TCF Bank 2014 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2014 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

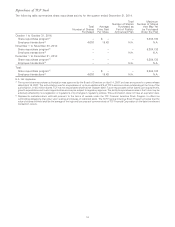

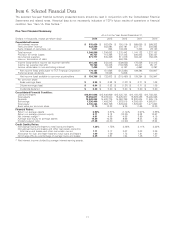

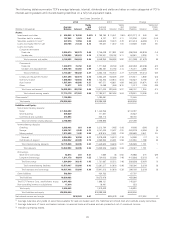

Item 6. Selected Financial Data

The selected five-year financial summary presented below should be read in conjunction with the Consolidated Financial

Statements and related notes. Historical data is not necessarily indicative of TCF’s future results of operations or financial

condition. See ‘‘Item 1A. Risk Factors.’’

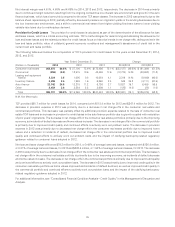

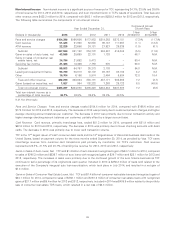

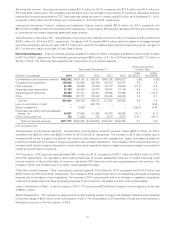

Five Year Financial Summary

At or For the Year Ended December 31,

(Dollars in thousands, except per-share data) 2014 2013 2012 2011 2010

Consolidated Income:

Net interest income $ 815,629 $ 802,624 $ 780,019 $ 699,688 $ 699,202

Fees and other revenue 432,240 403,094 388,191 437,171 508,862

Gains (losses) on securities, net 1,027 964 102,232 7,263 29,123

Total revenue 1,248,896 1,206,682 1,270,442 1,144,122 1,237,187

Provision for credit losses 95,737 118,368 247,443 200,843 236,437

Non-interest expense 871,777 845,269 811,819 764,451 756,335

Loss on termination of debt –– 550,735 – –

Income (loss) before income tax expense (benefit) 281,382 243,045 (339,555) 178,828 244,415

Income tax expense (benefit) 99,766 84,345 (132,858) 64,441 90,171

Income attributable to non-controlling interest 7,429 7,032 6,187 4,993 3,297

Net income (loss) attributable to TCF Financial Corporation 174,187 151,668 (212,884) 109,394 150,947

Preferred stock dividends 19,388 19,065 5,606 – –

Net income (loss) available to common stockholders $ 154,799 $ 132,603 $ (218,490) $ 109,394 $ 150,947

Per common share:

Basic earnings (loss) $ 0.95 $ 0.82 $ (1.37) $ 0.71 $ 1.08

Diluted earnings (loss) $ 0.94 $ 0.82 $ (1.37) $ 0.71 $ 1.08

Dividends declared $ 0.20 $ 0.20 $ 0.20 $ 0.20 $ 0.20

Consolidated Financial Condition:

Loans and leases $16,401,646 $15,846,939 $15,425,724 $14,150,255 $14,788,304

Total assets 19,394,611 18,379,840 18,225,917 18,979,388 18,465,025

Deposits 15,449,882 14,432,776 14,050,786 12,202,004 11,585,115

Borrowings 1,236,490 1,488,243 1,933,815 4,388,080 4,985,611

Total equity 2,135,364 1,964,759 1,876,643 1,878,627 1,471,663

Book value per common share 11.10 10.23 9.79 11.65 10.30

Financial Ratios:

Return on average assets 0.96% 0.87% (1.14)% 0.61% 0.85%

Return on average common equity 8.71 8.12 (13.33) 6.32 10.67

Net interest margin(1) 4.61 4.68 4.65 3.99 4.15

Average total equity to average assets 10.89 10.46 9.66 9.24 7.83

Dividend payout ratio 21.28 24.30 (14.60) 28.10 18.52

Credit Quality Ratios:

Non-accrual loans and leases to total loans and leases 1.32% 1.75% 2.46% 2.11% 2.33%

Non-accrual loans and leases and other real estate owned to

total loans and leases and other real estate owned 1.71 2.17 3.07 3.03 3.26

Allowance for loan and lease losses to total loans and leases 1.00 1.59 1.73 1.81 1.80

Net charge-offs as a percentage of average loans and leases 0.49 0.81 1.54 1.45 1.47

(1) Net interest income divided by average interest-earning assets.

17