund any

advertising & publishing segment capital expenditures using

cash from operations.

Cash Used in or Provided by Financing Activities

In December 2007, our Board of Directors authorized a new

share repurchase plan of 400 million shares, which replaces

our previous share repurchase authorization from March 2006.

During 2008, we repurchased 164 million shares at a cost of

$6,077. These 2008 share repurchases are the only ones

made under the current authorization. This new authorization

represents approximately 6.7% of AT&T’s shares outstanding

at December 31, 2008 and expires at the end of 2009.

We have repurchased, and may continue to repurchase, a

portion of the shares pursuant to plans that comply with

the requirements of Rule 10b5-1(c) under the Securities

Exchange Act of 1934. We will fund any additional share

repurchases through a combination of cash from operations,

borrowings dependent upon market conditions, and cash

from the disposition of certain non-strategic investments.

However, we anticipate concentrating on reducing debt

levels rather than share repurchases in 2009.

We paid dividends of $9,507 in 2008, $8,743 in 2007

and $5,153 in 2006, reflecting the issuance of additional

shares for the BellSouth and ATTC acquisitions and dividend

rate increases. In December 2008, our Board of Directors

approved a 2.5% increase in the quarterly dividend from

$0.40 to $0.41 per share. This increase recognizes our

expectations for growth and follows a 12.7% dividend

increase approved by AT&T’s Board in December 2007.

Dividends declared by our Board of Directors totaled

$1.61 per share in 2008, $1.465 per share in 2007 and

$1.35 per share in 2006. Our dividend policy considers both

the expectations and requirements of stockholders, internal

requirements of AT&T and long-term growth opportunities.

It is our intent to provide the financial flexibility to allow

our Board of Directors to consider dividend growth and to

recommend an increase in dividends to be paid in future

periods. All dividends remain subject to approval by our

Board of Directors.

At December 31, 2008, we had $14,119 of debt maturing

within one year, which included $9,503 of long-term debt

maturities and $4,616 of commercial paper borrowings and

other borrowings. Most of our commercial paper borrowings

are due within 90 days. We continue to examine our mix of

short- and long-term debt in light of interest rate trends

and current credit market conditions.

During 2008, we received net proceeds of $12,416 from

the issuance of $12,475 in long-term debt. Debt proceeds

were used for general corporate purposes and parts of the

proceeds were used for repurchases of our common stock.

Long-term debt issuances consisted of:

• $2,500of5.5%globalnotesduein2018.

• $2,000offloatingratenotesdue2010inaprivate

offering, which can be redeemed by the holder early

(which is classified as debt maturing in one year).

• €1,250of6.125%globalnotesdue2015(equivalent

to approximately $1,975 when issued).

• $1,500of4.95%globalnotesduein2013.

• $1,250of6.4%globalnotesdue2038.

• $1,000of5.6%globalnotesdue2018.

• $750of6.3%globalnotesduein2038.

• $1,500of6.7%globalnotesduein2013.

Beginning in May 2009, a $500 zero-coupon puttable note

may be presented for redemption by the holder at specified

dates but not more frequently than annually, excluding 2011.

If the note is held to maturity in 2022, the redemption

amount will be $1,030.

In November 2008, we agreed to acquire Centennial

Communications, a wireless operator in portions of the

United States and Puerto Rico, including its outstanding

debt of approximately $2,000. All of Centennial’s debt was

callable after January 2009. The various debt agreements

contain a number of restrictive operating covenants, which

make it likely that we will call such debt upon closing of

the acquisition.