AT&T Wireless 2008 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2008 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

26

| AT&T Annual Report 2008

Accounting for AT&T Mobility

The wireless segment reflects 100% of the results reported

by AT&T Mobility, which was our wireless joint venture with

BellSouth prior to the December 29, 2006 acquisition, at

which time it became a wholly-owned subsidiary of AT&T.

Prior to the BellSouth acquisition (see Note 2), we accounted

for our 60% economic interest in AT&T Mobility under the

equity method since we shared control equally with BellSouth.

This means that our 2006 consolidated results included our

60% share of AT&T Mobility’s results in “Equity in net income

of affiliates” in our consolidated statements of income.

Following the BellSouth acquisition, AT&T Mobility became

a wholly-owned subsidiary and AT&T Mobility’s results are

now included as operating revenues and expenses in our

consolidated statements of income. Accordingly, results from

this segment for the last two days of 2006 were included in

our operating revenues and expenses and not in the “Equity

in net income (loss) of affiliates” line. However, for all the

periods presented, the wireless segment reflects 100% of the

results reported by AT&T Mobility based on the management

of the business.

Dobson Acquisition

In November 2007, we acquired Dobson Communications

Corporation (Dobson). Dobson marketed wireless services

under the Cellular One brand and had provided roaming

services to AT&T subsidiaries since 1990. Dobson had

1.7million subscribers across 17 states, mostly in rural

and suburban areas. Dobson was incorporated into our

wireless operations subsequent to its acquisition.

Wireless Customer and Operating Trends

As of December 31, 2008, we served 77.0 million wireless

customers, compared to 70.1 million at December 31, 2007,

and 61.0 million at December 31, 2006. Approximately 69%

of our wireless customer net additions in 2008 were postpaid

customer additions. Contributing to our net additions and

retail customer growth was improvement in postpaid customer

turnover (customer churn) levels due to our strong network

performance and attractive products and services offerings,

including the Apple iPhone. The improvement in churn levels

benefited from network and customer service improvements

and continued high levels of advertising. Gross customer

additions were 21.4 million in 2008, 20.1 million in 2007

and 19.2 million in 2006. Postpaid customer gross additions

increased approximately 8.4% primarily due to attractive plan

offerings and exclusive product offerings such as the Apple

iPhone, BlackBerry® Bold and unique quick messaging devices.

As the wireless industry continues to mature, we believe

that future wireless growth will become increasingly

dependent on our ability to offer innovative services, which

will encourage existing customers to upgrade their current

services and handsets and will attract customers from other

providers, as well as on our ability to minimize customer

churn. Average service revenue per user/customer (ARPU)

increased approximately 1% compared to 2007 primarily due

to increased data services ARPU growth. ARPU from postpaid

customers increased 3.7% reflecting usage of more advanced

handsets, such as the Apple iPhone 3G, by these customers.

In 2008, data services ARPU grew 33.8% compared to 2007.

The continued increase in data revenue was related to

increased use of text messaging, Internet access, e-mail

and other data services. We expect continued growth from

data services as more customers purchase advanced

handsets, such as iPhone 3G, and laptop cards and as our

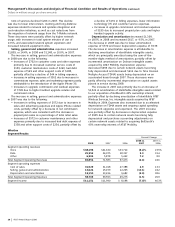

Wireless

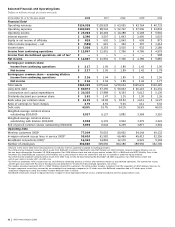

Segment Results

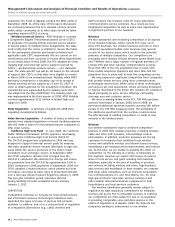

Percent Change

2008 vs. 2007 vs.

2008 2007 2006 2007 2006

Segment operating revenues

Service $44,410 $38,678 $33,788 14.8% 14.5%

Equipment 4,925 4,006 3,749 22.9 6.9

Total Segment Operating Revenues 49,335 42,684 37,537 15.6 13.7

Segment operating expenses

Cost of services and equipment sales 18,078 15,991 15,057 13.1 6.2

Selling, general and administrative 14,403 12,594 11,446 14.4 10.0

Depreciation and amortization 5,770 7,079 6,462 (18.5) 9.5

Total Segment Operating Expenses 38,251 35,664 32,965 7.3 8.2

Segment Operating Income 11,084 7,020 4,572 57.9 53.5

Equity in Net Income of Affiliates 6 16 40 (62.5) (60.0)

Minority Interest1 (256) (198) (169) (29.3) (17.2)

Segment Income $10,834 $ 6,838 $ 4,443 58.4% 53.9%

1Minority interest is recorded as “Other Income (Expense) – Net” in the consolidated statements of income.

Management’s Discussion and Analysis of Financial Condition and Results of Operations (continued)

Dollars in millions except per share amounts