TCF Bank 2014 Annual Report Download - page 109

Download and view the complete annual report

Please find page 109 of the 2014 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

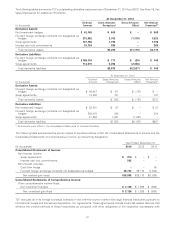

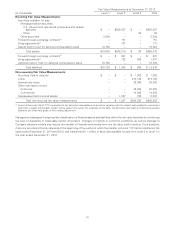

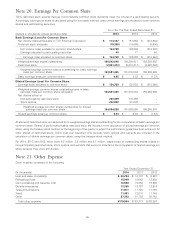

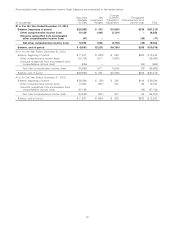

Note 22. Business Segments

Lending, Funding and Support Services have been identified as reportable segments. Lending includes consumer real estate,

commercial real estate and business lending, leasing and equipment finance, inventory finance and auto finance. Funding

includes branch banking and treasury services. Support Services includes Holding Company and corporate functions that provide

data processing, bank operations and other professional services to the operating segments.

TCF evaluates performance and allocates resources based on each segment’s net income or loss. The business segments follow

GAAP as described in Note 1, Summary of Significant Accounting Policies. TCF generally accounts for inter-segment sales and

transfers at cost.

The following tables set forth certain information for each of TCF’s reportable segments, including a reconciliation of TCF’s

consolidated totals.

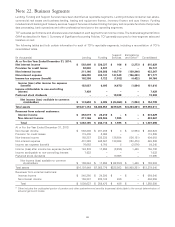

Support Eliminations

(In thousands) Lending Funding Services and Other(1) Consolidated

At or For the Year Ended December 31, 2014:

Net interest income $ 592,409 $ 226,327 $ 166 $ (3,273) $ 815,629

Provision for credit losses 92,800 2,937 – – 95,737

Non-interest income 211,166 220,568 140,779 (139,246) 433,267

Non-interest expense 426,290 434,141 147,549 (136,203) 871,777

Income tax expense (benefit) 102,398 3,722 (1,932) (4,422) 99,766

Income (loss) after income tax expense

(benefit) 182,087 6,095 (4,672) (1,894) 181,616

Income attributable to non-controlling

interest 7,429 – – – 7,429

Preferred stock dividends – – 19,388 – 19,388

Net income (loss) available to common

stockholders $ 174,658 $ 6,095 $ (24,060) $ (1,894) $ 154,799

Total assets $16,871,154 $6,488,853 $239,425 $(4,204,821) $19,394,611

Revenues from external customers:

Interest income $ 852,019 $ 22,210 $ – $ – $ 874,229

Non-interest income 211,166 220,506 1,595 – 433,267

Total $ 1,063,185 $ 242,716 $ 1,595 $ – $ 1,307,496

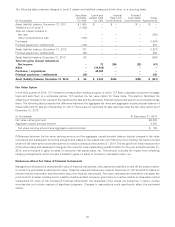

At or For the Year Ended December 31, 2013:

Net interest income $ 568,286 $ 237,289 $ 3 $ (2,954) $ 802,624

Provision for credit losses 115,408 2,960 – – 118,368

Non-interest income 168,387 235,238 136,584 (136,151) 404,058

Non-interest expense 401,326 442,557 139,864 (138,478) 845,269

Income tax expense (benefit) 76,663 9,750 8 (2,076) 84,345

Income (loss) after income tax expense (benefit) 143,276 17,260 (3,285) 1,449 158,700

Income attributable to non-controlling interest 7,032 – – – 7,032

Preferred stock dividends – – 19,065 – 19,065

Net income (loss) available to common

stockholders $ 136,244 $ 17,260 $ (22,350) $ 1,449 $ 132,603

Total assets $16,197,449 $7,862,779 $228,863 $(5,909,251) $18,379,840

Revenues from external customers:

Interest income $ 840,250 $ 24,290 $ – $ – $ 864,540

Non-interest income 168,387 235,185 486 – 404,058

Total $ 1,008,637 $ 259,475 $ 486 $ – $ 1,268,598

(1) Other includes the unallocated portion of pension and other postretirement benefits (expenses) attributable to the annual determination of

actuarial gains and losses.

96