TCF Bank 2014 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2014 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

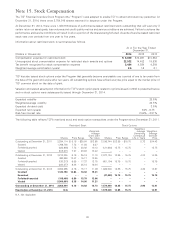

Note 15. Stock Compensation

The TCF Financial Incentive Stock Program (the ‘‘Program’’) was adopted to enable TCF to attract and retain key personnel. At

December 31, 2014, there were 2,754,016 shares reserved for issuance under the Program.

At December 31, 2014, there were 1,080,916 shares of performance-based restricted stock outstanding that will vest only if

certain return on asset goals, loan volumes and credit quality metrics and service conditions are achieved. Failure to achieve the

performance and service conditions will result in all or a portion of the shares being forfeited. Awards of service-based restricted

stock vest over periods from one year to five years.

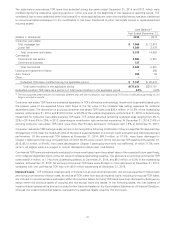

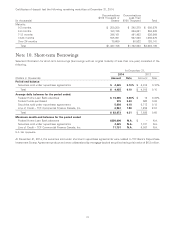

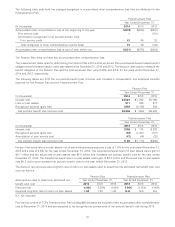

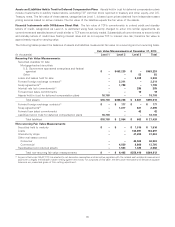

Information about restricted stock is summarized as follows.

At or For the Year Ended

December 31,

(Dollars in thousands) 2014 2013 2012

Compensation expense for restricted stock $ 8,690 $10,467 $10,934

Unrecognized stock compensation expense for restricted stock awards and options 22,532 14,482 19,530

Tax benefit recognized for stock compensation expense 3,424 4,034 4,259

Weighted average amortization (years) 2.6 1.6 2.1

TCF has also issued stock options under the Program that generally become exercisable over a period of one to ten years from

the date of the grant and expire after ten years. All outstanding options have a fixed exercise price equal to the market price of

TCF common stock on the date of grant.

Valuation and related assumption information for TCF’s stock option plans related to options issued in 2008 is presented below

and no stock options were subsequently issued through December 31, 2014.

