TCF Bank 2014 Annual Report Download - page 23

Download and view the complete annual report

Please find page 23 of the 2014 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.It is highly likely that banks and bank holding companies will continue to be subject to significantly increased regulation and

compliance obligations that expose TCF to risk and consequences of noncompliance, which could have a material adverse effect

on TCF’s financial condition and results of operations.

TCF’s framework for managing risks may not be effective in mitigating risk and any resulting loss.

TCF’s risk management framework seeks to mitigate risk and any resulting loss. TCF has established processes intended to

identify, measure, monitor, report and analyze the types of risk to which TCF is subject, including legal and compliance,

operational, reputational, strategic and market risk such as credit, interest rate, liquidity and foreign currency risk. However, as

with any risk management framework, there are inherent limitations to TCF’s risk management strategies. There may exist, or

develop in the future, risks that TCF has not appropriately anticipated or identified. Any future breakdowns in TCF’s risk

management framework could have a material adverse effect on its financial condition and results of operations.

Failure to keep pace with technological change could adversely affect TCF’s business.

The financial services industry is continually undergoing rapid technological change with frequent introductions of new

technology-driven products and services. TCF’s future success depends, in part, upon its ability to address the needs of its

customers by using technology to provide products and services that will satisfy customer demands, as well as to create

additional efficiencies in its operations. Many of TCF’s competitors have substantially greater resources to invest in technological

improvements. TCF may not be able to effectively implement new technology-driven products and services or be successful in

marketing these products and services to its customers. Failure to successfully keep pace with technological change affecting

the financial services industry could have a material adverse effect on TCF’s financial condition and results of operations.

The Company may be subject to certain risks related to originating and selling loans.

When loans are sold or securitized, it is customary to make representations and warranties to the purchaser or investors about

the loans and the manner in which they were originated. These agreements generally require the repurchase or substitution of

loans in the event TCF breaches any of these representations or warranties. In addition, there may be a requirement to

repurchase loans as a result of borrower fraud or in the event of early payment default of the borrower on a loan. TCF has not

received a significant number of repurchase and indemnity demands from purchasers, and such demands have typically resulted

from borrower fraud and early payment default of the borrower on loans. A material increase in repurchase and indemnity

demands could have a material adverse effect on TCF’s financial condition and results of operations.

TCF retains interest-only strips in connection with certain of its loan sales. The interest-only strip is recorded at fair value at the

time of sale, which represents the present value of future cash flows generated by the loans to be retained by TCF. The value of

these interest-only strips may be affected by factors such as changes in the behavior patterns of customers (including defaults

and prepayments), changes in the strength of the economy and developments in the interest rate markets; therefore, actual

performance may differ from TCF’s expectations. The impact of such factors could have a material adverse effect on the value of

these interest-only strips and on TCF’s financial condition and results of operations.

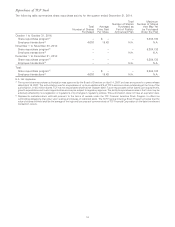

In addition, TCF relies on the sale and securitization of loans to generate earnings and manage its liquidity and capital levels, as

well as geographical and product diversity in its loan portfolio. For example, TCF sold $2.7 billion of loans from its auto and

consumer real estate businesses for a pre-tax gain of $78.8 million in 2014 including its inaugural consumer auto loan

securitization of $256.3 million of loans during the third quarter of 2014 for a pre-tax gain of $7.4 million. Disruptions in the

financial markets, changes to regulations that reduce the attractiveness of such loans to purchasers of the loans, or a decrease in

the willingness of purchasers to purchase loans in general, or from TCF, could require TCF to decrease its lending activities or

retain a greater portion of the loans it originates. Although retaining, rather than selling, loans would generate additional interest

income, it would result in a decrease in the gains recognized on the sale of loans, could result in decreased liquidity, and could

result in increased credit risk as TCF’s loan portfolio increased in size from loans it originated but had otherwise planned to sell.

As a result, any of these developments could have a material adverse effect on TCF’s financial condition and results of

operations.

Financial institutions depend on the accuracy and completeness of information about customers and counterparties.

In deciding whether to extend credit or enter into other transactions, TCF may rely on information furnished by or on behalf of

customers and counterparties, including financial statements, credit reports and other financial information. TCF may also rely on

representations of those customers, counterparties or other third parties, such as independent auditors, as to the accuracy and

completeness of that information. Reliance on inaccurate or misleading financial statements, credit reports or other financial

10