AT&T Wireless 2008 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2008 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

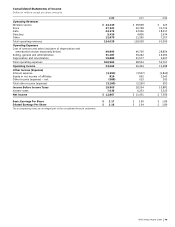

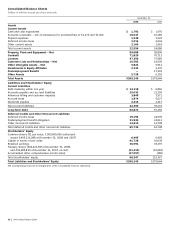

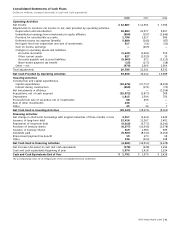

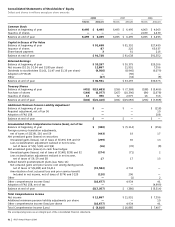

Management’s Discussion and Analysis of Financial Condition and Results of Operations (continued)

Dollars in millions except per share amounts

42

| AT&T Annual Report 2008

Other

Our total capital consists of debt (long-term debt and

debt maturing within one year) and stockholders’ equity.

Our capital structure does not include debt issued by our

international equity investees. Our debt ratio was 43.8%,

35.7%, and 34.1% at December 31, 2008, 2007 and 2006.

The debt ratio is affected by the same factors that affect

total capital. Total capital decreased $8,144 in 2008 compared

to an increase of $4,146 in 2007. The 2008 total capital

decrease was due to a $16,677 decrease in accumulated

other comprehensive loss that reflects a decrease in

retirement plans funded status partially offset by an increase

in debt of $10,876 related to our financing activities.

Our stockholders’ equity balance was down $19,020

primarily due to the decrease in retirement plan funded

status discussed above.

The primary factor contributing to the increase in our

2007 debt ratio was the increase in debt of $4,319 related

to our financing activities. Our stockholders’ equity balance

decreased $173 and included our increase in net income and

current adjustments for unrealized pension and postretirement

gains, which were more than offset by our increased share

repurchase activity and dividend distributions.

CO N TRACTUA L OBLIGATIO N S , CO MMITM E N TS AND CONT I N GENCI E S

Current accounting standards require us to disclose our

material obligations and commitments to making future

payments under contracts, such as debt and lease agree-

ments, and under contingent commitments, such as debt

guarantees. We occasionally enter into third-party debt

guarantees, but they are not, nor are they reasonably likely

to become, material. We disclose our contractual long-term

debt repayment obligations in Note 8 and our operating

lease payments in Note 5. Our contractual obligations

do not include expected pension and postretirement

payments as we maintain pension funds and Voluntary

Employee Beneficiary Association trusts to fully or partially

fund these benefits (see Note 11). In the ordinary course of

business, we routinely enter into commercial commitments

for various aspects of our operations, such as plant additions

and office supplies. However, we do not believe that the

commitments will have a material effect on our financial

condition, results of operations or cash flows.

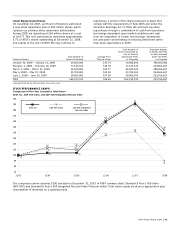

Our contractual obligations as of December 31, 2008, are

in the following table. The purchase obligations that follow

are those for which we have guaranteed funds and will be

funded with cash provided by operations or through incre-

mental borrowings. The minimum commitment for certain

obligations is based on termination penalties that could be

paid to exit the contract. Since termination penalties would

not be paid every year, such penalties are excluded from the

table. Other long-term liabilities were included in the table

based on the year of required payment or an estimate of

the year of payment. Such estimate of payment is based

on a review of past trends for these items, as well as a

forecast of future activities. Certain items were excluded from

the following table as the year of payment is unknown and

could not be reliably estimated since past trends were not

deemed to be an indicator of future payment.

We entered into fixed-to-fixed cross-currency swaps on

our 2015 euro-denominated debt instruments to hedge our

exposure to changes in foreign currency exchange rates.

These hedges also include interest rate swaps of a fixed

euro-denominated interest rate to a fixed U.S.-denominated

interest rate, which results in a U.S.-denominated semiannual

rate of 5.77%.

During 2008, debt repayments totaled $4,010 and

consisted of:

• $3,915relatedtodebtrepaymentswithaweighted-

average interest rate of 3.98%.

• $66relatedtorepaymentsofEdgeWirelesstermloan.

• $29relatedtoscheduledprincipalpaymentsonother

debt and repayments of other borrowings.

We have a five-year $10,000 credit agreement with a

syndicate of investment and commercial banks, which we

have the right to increase up to an additional $2,000, provided

no event of default under the credit agreement has occurred.

One of the participating banks is Lehman Brothers Bank, Inc.,

which recently declared bankruptcy. We are unable to

determine the status of its stated commitment of $595 at this

time. The current agreement will expire in July 2011. We also

have the right to terminate, in whole or in part, amounts

committed by the lenders under this agreement in excess of

any outstanding advances; however, any such terminated

commitments may not be reinstated. Advances under this

agreement may be used for general corporate purposes,

including support of commercial paper borrowings and other

short-term borrowings. There is no material adverse change

provision governing the drawdown of advances under this

credit agreement. This agreement contains a negative pledge

covenant, which requires that, if at any time we or a

subsidiary pledge assets or otherwise permits a lien on its

properties, advances under this agreement will be ratably

secured, subject to specified exceptions. We must maintain

a debt-to-EBITDA (earnings before interest, income taxes,

depreciation and amortization, and other modifications

described in the agreement) financial ratio covenant of not

more than three-to-one as of the last day of each fiscal

quarter for the four quarters then ended. We comply with

all covenants under the agreement. At December 31, 2008,

we had no borrowings outstanding under this agreement

(see Note 8).

During 2008, proceeds of $319 from the issuance of

treasury shares were related to the settlement of share-based

awards.

During 2007, we paid $190 to minority interest holders and

$47 to terminate interest rate swaps with notional amounts

totaling $1,800 acquired as a result of our acquisition of

BellSouth.

In February of 2009, we issued $1,000 of 4.85% global

notes due 2014, $2,250 of 5.8% global notes due 2019

and $2,250 of 6.55% global notes due 2039.

We plan to fund our 2009 financing activities through a

combination of debt issuances and cash from operations.

Our financing activities emphasis will be on the repayment of

debt. We will continue to examine opportunities to fund our

activities by issuing debt at favorable rates and with cash from

the disposition of certain other non-strategic investments.