AT&T Wireless 2008 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2008 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

AT&T Annual Report 2008

| 59

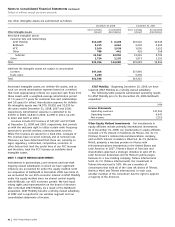

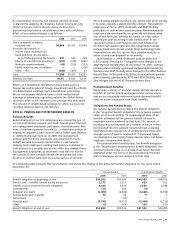

includes minority interest reported as other income (expense)

– net in the consolidated statements of income. Therefore,

these items are not included in the calculation of each

segment’s percentage of our consolidated results. As a result

of the December 29, 2006 acquisition of BellSouth we have

revised our segment reporting to represent how we now

manage our business, restating prior periods to conform to

the current segments. The customers and long-lived assets

of our reportable segments are predominantly in the

United States. We have four reportable segments: (1)wireless,

(2)wireline, (3)advertising & publishing and (4)other.

The wireless segment provides voice, data and other

wireless communications services, and includes 100% of the

results of AT&T Mobility, which was our wireless joint venture

with BellSouth prior to the December 29, 2006 acquisition

and is now a wholly-owned subsidiary of AT&T. Prior to the

acquisition, we analyzed AT&T Mobility’s revenues and

expenses under the wireless segment, and we eliminated

the wireless segment in our consolidated financial statements.

In our 2006 and prior consolidated financial statements we

reported our 60% proportionate share of AT&T Mobility’s

results as equity in net income of affiliates.

The wireline segment provides both retail and wholesale

landline communications services, including local and long-

distance voice, switched access, Internet protocol and Internet

access data, messaging services, managed networking to

business customers, AT&T U-verseSM TV service and satellite

television services through our agency agreements with

EchoStar Communications Corp. (EchoStar) and the DIRECTV

Group, Inc.

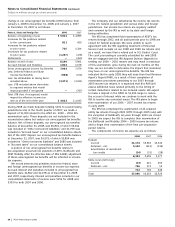

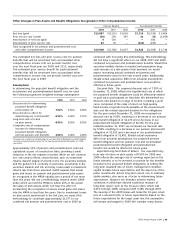

The advertising & publishing segment includes our

directory operations, which publish Yellow and White Pages

directories and sell directory advertising and Internet-based

advertising and local search. This segment includes the

results of YPC, which was a joint venture with BellSouth

prior to the December 29, 2006 acquisition and is now a

wholly-owned subsidiary of AT&T. For segment reporting

disclosure, we have carried forward the deferred revenue

and deferred cost balances for BellSouth at the acquisition

date in order to reflect how the segment is managed. This

is different for consolidated reporting purposes as under

FAS 141, BellSouth deferred revenue and expenses from

directories published during the 12-month period ending

with the December 29, 2006 acquisition date, are not

recognized and therefore were not included in the opening

balance sheet. For management reporting purposes, we

continue to amortize these balances over the life of the

directory. Thus, our advertising & publishing segment

results in 2007 include revenue of $964 and expenses

of $308, related to directories published in the Southeast

region during 2006, prior to our acquisition of BellSouth.

These amounts are eliminated in the consolidations and

eliminations column in the following reconciliation.

The other segment includes results from Sterling

Commerce, Inc., customer information services and all

corporate and other operations. This segment includes

our portion of the results from our international equity

investments. Also included in the other segment are

impacts of corporate wide decisions for which the individual

operating segments are not being evaluated. Prior to

December 29, 2006, this segment also included our results

from AT&T Mobility as equity in net income of affiliates,

as discussed above.

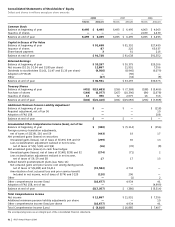

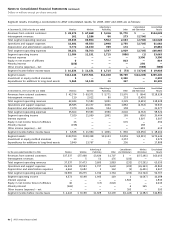

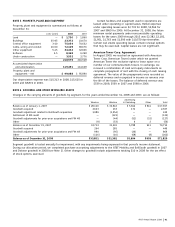

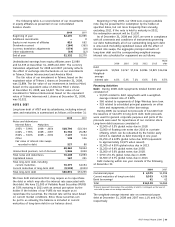

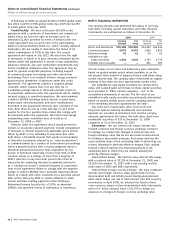

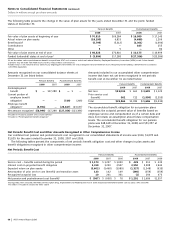

In the following tables, we show how our segment

results are reconciled to our consolidated results reported in

accordance with GAAP. The Wireless, Wireline, Advertising &

Publishing and Other columns represent the segment results

of each such operating segment. The Consolidation and

Elimination column adds in those line items that we manage

on a consolidated basis only: interest expense, interest

income and other income (expense) – net. This column also

eliminates any intercompany transactions included in each

segment’s results as well as the advertising & publishing

revenue and expenses in 2007 related to directories

published in the Southeast region during 2006, mentioned

previously. In 2006, since our 60% share of the results from

AT&T Mobility is already included in the Other column, the

Wireless Elimination column removes the non-consolidated

results shown in the wireless segment. In the “Segment

assets” line item, we have eliminated the value of our

investments in our fully consolidated subsidiaries and the

intercompany financing assets as these have no impact to

the segments’ operations.