TCF Bank 2014 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2014 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

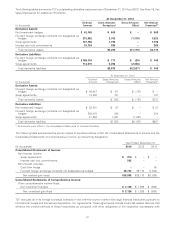

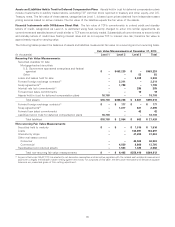

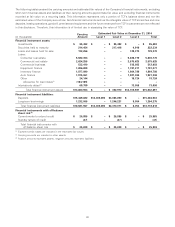

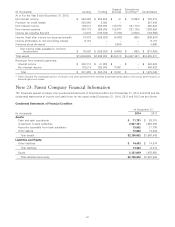

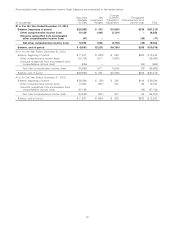

Estimated Fair Value at December 31, 2013

Carrying

(In thousands) Amount Level 1 Level 2 Level 3 Total

Financial instrument assets:

Investments $ 94,326 $ – $ 94,326 $ – $ 94,326

Securities held to maturity 19,912 – 14,610 5,302 19,912

Loans and leases held for sale 79,768 – – 84,341 84,341

Loans:

Consumer real estate 6,339,326 – – 6,279,328 6,279,328

Commercial real estate 2,743,697 – – 2,673,825 2,673,825

Commercial business 404,655 – – 392,947 392,947

Equipment finance 1,546,134 – – 1,534,905 1,534,905

Inventory finance 1,664,377 – – 1,653,345 1,653,345

Auto finance 1,239,386 – – 1,256,357 1,256,357

Other 26,743 – – 25,216 25,216

Allowance for loan losses(1) (252,230) ––––

Interest-only strips(2) 84,561 – – 85,265 85,265

Total financial instrument

assets $13,990,655 $ – $ 108,936 $13,990,831 $14,099,767

Financial instrument liabilities:

Deposits $14,432,776 $12,006,364 $2,434,946 $ – $14,441,310

Long-term borrowings 1,483,325 – 1,496,017 10,838 1,506,855

Total financial instrument liabilities $15,916,101 $12,006,364 $3,930,963 $ 10,838 $15,948,165

Financial instruments with

off-balance sheet risk:(3)

Commitments to extend credit $ 29,057 $ – $ 29,057 $ – $ 29,057

Standby letters of credit (52) – (52) – (52)

Total financial instruments with

off-balance sheet risk $ 29,005 $ – $ 29,005 $ – $ 29,005

(1) Expected credit losses are included in the estimated fair values.

(2) Carrying amounts are included in other assets.

(3) Positive amounts represent assets, negative amounts represent liabilities.

94