TCF Bank 2014 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2014 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

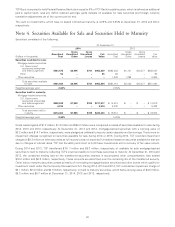

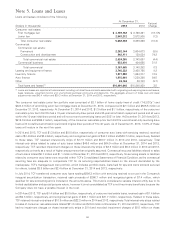

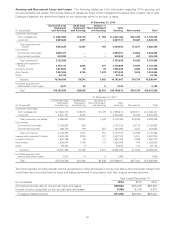

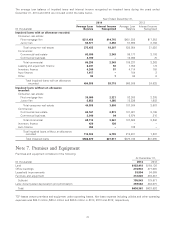

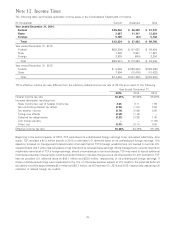

Accruing and Non-accrual Loans and Leases The following tables set forth information regarding TCF’s accruing and

non-accrual loans and leases. Non-accrual loans and leases are those which management believes have a higher risk of loss.

Delinquent balances are determined based on the contractual terms of the loan or lease.

At December 31, 2014

Current-59 Days 60-89 Days 90 Days or

Delinquent Delinquent More Delinquent Total

(In thousands) and Accruing and Accruing and Accruing Accruing Non-accrual Total

Consumer real estate:

First mortgage lien $ 2,987,992 $13,176 $ 194 $ 3,001,362 $137,790 $ 3,139,152

Junior lien 2,505,640 2,091 – 2,507,731 35,481 2,543,212

Total consumer real

estate 5,493,632 15,267 194 5,509,093 173,271 5,682,364

Commercial:

Commercial real estate 2,599,701 – – 2,599,701 24,554 2,624,255

Commercial business 532,929 – – 532,929 481 533,410

Total commercial 3,132,630 – – 3,132,630 25,035 3,157,665

Leasing and equipment

finance 3,728,115 2,242 307 3,730,664 12,670 3,743,334

Inventory finance 1,874,933 49 26 1,875,008 2,082 1,877,090

Auto finance 1,907,005 2,785 1,478 1,911,268 3,676 1,914,944

Other 24,144 – – 24,144 – 24,144

Subtotal 16,160,459 20,343 2,005 16,182,807 216,734 16,399,541

Portfolios acquired with

deteriorated credit quality 2,017 83 5 2,105 – 2,105

Total $16,162,476 $20,426 $2,010 $16,184,912 $216,734 $16,401,646

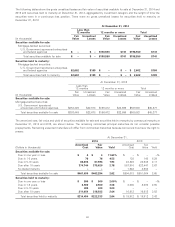

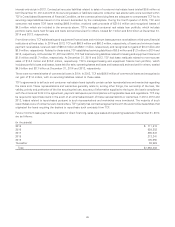

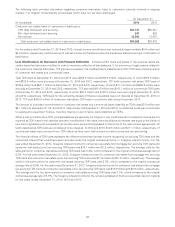

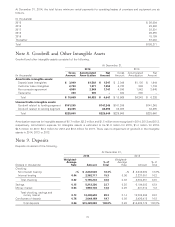

At December 31, 2013

Current-59 Days 60-89 Days 90 Days or

Delinquent Delinquent More Delinquent Total

(In thousands) and Accruing and Accruing and Accruing Accruing Non-accrual Total

Consumer real estate:

First mortgage lien $ 3,564,716 $19,815 $1,079 $ 3,585,610 $180,811 $ 3,766,421

Junior lien 2,531,151 3,532 – 2,534,683 38,222 2,572,905

Total consumer real estate 6,095,867 23,347 1,079 6,120,293 219,033 6,339,326

Commercial:

Commercial real estate 2,706,633 886 – 2,707,519 36,178 2,743,697

Commercial business 399,750 190 354 400,294 4,361 404,655

Total commercial 3,106,383 1,076 354 3,107,813 40,539 3,148,352

Leasing and equipment finance 3,404,346 2,226 613 3,407,185 14,041 3,421,226

Inventory finance 1,661,798 29 21 1,661,848 2,529 1,664,377

Auto finance 1,236,678 1,105 773 1,238,556 470 1,239,026

Other 26,323 9 1 26,333 410 26,743

Subtotal 15,531,395 27,792 2,841 15,562,028 277,022 15,839,050

Portfolios acquired with

deteriorated credit quality 7,870 14 5 7,889 – 7,889

Total $15,539,265 $27,806 $2,846 $15,569,917 $277,022 $15,846,939

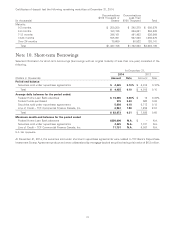

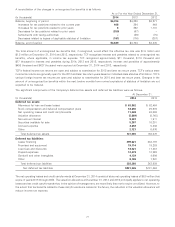

The following table provides interest income recognized on loans and leases in non-accrual status and contractual interest that

would have been recorded had the loans and leases performed in accordance with their original contractual terms.

Year Ended December 31,

(In thousands) 2014 2013 2012

Contractual interest due on non-accrual loans and leases $26,584 $33,046 $39,232

Interest income recognized on non-accrual loans and leases 9,359 12,149 9,401

Foregone interest income $17,225 $20,897 $29,831

68