AT&T Wireless 2008 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2008 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

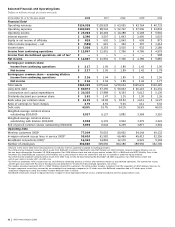

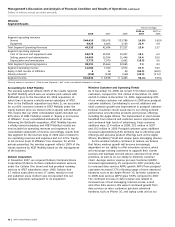

Management’s Discussion and Analysis of Financial Condition and Results of Operations (continued)

Dollars in millions except per share amounts

30

| AT&T Annual Report 2008

2008, driven by an increase in management services, and

decreased $274 in 2007 primarily due to less emphasis on

the sale of lower-margin equipment. Governmental

professional services revenue increased $100 in 2008

driven by growth across various contracts. Revenue also

decreased by $70 in 2007 due to the recognition of

intellectual property license fees in 2006 that did not recur

in 2007. More than offsetting these declines in 2007 was

incremental revenue from our acquisition of BellSouth.

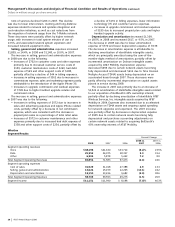

Cost of sales expenses increased $911, or 2.9%, in 2008

and $3,630, or 13.3%, in 2007. Cost of sales consists of costs

we incur in order to provide our products and services,

including costs of operating and maintaining our networks

and personnel costs, such as salary, wage and bonus

accruals. Costs in this category include our repair technicians

and repair services, certain network planning and engineering

expenses, operator services, IT and property taxes related to

elements of our network. Pension and postretirement costs,

net of amounts capitalized as part of construction labor, are

also included to the extent that they are associated with

these employees.

Cost of sales in 2008 increased due to the following:

• Highernonemployee-relatedexpenses,suchascontract

services, agent commissions and materials and supplies

costs, of $1,056.

• Salaryandwagemeritincreases,otherbonusaccruals

and higher employee levels, which increased

compensation expenses by $423 and increased

medical and other benefits by $239.

• Highercostofequipmentsalesandrelatednetwork

integration services of $60 in 2008 primarily due to

increased U-verse customers partially offset by

reductions due to less emphasis on sales of lower-

margin equipment.

Partially offsetting these increases, cost of sales in

2008 decreased due to:

• Lowertrafficcompensationexpenses(foraccessto

another carrier’s network) of $633 primarily due to

reduced portal fees from renegotiation of our agreement

with Yahoo!, continued migration of long-distance calls

onto our network and a lower volume of calls from

ATTC’s declining national mass-market customer base.

• Lowernetpensionandpostretirementcostof$387,

primarily due to changes in our actuarial assumptions,

including the increase of our discount rate from 6.00%

to 6.50% (a decrease to expense) and favorable prior-year

investment returns on plan assets resulting in a decrease

in the recognition of net losses from prior years.

In addition to the impact of the BellSouth acquisition, cost

of sales in 2007 increased due to the following:

• Highernonemployee-relatedexpenses,suchascontract

services, agent commissions and materials and supplies

costs, of $605.

• Higherexpensesof$225in2007duetoa2006change

in our policy regarding the timing for earning vacation

days, which reduced expense in 2006.

• Salaryandwagemeritincreasesandotherbonus

accruals of $165.

Partially offsetting these increases, cost of sales in 2007

decreased due to:

• Lowertrafficcompensationexpenses(foraccessto

another carrier’s network) of $831 primarily due to

migration of long-distance calls onto our network and

a lower volume of calls from ATTC’s declining national

mass-market customer base.

• Lowernetpensionandpostretirementcostof$398,

primarily due to changes in our actuarial assumptions,

including the increase of our discount rate from 5.75%

to 6.00% (a decrease to expense) and favorable

investment returns on plan assets resulting in a decrease

in the recognition of net losses from prior years.

• Lowercostofequipmentsalesandrelatednetwork

integration services of $300, primarily due to less

emphasis on sales of lower-margin equipment.

Costs associated with equipment for large-business

customers typically are greater than costs associated

with services that are provided over multiple years.

•Lowerexpensesof$163in2007duetothe

discontinuance of DSL Universal Service Fund fees

in the third quarter of 2006.

Selling, general and administrative expenses decreased

$1,535, or 10.1%, in 2008 and increased $2,954, or 24.2%, in

2007. Selling, general and administrative expenses consist

of our provision for uncollectible accounts; advertising costs;

sales and marketing functions, including our retail and

wholesale customer service centers; centrally managed real

estate costs, including maintenance and utilities on all owned

and leased buildings; credit and collection functions; and

corporate overhead costs, such as finance, legal, human

resources and external affairs. Pension and postretirement

costs are also included to the extent that they relate to

those employees.

Selling, general and administrative expenses in 2008

decreased due to the following:

• Lowerotherwirelinesupportcostsof$616primarily

due to higher advertising costs incurred in 2007 for

brand advertising and re-branding related to the

BellSouth acquisition.

• Lowernetpensionandpostretirementcostof$231,

primarily due to changes in our actuarial assumptions,

including the increase of our discount rate from 6.00%

to 6.50% (a decrease to expense) and favorable

prior-year investment returns on plan assets resulting

in a decrease in the recognition of net losses from

prior years.

• Lowercompensationexpensesprimarilyreflectingshifts

of force levels to cost of sales functions of $420 with

related declines in medical and other benefits by $210.

Partially offsetting these decreases, selling, general and

administrative expenses in 2008 increased due to:

• Highernonemployee-relatedexpenses,suchascontract

services, agent commissions and materials and supplies

costs, of $79.

• Higherprovisionforuncollectibleaccountsprimarily

related to our business and wholesale customers of $35.