Expected volatility 28.5%

Weighted-average volatility 28.5%

Expected dividend yield 3.5%

Expected term (years) 6.25 - 6.75

Risk-free interest rate 2.58% - 2.91%

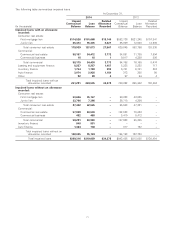

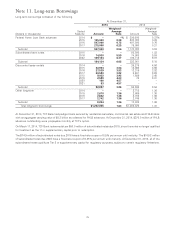

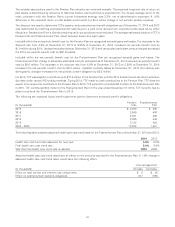

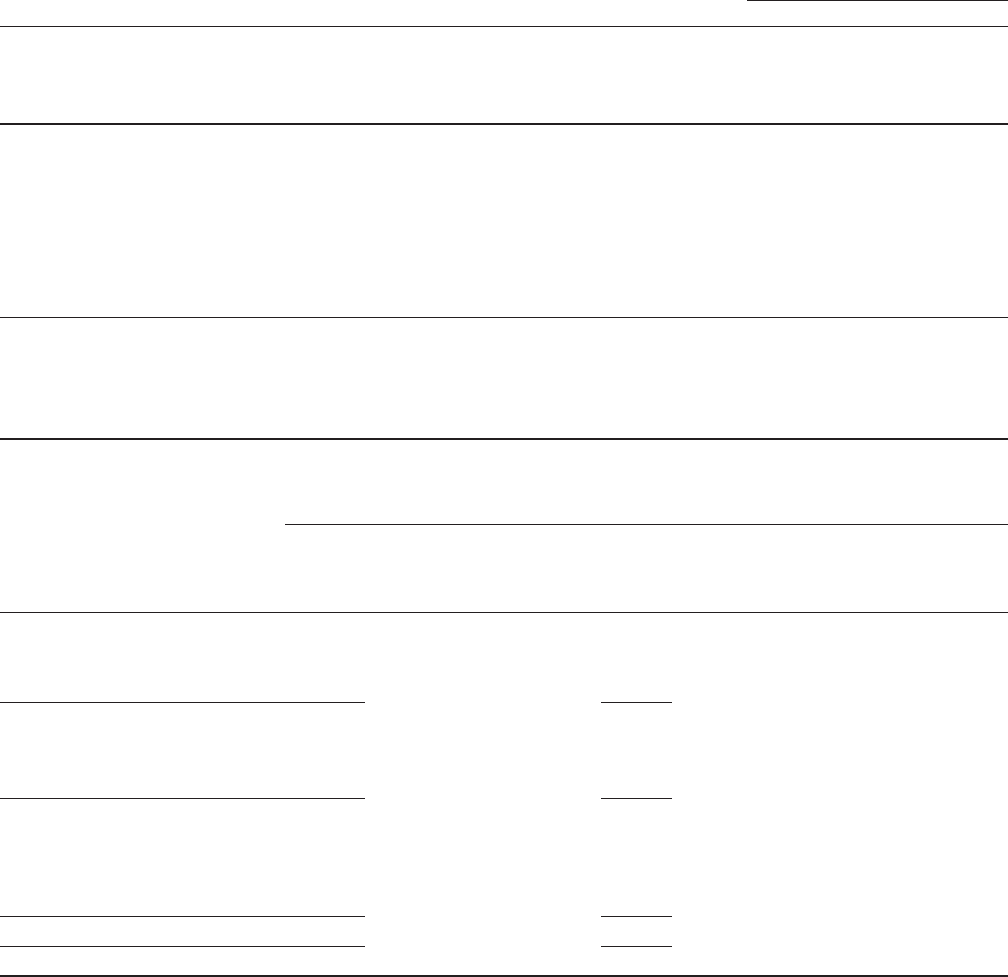

The following table reflects TCF’s restricted stock and stock option transactions under the Program since December 31, 2011.

Restricted Stock Stock Options

Weighted-

Weighted- Average Weighted-

Average Remaining Average

Grant Date Contractual Exercise

Shares Price Range Fair Value Shares Price Range Life in Years Price

Outstanding at December 31, 2011 2,284,114 $ 6.16 - $28.64 $12.95 2,198,744 $12.85 - $15.75 5.72 $14.43

Granted 1,769,700 7.73 - 11.56 9.27 – – - – – –

Forfeited/canceled (322,908) 7.73 - 28.02 10.13 (121,640) 15.75 - 15.75 – 15.75

Vested (518,671) 7.57 - 28.64 13.42 – – - – – –

Outstanding at December 31, 2012 3,212,235 6.16 - 25.18 11.13 2,077,104 12.85 - 15.75 4.22 14.35

Granted 493,650 12.47 - 15.17 13.55 – – - – – –

Forfeited/canceled (120,313) 9.65 - 17.37 12.75 (451,104) 15.75 - 15.75 – 15.75

Vested (230,277) 9.48 - 25.18 16.04 – – - – – –

Outstanding at December 31, 2013 3,355,295 6.16 - 15.17 11.09 1,626,000 12.85 - 15.75 4.36 13.97

Granted 1,120,750 13.84 - 16.02 15.61 – – - – – –

Exercised – – - – – (47,000) 15.75 - 15.75 – 15.75

Forfeited/canceled (108,490) 6.80 - 15.79 13.06 – – - – – –

Vested (1,509,061) 8.35 - 14.90 11.21 – – - – – –

Outstanding at December 31, 2014 2,858,494 6.16 - 16.02 12.73 1,579,000 12.85 - 15.75 2.98 13.91

Exercisable at December 31, 2014 N.A. N.A. 1,579,000 12.85 - 15.75 13.91

N.A. Not Applicable.

80