TCF Bank 2014 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2014 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

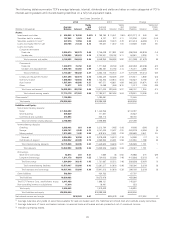

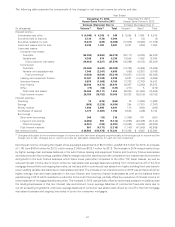

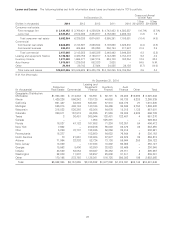

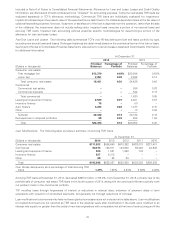

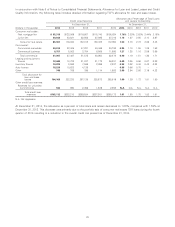

Loans and leases outstanding at December 31, 2014, are shown by contractual maturity in the following table.

At December 31, 2014(1)

Leasing and

Consumer Equipment Inventory Auto

(In thousands) Real Estate Commercial Finance Finance Finance Other Total

Amounts due:

Within 1 year $ 142,862 $ 452,918 $1,277,140 $1,877,090 $ 376,920 $ 3,483 $ 4,130,413

1 to 2 years 139,970 384,007 962,238 – 392,767 1,033 1,880,015

2 to 3 years 153,822 519,980 696,560 – 394,619 752 1,765,733

3 to 5 years 369,490 1,354,390 704,794 – 625,536 1,112 3,055,322

5 to 10 years 822,424 435,233 104,590 – 125,219 2,423 1,489,889

10 to 15 years 935,776 8,285 – – – 1,978 946,039

Over 15 years 3,118,020 2,852 – – – 13,363 3,134,235

Total after 1 year 5,539,502 2,704,747 2,468,182 – 1,538,141 20,661 12,271,233

Total $5,682,364 $3,157,665 $3,745,322 $1,877,090 $1,915,061 $24,144 $16,401,646

Amounts due after 1 year on:

Fixed-rate loans and leases $2,842,852 $1,365,948 $2,449,715 $ – $1,538,141 $20,438 $ 8,217,094

Variable- and adjustable-rate

loans 2,696,650 1,338,799 18,467 – – 223 4,054,139

Total after 1 year $5,539,502 $2,704,747 $2,468,182 $ – $1,538,141 $20,661 $12,271,233

(1) Gross of deferred fees and costs. This table does not include the effect of prepayments, which is an important consideration in management’s

interest-rate risk analysis. Company experience indicates that loans and leases remain outstanding for significantly shorter periods than their

contractual terms.

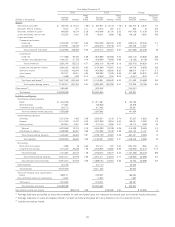

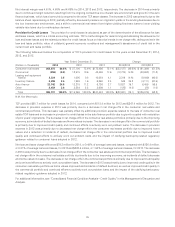

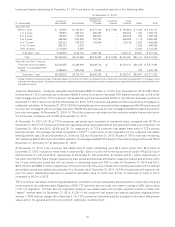

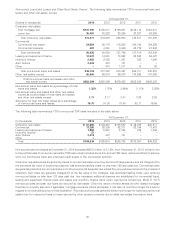

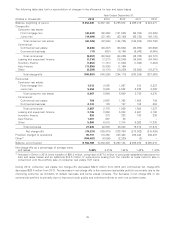

Consumer Real Estate Consumer real estate loans decreased $657.0 million, or 10.4%, from December 31, 2013 to $5.7 billion

at December 31, 2014, primarily due to the sale of $405.9 million of consumer real estate TDR loans and continued run-off of the

first mortgage lien portfolio. TCF’s consumer real estate loan portfolio represented 34.6% of its total loan and lease portfolio at

December 31, 2014, down from 40.0% at December 31, 2013. TCF’s consumer real estate portfolio is secured by mortgages on

residential real estate. At December 31, 2014, 55.2% of loan balances were secured by first mortgages and 44.8% were secured

by junior lien mortgages with an average loan size of $106 thousand secured by first mortgages and $42 thousand secured by

junior lien mortgages. At December 31, 2014, 47.7% of the consumer real estate portfolio carried a variable interest rate tied to

the prime rate, compared with 44.2% at December 31, 2013.

At December 31, 2014, 59.1% of TCF’s consumer real estate loans consisted of closed-end loans, compared with 63.7% at

December 31, 2013. TCF’s closed-end consumer real estate loans require payments of principal and interest over a fixed term. At

December 31, 2014 and 2013, 82.8% and 88.1%, respectively, of TCF’s consumer real estate loans were in TCF’s primary

banking markets. The average Fair Isaac Corporation (‘‘FICO(R)’’) credit score at loan origination for the consumer real estate

lending portfolio was 734 as of December 31, 2014 and 723 as of December 31, 2013. As part of TCF’s credit risk monitoring,

TCF obtains updated FICO score information quarterly. The average updated FICO score for the retail lending portfolio was 730 at

December 31, 2014 and 717 at December 31, 2013.

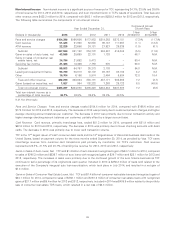

At December 31, 2014, total consumer real estate lines of credit outstanding were $2.3 billion, down from $2.5 billion at

December 31, 2013. Included in these lines of credit are $2.1 billion of junior lien home equity lines of credit (‘‘HELOCs’’) as of

both December 31, 2014 and 2013, respectively. At December 31, 2014 and 2013, $1.3 billion and $1.1 billion, respectively, of

the junior lien HELOCs had a 10-year interest-only draw period and a 20-year amortization repayment period and all were within

the 10-year initial draw period and will not convert to amortizing loans until 2021 or later. At December 31, 2014 and 2013,

$816.0 million and $969.2 million, respectively, of the junior lien HELOCs were interest-only revolving draw loans with no defined

amortization period and original draw periods of 5 to 40 years. As of December 31, 2014, 14.6% of these loans will mature in the

next five years. Outstanding balances on consumer real estate lines of credit were 67.2% of total lines of credit in 2014,

compared to 66.5% in 2013.

TCF’s consumer real estate underwriting standards are intended to produce adequately secured loans to customers with good

credit scores at the origination date. Beginning in 2008, TCF generally has not made new loans in excess of 90% loan-to-value

(‘‘LTV’’) at origination. TCF also has not originated consumer real estate loans with multiple payment options or loans with

‘‘teaser’’ interest rates. At December 31, 2014, 51.2% of the consumer real estate loan balance had been originated since

January 1, 2009 with net charge-offs of less than 0.1%. TCF’s consumer real estate portfolio is subject to the risk of falling home

values and to the general economic environment, particularly unemployment.

30