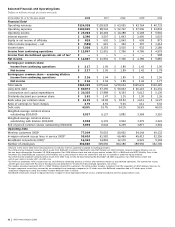

AT&T Wireless 2008 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2008 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

AT&T Annual Report 2008

| 29

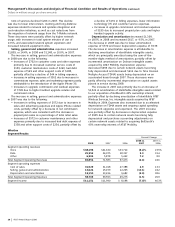

• Localwholesalerevenuesdecreased$350,or18.7%,

in 2008 and increased $324, or 20.9%, in 2007.

The decrease in 2008 was primarily due to the declining

number of competitive providers using local wholesale

lines. However, this declining revenue trend stabilized

in the second half of 2008 since industry consolidation

and local wholesale line loss has slowed. The increase in

2007 was primarily due to the acquisition of BellSouth,

which increased local wholesale revenues approximately

$615. Wholesale revenue decreased in 2007 due to

industry consolidation as certain customers moved

more traffic to their own networks.

Data revenues increased $1,277, or 5.3%, in 2008 and

increased $5,758, or 31.4%, in 2007. Data revenues accounted

for approximately 36% of wireline operating revenues in

2008, 34% in 2007 and 32% in 2006. Data revenues include

transport, IP and packet-switched data services.

IP data revenues increased $1,537, or 16.1%, in 2008

primarily due to growth in consumer and business broadband,

VPNs and managed Internet services, and increased $3,080,

or 47.6%, in 2007 primarily due to the acquisition of BellSouth,

which increased IP data approximately $2,235. Broadband

high-speed Internet access increased IP data revenues

$498 in 2008. The increase in broadband revenues was

partially offset by the decline in revenue due to the

renegotiation of our Yahoo! agreement which took effect

April 2008. VPNs increased $477 and various other

IP data services such as U-verse video and dedicated

Internet access services contributed $535 to the increase

in 2008. The increase in IP data revenues in 2008 and

2007 reflects continued growth in the customer base and

migration from other traditional circuit-based services.

Our transport services increased $163, or 1.4%, in 2008,

primarily due to continuing volume growth in Ethernet (types

of high-capacity switched lines), ISDN and international private

lines. These increases were partially offset by declines in

usage-based transport services used by our largest business

customers. In 2007, transport services revenues increased

$2,640, or 29.7%, due to the acquisition of BellSouth.

Our traditional circuit-based services, which include frame

relay, asynchronous transfer mode and managed packet

services, decreased $423, or 14.1%, in 2008. This decrease

is primarily due to lower demand as customers continue to

shift to IP-based technology such as VPNs, broadband and

managed Internet services. We expect these traditional

services to continue to decline as a percentage of our

overall data revenues. In 2007, circuit-based services

revenues increased $38, or 1.3%, primarily due to the

acquisition of BellSouth, which increased circuit-based

services revenues $265.

Other operating revenues increased $426, or 7.2%, in

2008 and $436, or 8.0%, in 2007. Major items included

in other operating revenues are integration services and

customer premises equipment, government-related services

and outsourcing, which account for more than 60% of total

revenue for all periods. Equipment sales and related network

integration and management services increased $260 in

Operating Margin Trends

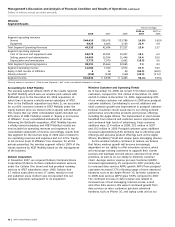

Our wireline segment operating income margin was 16.0%

in 2008, compared to 16.7% in 2007 and 14.3% in 2006.

Results for 2008 reflect revenue declines that exceeded

expense declines. Our wireline segment operating income

decreased $839, or 7.0%, in 2008 and increased $3,792 in

2007 primarily reflecting the addition of BellSouth’s operating

results in 2007. Our operating income continued to be

pressured by access line declines due to increased

competition, as customers disconnected both primary and

additional lines and switched to alternative technologies,

such as wireless, VoIP and cable for voice and data.

The deteriorating economy during 2008 also adversely

affected our customers’ ability to purchase and maintain

both wireline and wireless services. Our strategy is to offset

these line losses by increasing non-access-line-related

revenues from customer connections for data, video and

voice. Additionally, we have the opportunity to increase

wireless segment revenues if customers choose AT&T Mobility

as an alternative provider. As noted above, 2007 revenues

and expenses reflect the addition of BellSouth’s results while

our 2006 results only include two days of their results.

Accordingly, the following discussion of changes in our

revenues and expenses is affected by this acquisition.

Voice revenues decreased $3,432, or 8.2%, in 2008

primarily due to declining demand for traditional voice

services and increased $7,916, or 23.5%, in 2007. Included in

voice revenues are revenues from local voice, long-distance

and local wholesale services. Voice revenues do not include

VoIP revenues, which are included in data revenues.

•Localvoicerevenuesdecreased$1,887,or7.7%,in2008

and increased $6,831, or 38.4%, in 2007. The decrease

in 2008 was driven primarily by loss of revenue of

$1,230 from a decline in access lines and by $422

from a decline from ATTC’s mass-market customers.

The increase in 2007 was primarily due to the

acquisition of BellSouth, which increased local voice

revenues approximately $8,040. Local voice revenues

also increased in 2007 due to pricing increases for

regional telephone service, custom calling features

and inside wire maintenance agreements. Local voice

revenues in 2007 were negatively impacted by

expected declines in revenues from ATTC’s mass-

market customers and from customer demand-related

declines for calling features and inside wire agreements.

We expect our local voice revenue to continue to be

negatively affected by increased competition from

alternative technologies, the disconnection of additional

lines and the deteriorating economy.

• Long-distancerevenuesdecreased$1,195,or7.9%,in

2008 and increased $761, or 5.3%, in 2007 primarily

due to the acquisition of BellSouth, which increased

long-distance revenues approximately $2,075. The

decrease in 2008 was primarily due to a net decrease

in demand for long-distance service, due to expected

declines in the number of ATTC’s mass-market customers,

which decreased revenues $677 and decreased demand

from global and consumer customers, which decreased

revenues $532.