TCF Bank 2014 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2014 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

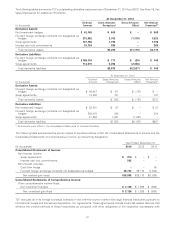

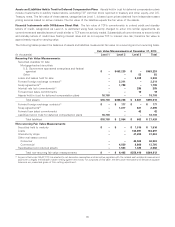

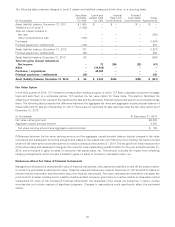

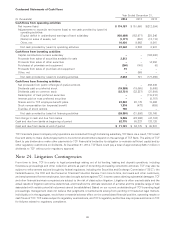

The following tables present the carrying amounts and estimated fair values of the Company’s financial instruments, excluding

short-term financial assets and liabilities as their carrying amounts approximate fair value and excluding financial instruments

recorded at fair value on a recurring basis. This information represents only a portion of TCF’s balance sheet and not the

estimated value of the Company as a whole. Non-financial instruments such as the intangible value of TCF’s branches and core

deposits, leasing operations, goodwill, premises and equipment and the future revenues from TCF’s customers are not reflected

in this disclosure. Therefore, this information is of limited use in assessing the value of TCF.

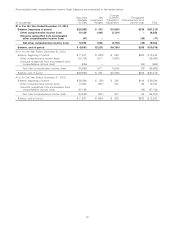

Estimated Fair Value at December 31, 2014

Carrying

(In thousands) Amount Level 1 Level 2 Level 3 Total

Financial instrument assets:

Investments $ 85,492 $ – $ 85,492 $ – $ 85,492

Securities held to maturity 214,454 – 217,418 4,916 222,334

Loans and leases held for sale 132,266 – – 139,370 139,370

Loans:

Consumer real estate 5,682,364 – – 5,836,770 5,836,770

Commercial real estate 2,624,255 – – 2,575,625 2,575,625

Commercial business 533,410 – – 512,083 512,083

Equipment finance 1,806,808 – – 1,787,271 1,787,271

Inventory finance 1,877,090 – – 1,864,786 1,864,786

Auto finance 1,915,061 – – 1,927,384 1,927,384

Other 24,144 – – 18,724 18,724

Allowance for loan losses(1) (164,169) – – – –

Interest-only strips(2) 69,789 – – 73,058 73,058

Total financial instrument assets $14,800,964 $ – $ 302,910 $14,739,987 $15,042,897

Financial instrument liabilities:

Deposits $15,449,882 $12,400,693 $3,063,850 $ – $15,464,543

Long-term borrowings 1,232,065 – 1,246,221 8,054 1,254,275

Total financial instrument liabilities $16,681,947 $12,400,693 $4,310,071 $ 8,054 $16,718,818

Financial instruments with off-balance

sheet risk:(3)

Commitments to extend credit $ 25,885 $ – $ 25,885 $ – $ 25,885

Standby letters of credit (47) – (47) – (47)

Total financial instruments with

off-balance sheet risk $ 25,838 $ – $ 25,838 $ – $ 25,838

(1) Expected credit losses are included in the estimated fair values.

(2) Carrying amounts are included in other assets.

(3) Positive amounts represent assets, negative amounts represent liabilities.

93