TCF Bank 2014 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2014 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

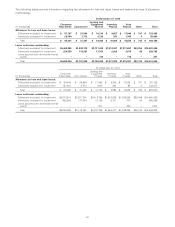

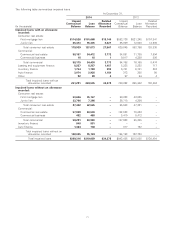

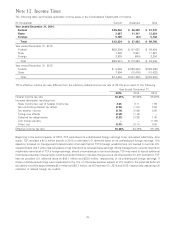

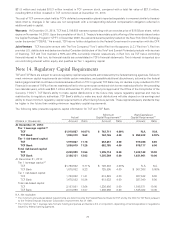

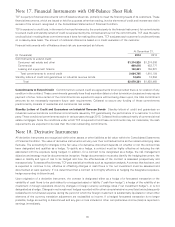

A reconciliation of the changes in unrecognized tax benefits is as follows.

At or For the Year Ended December 31,

(In thousands) 2014 2013 2012

Balance, beginning of period $4,704 $4,230 $2,377

Increases for tax positions related to the current year 468 394 449

Increases for tax positions related to prior years 8362 1,781

Decreases for tax positions related to prior years (350) (67) –

Settlements with taxing authorities –(39) (70)

Decreases related to lapses of applicable statutes of limitation (181) (176) (307)

Balance, end of period $4,649 $4,704 $4,230

The total amount of unrecognized tax benefits that, if recognized, would affect the effective tax rate was $1.5 million and

$1.2 million at December 31, 2014 and 2013, respectively. TCF recognizes interest and penalties related to unrecognized tax

benefits, where applicable, in income tax expense. TCF recognized approximately $71 thousand, $110 thousand and

$77 thousand in interest and penalties during 2014, 2013 and 2012, respectively. Interest and penalties of approximately

$498 thousand and $427 thousand were accrued at December 31, 2014 and 2013, respectively.

TCF’s federal income tax returns are open and subject to examination for 2012 and later tax return years. TCF’s various state

income tax returns are generally open for the 2010 and later tax return years based on individual state statutes of limitation. TCF’s

various foreign income tax returns are open and subject to examination for 2010 and later tax return years. Changes in the

amount of unrecognized tax benefits within the next twelve months from normal expirations of statutes of limitation are not

expected to be material.

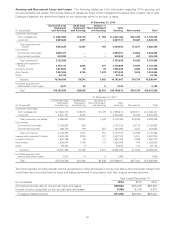

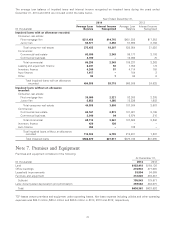

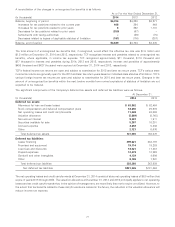

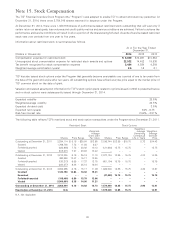

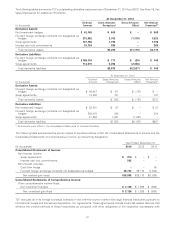

The significant components of the Company’s deferred tax assets and deferred tax liabilities were as follows.

At December 31,

(In thousands) 2014 2013

Deferred tax assets:

Allowance for loan and lease losses $ 63,862 $ 62,464

Stock compensation and deferred compensation plans 34,850 29,576

Net operating losses and credit carryforwards 11,649 48,692

Valuation allowance (5,669) (8,745)

Non-accrual interest 9,333 1,911

Securities available for sale 5,397 16,301

Accrued expense 4,892 5,203

Other 2,721 6,676

Total deferred tax assets 127,035 162,078

Deferred tax liabilities:

Lease financing 299,621 284,767

Premises and equipment 19,114 19,289

Loan fees and discounts 14,921 17,287

Prepaid expenses 12,479 10,526

Goodwill and other intangibles 4,139 4,694

Other 8,106 7,361

Total deferred tax liabilities 358,380 343,924

Net deferred tax liabilities $231,345 $181,846

The net operating losses and credit carryforwards at December 31, 2014 consist of state net operating losses of $6.0 million that

expire in years 2015 through 2034. The valuation allowance at December 31, 2014 and 2013 principally applies to net operating

losses and tax credit carryforwards that, in the opinion of management, are more likely than not to expire un-utilized. However, to

the extent that tax benefits related to these carryforwards are realized in the future, the reduction in the valuation allowance will

reduce income tax expense.

77