TCF Bank 2014 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2014 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

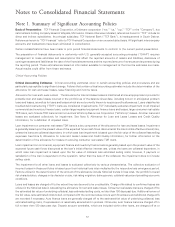

quantitative analysis is performed. Quantitative valuation methodologies primarily include discounted cash flow analysis in

determining fair value of reporting units. If the fair value is less than the carrying amount, additional analysis is required to

measure the amount of impairment. Impairment losses, if any, are recorded as a charge to non-interest expense and an

adjustment to the carrying value of goodwill.

Other intangible assets are reviewed for impairment whenever events or changes in circumstances indicate their carrying

amount may not be recoverable. Impairment is indicated if the sum of the undiscounted estimated future net cash flows is less

than the carrying value of the intangible asset. Impairment losses, if any, permanently reduce the carrying value of the other

intangible assets.

Stock-Based Compensation The fair value of restricted stock and stock options is determined on the date of grant and

amortized to compensation expense, with a corresponding increase in additional paid-in capital, over the longer of the service

period or performance period, but in no event beyond an employee’s retirement date or date of employment termination. For

performance-based restricted stock, TCF estimates the degree to which performance conditions will be met to determine the

number of shares that will vest and the related compensation expense. Compensation expense is adjusted in the period such

estimates change. Non-forfeitable dividends, if any, paid on shares of restricted stock are recorded to retained earnings for

shares that are expected to vest and to compensation expense for shares that are not expected to vest.

Income tax benefits related to stock compensation, in excess of grant date fair value less any proceeds on exercise, are

recognized as additional paid-in capital upon vesting or exercise and delivery of the stock. Any income tax benefits that are less

than grant date fair value less any proceeds on exercise are recognized as a reduction of additional paid in capital to the extent of

previously recognized income tax benefits and then as income tax expense for any remaining amount. See Note 15, Stock

Compensation, for additional information concerning stock-based compensation.

Deposit Account Overdrafts Deposit account overdrafts are reported in other loans and leases. Net losses on uncollectible

overdrafts are reported as net charge-offs in the allowance for loan and lease losses within 60 days from the date of overdraft.

Uncollectible deposit fees are reversed against fees and service charges and a related reserve for uncollectible deposit fees is

maintained in other liabilities. Other deposit account losses are reported in other non-interest expense.

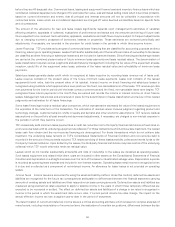

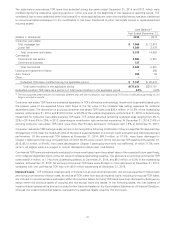

Note 2. Cash and Due from Banks

At December 31, 2014 and 2013, TCF Bank was required by Federal Reserve regulations to maintain reserves of $98.7 million

and $95.5 million, respectively, in cash on hand or at the Federal Reserve Bank.

TCF maintains cash balances that are restricted as to their use in accordance with certain contractual agreements primarily

related to the sale and servicing of auto loans and consumer real estate loans. Cash payments received on loans serviced for third

parties are held in separate accounts until remitted. TCF also retains cash balances for potential loss recourse on certain sold auto

loans as well as cash for collateral on certain borrowings, foreign exchange contracts and interest rate contracts. TCF maintained

restricted cash totaling $67.8 million and $46.1 million at December 31, 2014 and 2013, respectively.

TCF had cash held in interest-bearing accounts of $842.1 million and $613.3 million at December 31, 2014 and 2013,

respectively.

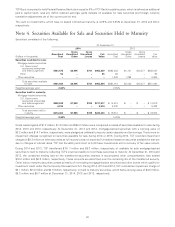

Note 3. Investments

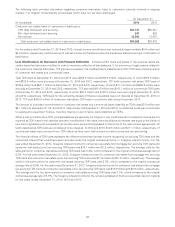

Investments consisted of the following.

At December 31,

(In thousands) 2014 2013

Federal Home Loan Bank stock, at cost $47,914 $56,845

Federal Reserve Bank stock, at cost 37,578 37,481

Total investments $85,492 $94,326

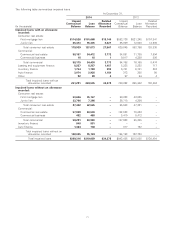

The investments in Federal Home Loan Bank stock are required investments related to TCF’s membership in and current

borrowings from the Federal Home Loan Bank (‘‘FHLB’’) of Des Moines. All Federal Home Loan Banks (‘‘FHLBanks’’) obtain their

funding primarily through issuance of consolidated obligations of the FHLB system. The U.S. Government does not guarantee

these obligations and each of the 12 FHLBanks are jointly and severally liable for repayment of each other’s debt. Therefore,

TCF’s investments in FHLB of Des Moines could be adversely impacted by the financial operations of the FHLBanks and actions

of their regulator, the Federal Housing Finance Agency.

61