TCF Bank 2014 Annual Report Download - page 132

Download and view the complete annual report

Please find page 132 of the 2014 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

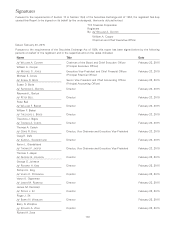

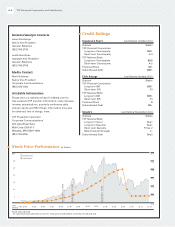

Stock Data

Year Close High Low

Dividends

Paid

Per Share

2014

Fourth Quarter $15.89 $16.12 $13.95 $0.05

Third Quarter 15.53 16.95 15.12 0.05

Second Quarter 16.37 17.30 15.01 0.05

First Quarter 16.66 17.39 15.31 0.05

2013

Fourth Quarter $16.25 $16.46 $14.29 $0.05

Third Quarter 14.28 16.68 13.69 0.05

Second Quarter 14.18 15.32 13.49 0.05

First Quarter 14.96 15.04 12.39 0.05

2012

Fourth Quarter $12.15 $12.49 $10.45 $0.05

Third Quarter 11.94 12.43 9.59 0.05

Second Quarter 11.48 12.53 10.43 0.05

First Quarter 11.89 12.58 10.04 0.05

2 011

Fourth Quarter $10.32 $11.68 $ 8.61 $0.05

Third Quarter 9.16 14.37 8.66 0.05

Second Quarter 13.80 16.04 13.37 0.05

First Quarter 15.86 17.37 14.60 0.05

2010

Fourth Quarter $14.81 $16.63 $12.90 $0.05

Third Quarter 16.19 17.66 13.87 0.05

Second Quarter 16.61 18.89 14.95 0.05

First Quarter 15.94 16.83 13.40 0.05

For more historical information on TCF’s stock price and

dividend, visit http://ir.tcfbank.com.

Annual Meeting

The Annual Meeting of Stockholders of TCF will be

held on Wednesday, April 22, 2015, 4:00 p.m. CDT at

the Marriott Minneapolis West, 9960 Wayzata Boulevard,

St. Louis Park, Minnesota.

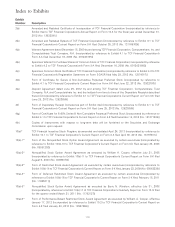

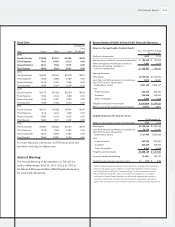

Reconciliation of GAAP to Non-GAAP Financial Measures

Return on Average Tangible Common Equity1

At or For the Year Ended

December 31,

(Dollars in thousands) 2014 2013

Net income available to common stockholders $ 154,799 $ 132,603

Other intangibles amortization, net of tax 1,062 1,479

Adjusted net income available to

common stockholders $ 155,861 134,082

Average balances:

Total equity $2,058,442 $1,912,622

Less: Non-controlling interest in subsidiaries 17,014 16,491

Total TCF Financial Corporation

stockholders’ equity 2,041,428 1,896,131

Less:

Preferred stock 263,240 263,240

Goodwill 225,640 225,640

Other intangibles 5,498 7,418

Tangible average common equity $ 1,547,050 $1,399,833

Return on average tangible common equity 10.08% 9.58%

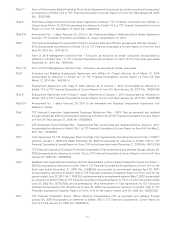

Tangible Book Value Per Common Share1

At December 31,

(Dollars in thousands, except per-share data) 2014 2013

Total equity $2,135,364 $1,964,759

Less: Non-controlling interest in subsidiaries 13,715 11,791

Total TCF Financial Corporation

stockholders’ equity 2,121,649 1,952,968

Less:

Preferred stock 263,240 263,240

Goodwill 225,640 225,640

Other intangibles 4,641 6,326

Tangible common equity $1,628,128 $ 1,457,762

Common shares outstanding 167,461 165,122

Tangible book value per common share $ 9.72 $ 8.83

1 When evaluating capital adequacy and utilization, management considers

fi nancial measures such as Return on Average Tangible Common Equity

and Tangible Book Value Per Common Share. These measures are non-

GAAP fi nancial measures and are viewed by management as useful

indicators of capital levels available to withstand unexpected market or

economic conditions, and also provide investors, regulators, and other

users with information to be viewed in relation to other banking institutions.

A-52014 Annual Report