TCF Bank 2014 Annual Report Download - page 94

Download and view the complete annual report

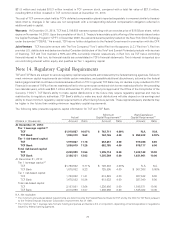

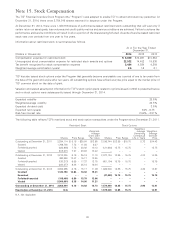

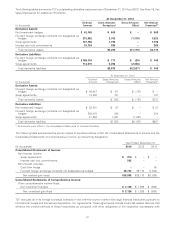

Please find page 94 of the 2014 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Note 16. Employee Benefit Plans

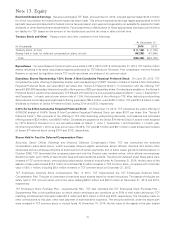

Employees Stock Purchase Plan The TCF Employees Stock Purchase Plan (the ‘‘ESPP’’), a qualified 401(k) and employee

stock ownership plan, generally allows participants to make contributions of up to 50% of their covered compensation on a

tax-deferred basis, subject to the annual covered compensation limitation imposed by the Internal Revenue Service (‘‘IRS’’).

TCF matches the contributions of all participants with TCF common stock at the rate of 50 cents per dollar for employees with

one through four years of service up to a maximum company contribution of 3.0% of the employee’s covered compensation,

75 cents per dollar for employees with five through nine years of service up to a maximum company contribution of 4.5% of the

employee’s covered compensation and $1 per dollar for employees with ten or more years of service up to a maximum company

contribution of 6.0% of the employee’s covered compensation, subject to the annual covered compensation limitation imposed

by the IRS. Employee contributions vest immediately while the Company’s matching contributions are subject to a graduated

vesting schedule based on an employee’s years of service with full vesting after five years. Employees have the opportunity to

diversify and invest their account balance, including matching contributions, in various mutual funds or TCF common stock. At

December 31, 2014, the fair value of the assets in the ESPP totaled $244.0 million and included $139.6 million invested in

TCF common stock. Dividends on TCF common shares held in the ESPP reduce retained earnings and the shares are considered

outstanding for computing earnings per share. The Company’s matching contributions are expensed when made. TCF’s

contributions to the ESPP were $9.6 million in 2014, $8.9 million in 2013 and $8.0 million in 2012.

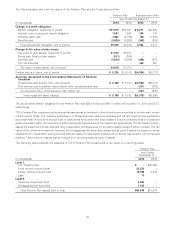

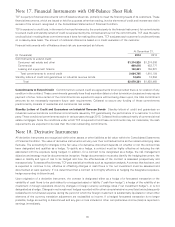

Pension Plan The TCF Cash Balance Pension Plan (the ‘‘Pension Plan’’) is a qualified defined benefit plan covering eligible

employees who are at least 21 years old and have completed a year of eligible service with TCF. Employees hired after June 30,

2004 are not eligible to participate in the Pension Plan. Effective March 31, 2006, TCF amended the Pension Plan to discontinue

compensation credits for all participants. Interest credits will continue to be paid until participants’ accounts are distributed from

the Pension Plan. Each month TCF credits participants’ accounts with interest on the account balance based on the five-year

Treasury rate plus 25 basis points determined at the beginning of each year. All participant accounts are vested.

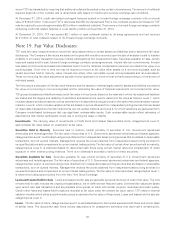

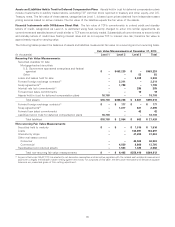

The measurement of the projected benefit obligation, prepaid pension asset, pension liability and annual pension expense

involves complex actuarial valuation methods and the use of actuarial and economic assumptions. Due to the long-term nature of

the Pension Plan obligation, actual results may differ significantly from the actuarial-based estimates. Differences between

estimates and actual experience are recorded in the year they arise. TCF closely monitors all assumptions and updates them

annually. The Company does not consolidate the assets and liabilities associated with the Pension Plan.

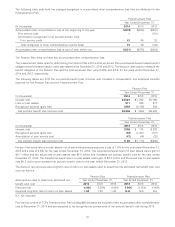

Postretirement Plan TCF provides health care benefits for eligible retired employees (the ‘‘Postretirement Plan’’). Effective

January 1, 2000, TCF modified the Postretirement Plan for employees not yet eligible for benefits under the Postretirement Plan

by eliminating the Company subsidy. The Postretirement Plan provisions for full-time and retired employees then eligible for

these benefits were not changed. Employees retiring after December 31, 2009 are no longer eligible to participate in the

Postretirement Plan. The Postretirement Plan is not funded.

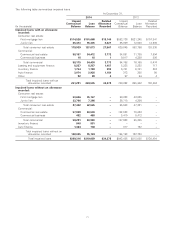

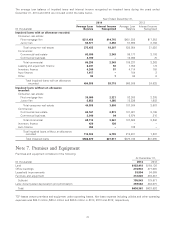

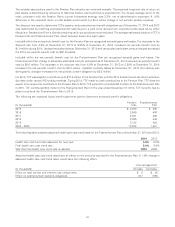

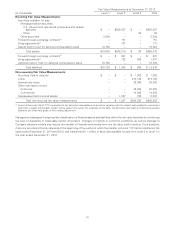

The information set forth in the following tables is based on current actuarial reports using the measurement date of

December 31 for TCF’s Pension Plan and Postretirement Plan.

81