TCF Bank 2014 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2014 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

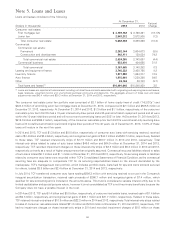

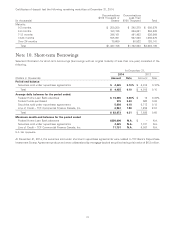

Note 6. Allowance for Loan and Lease Losses and Credit Quality

Information

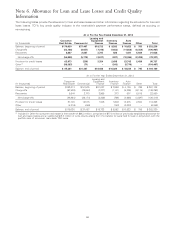

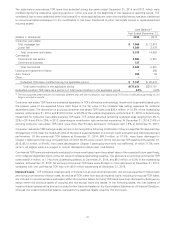

The following tables provide the allowance for loan and lease losses and other information regarding the allowance for loan and

lease losses. TCF’s key credit quality indicator is the receivable’s payment performance status, defined as accruing or

non-accruing.

At or For the Year Ended December 31, 2014

Leasing and

Consumer Equipment Inventory Auto

(In thousands) Real Estate Commercial Finance Finance Finance Other Total

Balance, beginning of period $176,030 $37,467 $18,733 $ 8,592 $ 10,623 $ 785 $ 252,230

Charge-offs (63,126) (8,657) (7,316) (1,653) (11,856) (8,359) (100,967)

Recoveries 6,867 2,887 3,705 826 1,491 5,860 21,636

Net charge-offs (56,259) (5,770) (3,611) (827) (10,365) (2,499) (79,331)

Provision for credit losses 63,973 (259) 3,324 2,498 23,742 2,459 95,737

Other(1) (98,383) (71) – (243) (5,770) – (104,467)

Balance, end of period $ 85,361 $31,367 $18,446 $10,020 $ 18,230 $ 745 $ 164,169

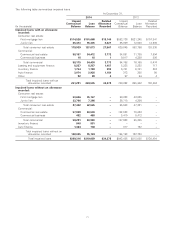

At or For the Year Ended December 31, 2013

Leasing and

Consumer Equipment Inventory Auto

(In thousands) Real Estate Commercial Finance Finance Finance Other Total

Balance, beginning of period $182,013 $ 51,575 $21,037 $ 7,569 $ 4,136 $ 798 $ 267,128

Charge-offs (97,508) (28,944) (7,277) (1,141) (5,305) (9,115) (149,290)

Recoveries 8,644 2,770 3,968 373 607 6,518 22,880

Net charge-offs (88,864) (26,174) (3,309) (768) (4,698) (2,597) (126,410)

Provision for credit losses 87,100 12,515 1,005 1,949 13,215 2,584 118,368

Other (4,219) (449) – (158) (2,030) – (6,856)

Balance, end of period $176,030 $ 37,467 $18,733 $ 8,592 $10,623 $ 785 $ 252,230

(1) Included in Other for consumer real estate is the transfer of $95.3 million, comprised of $77.0 million of previously established allowance for

loan and lease losses and an additional $18.3 million of write-downs arising from the transfer to loans held for sale in conjunction with the

portfolio sale of consumer real estate TDR loans.

66