TCF Bank 2014 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2014 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

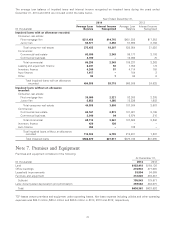

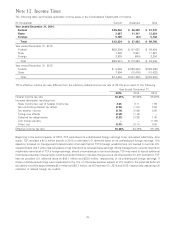

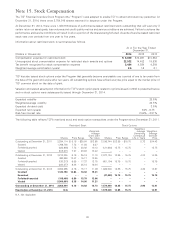

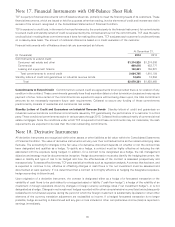

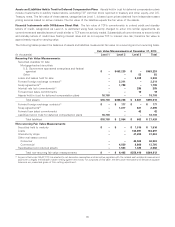

The following table sets forth the status of the Pension Plan and the Postretirement Plan.

Pension Plan Postretirement Plan

Year Ended December 31,

(In thousands) 2014 2013 2014 2013

Change in benefit obligation:

Benefit obligation, beginning of period $41,870 $45,037 $ 5,217 $ 6,675

Interest cost on projected benefit obligation 1,587 1,292 198 174

Actuarial (gain) loss 1,862 (2,196) (63) (1,241)

Benefits paid (5,829) (2,263) (368) (391)

Projected benefit obligation, end of period 39,490 41,870 4,984 5,217

Change in fair value of plan assets:

Fair value of plan assets, beginning of period 51,018 53,617 ––

Actual gain (loss) on plan assets (511) (336) ––

Benefits paid (5,829) (2,263) (368) (391)

TCF contributions ––368 391

Fair value of plan assets, end of period 44,678 51,018 ––

Funded status of plans, end of period $ 5,188 $ 9,148 $(4,984) $(5,217)

Amounts recognized in the Consolidated Statements of Financial

Condition:

Prepaid (accrued) benefit cost, end of period $ 5,188 $ 9,148 $(4,984) $(5,217)

Prior service cost included in accumulated other comprehensive loss ––(331) (378)

Accumulated other comprehensive loss, before tax ––(331) (378)

Total recognized asset (liability) $ 5,188 $ 9,148 $(5,315) $(5,595)

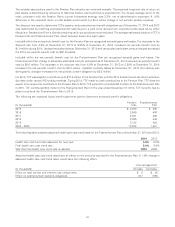

The accumulated benefit obligation for the Pension Plan was $39.5 million and $41.9 million at December 31, 2014 and 2013,

respectively.

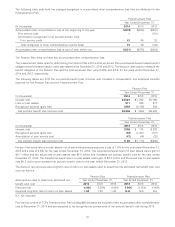

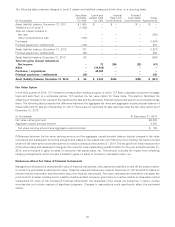

TCF’s Pension Plan investment policy states that assets may be invested in direct fixed income securities to include cash, money

market mutual funds, U.S. Treasury securities, U.S. Government-sponsored enterprises and indirect fixed income investment

securities made in fund form (mutual fund or institutional fund) where the fund invests in fixed income securities in investment

grade corporate credits, non-investment grade floating-rate bank loans and non-investment grade bonds. The fair value of Level 1

assets are based upon prices obtained from independent pricing sources for the same assets traded in active markets. The fair

value of the collective investment fund and the mortgage-backed securities categorized as Level 2 assets are based on prices

obtained from independent pricing sources that are based on observable transactions of similar instruments, but not quoted

markets. There were no assets that are valued on a recurring basis as Level 3 assets.

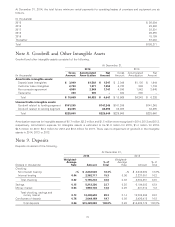

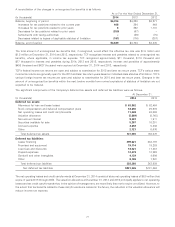

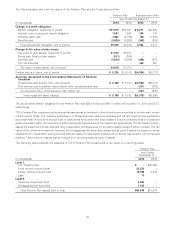

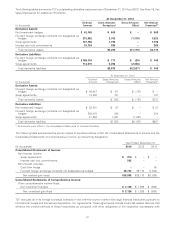

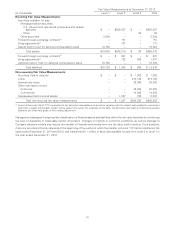

The following table presents the balances of TCF’s Pension Plan investments at fair value on a recurring basis.

Pension Plan

Year Ended

December 31,

(In thousands) 2014 2013

Level 1:

U.S. Treasury bills $–$47,999

Fixed income mutual funds 22,532 –

Money market mutual funds 16,088 3,019

Cash 71 –

Level 2:

Collective investment fund 4,961 –

Mortgage-backed securities 1,026 –

Total Pension Plan assets held in trust $44,678 $51,018

82