TCF Bank 2014 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2014 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.consideration of the current interest rate environment compared with the weighted average rate of each portfolio, a credit risk

component based on the historical and expected performance of each portfolio and a liquidity adjustment related to the current

market environment. TCF also uses pricing data from recent sales of loans with similar risk characteristics as data points to

validate the assumptions used in estimating the fair value of certain loans.

Loans for which repayment is expected to be provided solely by the value of the underlying collateral, categorized as Level 3 and

recorded at fair value on a non-recurring basis, are valued based on the fair value of that collateral less estimated selling costs.

Such loans include impaired loans as well as certain delinquent non-accrual consumer real estate and auto finance loans. The fair

value of the collateral is determined based on internal estimates and assessments provided by third-party appraisers.

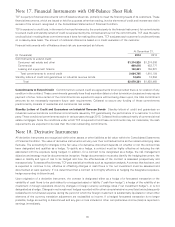

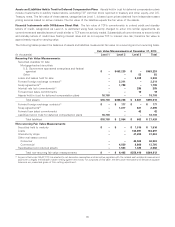

Forward Foreign Exchange Contracts TCF’s forward foreign exchange contracts are currency contracts executed in

over-the-counter markets and are recorded at fair value using a cash flow model that includes key inputs such as foreign

exchange rates and, in accordance with GAAP, an assessment of the risk of counterparty non-performance. The risk of

counterparty non-performance is based on external assessments of credit risk. The fair value of these contracts, categorized as

Level 2, is based on observable transactions, but not quoted markets.

Swap Agreements TCF executes interest rate swaps with commercial banking customers to facilitate the customer’s risk

management strategy. These interest rate swaps are simultaneously hedged by offsetting interest rate swaps TCF executes

with a third party, such that TCF minimizes its net risk exposure resulting from such transactions. These derivative instruments

are recorded at fair value. The fair value of these swap agreements, categorized as Level 2, is determined using a cash flow

model which considers the forward curve, the discount curve and credit valuation adjustments related to counterparty and

borrower non-performance risk. TCF also entered into a swap agreement related to the sale of TCF’s Visa Class B stock,

categorized as Level 3. The fair value of the Visa swap agreement is based upon TCF’s estimated exposure related to the Visa

covered litigation through a probability analysis of the funding and estimated settlement amounts.

Interest Rate Lock Commitments and Forward Loan Sales Commitments TCF’s interest rate lock commitments are

derivative instruments which are recorded at fair value. The related forward loan sales commitments to sell the resulting loans

held for sale are also carried at fair value under the elected fair value option. TCF relies on internal valuation models to estimate

the fair value of these instruments. The valuation models utilize estimated rates of successful loan closings and quoted investor

prices. While these models use both Level 2 and 3 inputs, TCF has determined that the majority of the inputs significant in the

valuation of these commitments fall within Level 3 and therefore they are categorized as Level 3.

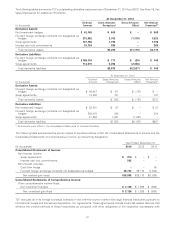

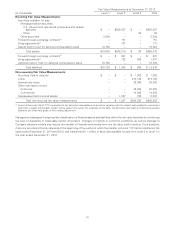

Interest-Only Strips The fair value of interest-only strips, categorized as Level 3, represents the present value of future cash

flows retained by TCF on certain assets. TCF uses available market data, along with its own empirical data and discounted cash

flow models, to arrive at the estimated fair value of its interest-only strips. The present value of the estimated expected future

cash flows to be received is determined by using discount, loss and prepayment rates that TCF believes are commensurate with

the risks associated with the cash flows and what a market participant would use. These assumptions are inherently subject to

volatility and uncertainty and, as a result, the estimated fair value of the interest-only strips may fluctuate significantly from period

to period.

Other Real Estate Owned and Repossessed and Returned Assets The fair value of other real estate owned is based on

independent appraisals, real estate brokers’ price opinions or automated valuation methods, less estimated selling costs. Certain

properties require assumptions that are not observable in an active market in the determination of fair value. The fair value of

repossessed and returned assets is based on available pricing guides, auction results or price opinions, less estimated selling

costs. Assets acquired through foreclosure, repossession or returned to TCF are initially recorded at the lower of the loan or lease

carrying amount or fair value less estimated selling costs at the time of transfer to other real estate owned or repossessed and

returned assets. Other real estate owned and repossessed and returned assets were written down $14.8 million and

$15.6 million, which was included in foreclosed real estate and repossessed assets, net expense for the years ended

December 31, 2014 and 2013, respectively.

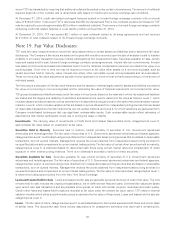

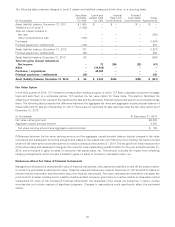

Deposits The fair value of checking, savings and money market deposits, categorized as Level 1, is deemed equal to the

amount payable on demand. The fair value of certificates of deposit, categorized as Level 2, is estimated based on discounted

cash flows using currently offered market rates. The intangible value of long-term relationships with depositors is not taken into

account in the fair values disclosed.

Long-term Borrowings The fair value of TCF’s long-term borrowings, categorized as Level 2, is estimated based on

observable market prices and discounted cash flows using interest rates for borrowings of similar remaining maturities and

characteristics. The fair value of other long-term borrowings, categorized as Level 3, is based on unobservable inputs determined

at the time of origination.

89