AT&T Wireless 2008 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2008 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

24

| AT&T Annual Report 2008

preparing 2008 spectrum purchases for service. The increase

in 2007 was primarily due to higher average debt balances

resulting from the inclusion of BellSouth and AT&T Mobility

outstanding debt on our consolidated balance sheet.

Equity in net income of affiliates Equity in net income

of affiliates increased $127, or 18.4%, in 2008, primarily due to

improved results from our investments in América Móvil S.A.

de C.V. (América Móvil), Télefonos de México, S.A. de C.V.

(Telmex) and Telmex Internacional, S.A.B. de C.V. (Telmex

Internacional) offset by foreign exchange adjustments.

Equity in net income of affiliates decreased $1,351 in 2007

as a result of the change in accounting for AT&T Mobility

which moved Mobility’s results from this line. Prior to the

December 29, 2006 BellSouth acquisition (see Note 2),

we accounted for our 60% economic interest in AT&T Mobility

under the equity method since we shared control equally

with BellSouth. AT&T Mobility is now a wholly-owned

subsidiary of AT&T, and wireless results are reflected in

operating revenues and expenses in our consolidated

statements of income.

Other income (expense) – net We had other expense

of $589 in 2008, and other income of $615 in 2007 and $393

in 2006. Results for 2008 included losses of $467 related to

asset impairments, $261 in minority interest expense and

$180 loss on the sale of merger-related investments held

under independent management which support certain

benefit plans (see Note 11). These losses were partially offset

by a $121 gain on the disposition of other non-strategic

assets, $107 gain related to interest income, $49 of income

from leveraged leases and $41 of dividend income.

Other income for 2007 included gains of $409 related to a

wireless spectrum license exchange, $166 in interest income,

$148 from the sale of administrative buildings and other

non-strategic assets, and $88 from other non-operating

activities. These gains were partially offset by $196 in minority

interest expense. Other income for 2006 included interest

income of $377. There were no other individually significant

other income or expense transactions during 2006.

Income taxes increased $783, or 12.5%, in 2008 and

$2,728, or 77.4%, in 2007. The increase in income taxes in 2008

was primarily due to higher operating income. Our effective tax

rate in 2008 was 35.4%, compared to 34.4% in 2007 and 32.4%

in 2006. The increase in our effective tax rate for 2008 was

primarily due to an increase in income before income taxes.

The increase in income taxes in 2007 compared to 2006

was primarily due to higher operating income reflecting the

acquisition of BellSouth and its share of AT&T Mobility’s

operating results. The increase in our effective tax rate for

2007 was primarily due to the consolidation of AT&T Mobility

and an increase in income before income taxes.

Supplemental Information

To provide improved comparability versus previous results,

below is a supplemental table providing pro forma consoli-

dated operating revenues for 2006, assuming the closing date

for the BellSouth acquisition was January 1, 2006, along with

a summary of how these 2006 pro forma numbers would

have affected 2007 results. The 2008 results are included to

provide trend information but the comparisons between

2008 and 2007 results are discussed in “Segment Results.”

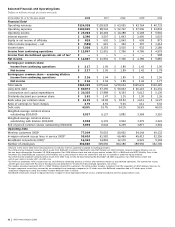

Management’s Discussion and Analysis of Financial Condition and Results of Operations (continued)

Dollars in millions except per share amounts

Supplemental Consolidated Operating Revenues Information

Percent Change

Actual Actual Pro Forma 2007 vs.

2008 2007 2006 2006

Segment operating revenues

Wireless service $ 44,249 $ 38,568 $ 33,692 14.5%

Voice 37,321 40,798 43,505 (6.2)

Data 24,372 23,206 22,173 4.7

Directory 5,416 4,806 5,823 (17.5)

Other 12,670 11,550 11,861 (2.6)

Total Operating Revenues $124,028 $118,928 $117,054 1.6%

Pro forma wireless service growth in 2007 was driven by

subscriber growth and strong increases in data usage,

including increased messaging, browsing, media bundles

and both laptop and smartphone connectivity. We have

historically discussed our wireless segment results on a basis

that included 100% of AT&T Mobility results, and a detailed

wireless service revenue discussion can be found in our

“Wireless Segment Results” section.

The pro forma voice revenue decline in 2007 is consistent

with trends and is due to access line declines reflecting

competition and substitution of alternative technologies,

pricing pressures due to competition, anticipated shifts of

traffic by major consolidated carriers to their own networks

and a continuing decline in the number of AT&T Corp.’s (ATTC)

mass-market customers, which are composed of consumers

and small businesses.

Pro forma data growth was led by an increase in IP data

revenues of 13.3% in 2007, with strength in high-speed

Internet, managed Internet, Virtual Private Network (VPN)

and hosting services. Data transport service revenues were

up 0.7% in 2007, and packet-switched data revenues, which

include frame relay and asynchronous transfer mode (ATM)

services, were down 7.0%, consistent with the industry trend

of customers switching to IP-based services from traditional

circuit-based services.