AT&T Wireless 2008 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2008 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

AT&T Annual Report 2008

| 33

held at our captive insurance company and by decreased

operating expenses from our operator services and retail

payphone operations. The increase in 2007 was primarily

due to the addition of BellSouth’s other operations and

increased operating expenses at Sterling partially offset by

decreased expense from our retail payphone operations.

Prior to the December 29, 2006 close of the BellSouth

acquisition, our other segment included our 60% proportionate

share of AT&T Mobility results as equity in net income of

affiliates. As a result of the BellSouth acquisition, we own

100% of AT&T Mobility and its results for the final two days

of 2006 and for the year 2007 have been excluded from

equity in net income of affiliates in this segment and on

our consolidated statements of income.

Our other segment also includes our equity investments

in international companies, the income from which we report

as equity in net income of affiliates. Our earnings from foreign

affiliates are sensitive to exchange-rate changes in the value

of the respective local currencies. Our foreign investments

are recorded under GAAP, which include adjustments for

the purchase method of accounting and exclude certain

adjustments required for local reporting in specific countries.

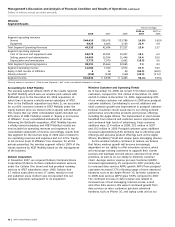

Our equity in net income of affiliates by major investment

is listed below:

2008 2007 2006

América Móvil $469 $381 $ 274

Telmex & Telmex Internacional 324 265 222

AT&T Mobility — — 1,508

Other 20 30 16

Other Segment Equity in

Net Income of Affiliates $813 $676 $2,020

Equity in net income of affiliates increased $137 in 2008.

Equity in net income in América Móvil increased $88 in 2008

primarily due to improved operating results. Equity in net

income in Telmex and Telmex Internacional increased $59

reflecting lower depreciation and tax expenses, and improved

operating results.

OPER ATING ENVIR ONMEN T AN D TR E N DS O F T H E B U S INESS

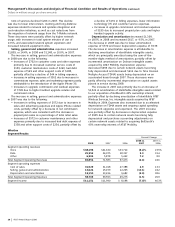

2009 Revenue Trends We expect a challenging operating

environment in 2009 due to the continuing economic

recession, increasing competition and changes at the

federal government level. Despite this environment, we

expect a modest expansion of our operating revenues in

2009 compared to 2008, reflecting continuing growth in

our wireless and broadband/data services. We expect our

primary driver of growth to be wireless, especially in sales

and increased use of advanced handsets including the

Apple iPhone 3G, and that all our major customer categories

will continue to increase their use of Internet-based

broadband/data services. We expect revenue growth will

also reflect the increased information and technology

services to be provided under our agreements with IBM.

We expect continuing declines in traditional access lines

but offsets in growth in broadband and video services.

We expect solid growth in broadband revenues as

customers continue to choose higher-speed services.

We expect to continue to expand our U-verse service

offerings in 2009.

2009 Expense Trends Our major merger integration

projects are now largely completed. However, given our

expected challenging operating environment for 2009,

we will continue to focus intensely on cost-control measures.

We expect our operating income margin to be stable

excluding pressure from our pension and retiree benefit

costs. We expect our pension and retiree benefit costs to

increase significantly due to our accounting policy for

handling substantial investment losses in 2008 on our

retirement plans’ assets (see “Significant Accounting

Policies and Estimates”). We do not expect significant

pension funding requirements in 2009. Expenses related

to growth initiatives (see “Expected Growth Areas”) will

apply some pressure to our operating income margin.

Market Conditions During 2008, the securities and

mortgage markets and the banking system in general

experienced significant declines in value and liquidity.

The U.S. Congress, the U.S. Treasury Department, the Federal

Reserve System and various other regulators have worked

together to adopt plans to restore liquidity and stability to

the securities, mortgage and banking systems. Although

we have issued short-term and long-term debt during this

economic decline, the U.S. government has provided capital

to financial institutions and has enabled access to short-term

borrowings for companies with high credit ratings. We are

not yet able to determine the outcome of these plans.

Included on our consolidated balance sheets are assets

held by benefit plans for the payment of future benefits.

The losses associated with the securities markets declines

during 2008 are not expected to have an impact on the ability

of our benefit plans to pay benefits. We do not expect to

make significant funding contributions to our pension plans

in 2009. However, because our pension plans are subject to

funding requirements of the Employee Retirement Income

Security Act of 1974, as amended (ERISA), a continued

weakness in the markets could require us to make

contributions to the pension plans in order to maintain

minimum funding requirements as established by ERISA.

In addition, our policy on recognizing losses on investments

in the pension and other postretirement plans will accelerate

the recognition of losses in 2009 earnings (see “Significant

Accounting Policies and Estimates”).

The ongoing weaknesses in the general economy and in

the securities, credit and mortgage markets are also affecting

portions of our customer and supplier bases although, at this

time, we are unable to quantify the effects. We are seeing

lower demand for our services from residential wireline

customers. Although business revenues remained relatively

stable this past year, we experienced some softening of

demand late in 2008 for usage-based services, such as

voice and transport. Our print directory revenues also

declined during 2008 as the economy continued to weaken.

Some of our suppliers also are experiencing increased

financial and operating costs and one large telecom

equipment supplier recently declared bankruptcy. As of

year-end, these negative trends had been offset by continued

growth in our wireless business. Our wireless growth

reflects both an increased demand for advanced services,

as evidenced by our successful launch of the iPhone 3G

and other advanced devices, and increased sales of other