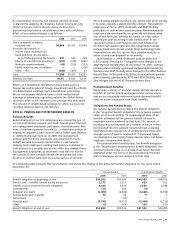

AT&T Wireless 2008 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2008 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

AT&T Annual Report 2008

| 65

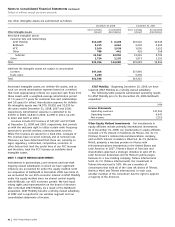

These hedges include initial and final exchanges of principal

from fixed foreign denominations to fixed U.S.-denominated

amounts, to be exchanged at a specified rate, which was

determined by the market spot rate upon issuance. They also

include an interest rate swap of a fixed foreign-denominated

rate to a fixed U.S.-denominated interest rate. These

derivatives have been designated at inception and qualify

as cash flow hedges with a net fair value of $(930) at

December 31, 2008. These swaps are valued using current

market quotes, which were obtained from dealers.

Interest Rate Locks We entered into interest rate forward

contracts to partially hedge interest expense related to our debt

issuances. At December 31, 2008, we carried an unutilized

interest rate lock with a notional value of $250 and a fair value

of $7. During 2009, we expect to reclassify into earnings net

settlement expenses of approximately $12 to $16, net of tax.

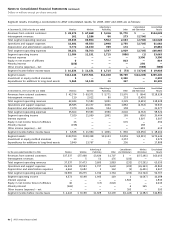

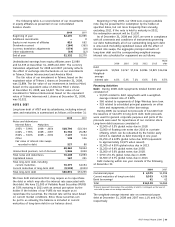

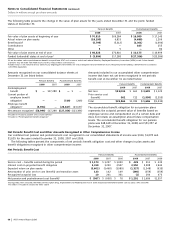

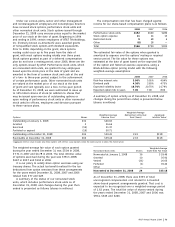

The following table summarizes our interest rate lock activity:

Utilized Settlement

Rate Lock Notional Notional Settlement Gain/(Cost) –

Execution Period Amount Amount Gain/(Cost) net of tax

2008 $ 750 $ 500 $(5) $(3)

2007 1,800 1,800 (8) (5)

2006 750 600 4 3

2005 500 500 (2) (1)

Foreign Currency Forward Contracts We enter into foreign

currency forward contracts to manage our exposure to

changes in currency exchange rates related to foreign

currency-denominated transactions. At December 31, 2008

and 2007, our foreign exchange contracts consisted principally

of Mexican pesos, Euros, Danish krone, Swedish krona and

Canadian dollars. At December 31, 2008, the notional

amounts under contract were $243, of which none were

designated as net investment hedges. At December 31, 2007,

the notional amounts under contract were $345, of which none

were designated as net investment hedges. The remaining

contracts in both periods were not designated for accounting

purposes. At December 31, 2008 and 2007, these foreign

exchange contracts had a net carrying and fair value asset

of less than $14 and fair value liability of less than $3,

respectively. These contracts were valued using current

market quotes, which were obtained from independent

sources.

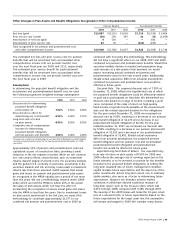

NOTE 10. INCOME TAXES

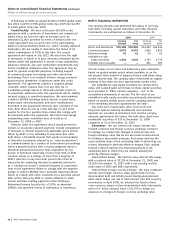

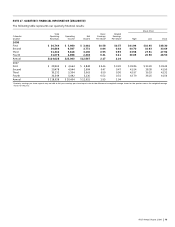

Significant components of our deferred tax liabilities (assets)

are as follows at December 31:

2008 2007

Depreciation and amortization $ 18,269 $17,004

Intangibles (nonamortizable) 1,990 1,990

Equity in foreign affiliates 275 231

Employee benefits (14,825) (6,121)

Currency translation adjustments (491) (287)

Allowance for uncollectibles (368) (388)

Net operating loss and other carryforwards (2,220) (2,838)

Investment in wireless partnership 16,028 13,997

Other – net (1,666) (1,763)

Subtotal 16,992 21,825

Deferred tax assets valuation allowance 1,190 1,070

Net deferred tax liabilities $ 18,182 $22,895

Net long-term deferred tax liabilities $ 19,196 $24,939

Less: Net current deferred tax assets (1,014) (2,044)

Net deferred tax liabilities $ 18,182 $22,895

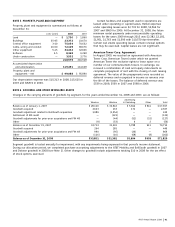

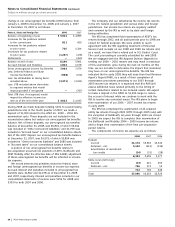

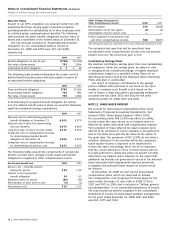

At December 31, 2008, we had combined net operating and

capital loss carryforwards (tax effected) for federal, and for

state and foreign income tax purposes of $673 and $1,142,

respectively, expiring through 2027. The federal net operating

loss carryforward primarily relates to the acquisitions of

AT&T Wireless Services, Inc. in 2004 and Dobson in 2007.

Additionally, we had federal and state credit carryforwards

of $105 and $300, respectively, expiring primarily

through 2025.

We recognize a valuation allowance if, based on the

weight of available evidence, it is more likely than not

that some portion, or all, of a deferred tax asset will not

be realized. Our valuation allowances at December 31, 2007

and 2008 relate primarily to state net operating loss

carryforwards.

On January 1, 2007, we adopted FIN 48 and, as

required, we reclassified $6,225 from net deferred tax

liabilities to unrecognized tax benefits. As a result of the

implementation of FIN 48, we recognized a $50 increase

in the liability for unrecognized tax benefits, which was

accounted for as a reduction to the January 1, 2007

balance of retained earnings. A reconciliation of the