TCF Bank 2014 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 2014 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

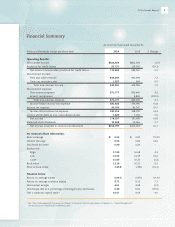

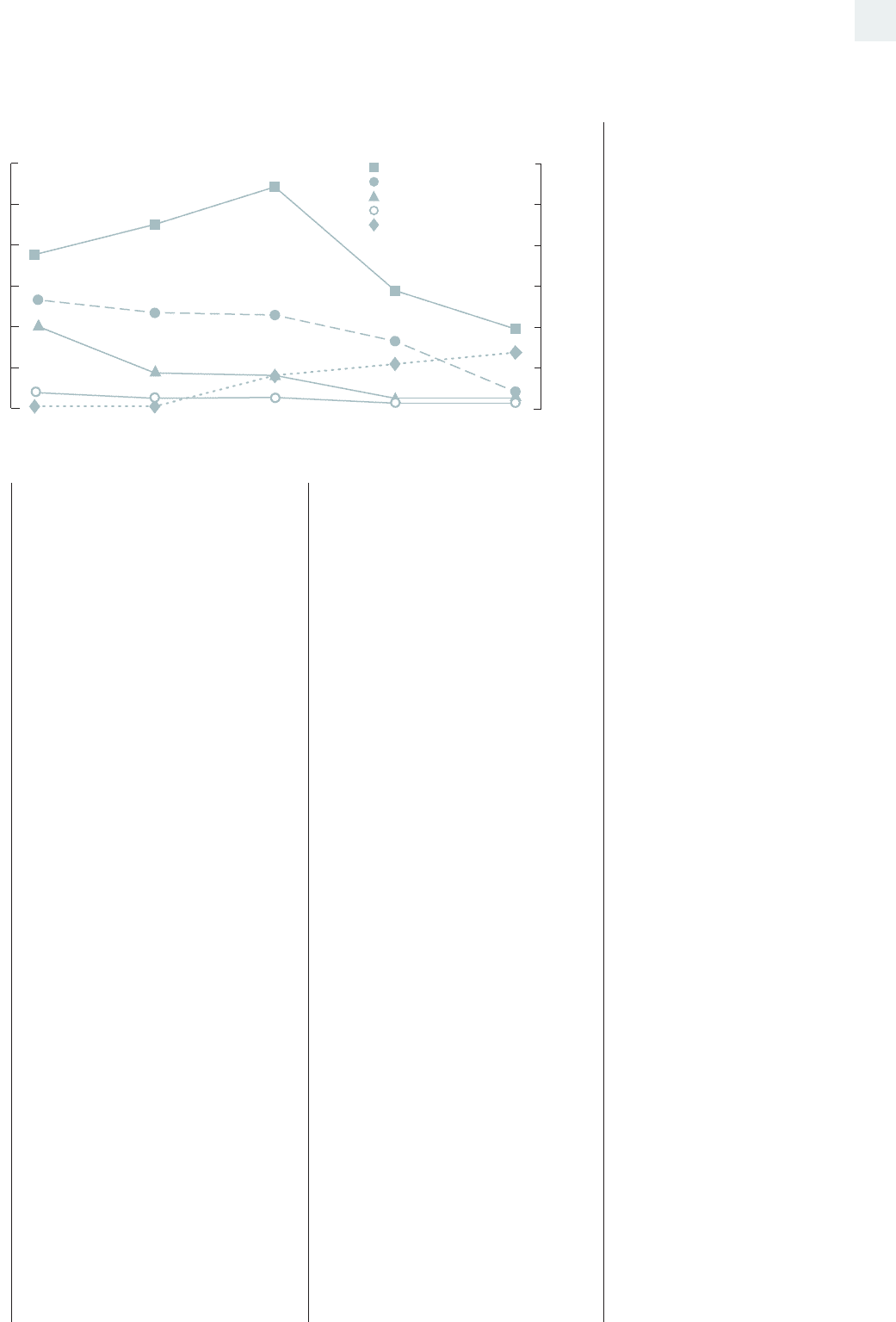

0.00%

1.00%

2.00%

3.00%

2010 2011 2012 2013 2014

Consumer Real Estate

Commerical

Leasing and Equipment Finance

Inventory Finance

Auto Finance

Net Charge-offs by Business

Percent

reduce inows into non-performing

assets. Our remaining accruing

TDR consumer portfolio totaled

$111.9 million with reserves of

23 percent at December 31, 2014.

We created these TDRs by rewriting

mortgage loans at lower interest

rates for troubled borrowers, helping

to keep thousands of TCF customers

in their homes. This program, of

which we are very proud, was a huge

success beneting both TCF and our

customers. This portfolio sale allows

us to diversify further away from our

legacy consumer real estate portfolio,

while providing a fresh start as we

move into 2015.

A Look Ahead

Executing on the investments we

have made in the business over the

past few years has brought the future

into focus at TCF. We are no longer

a bank which simply gathers

deposits and makes loans in our

footprint. As we look ahead, we are

now a company that uses our

high-quality deposit base to fund

loan and lease originations not only

in our markets, but also through

unique and diverse national lending

platforms. This strategy, with a

focus on strong enterprise risk

management, will carry us into

2015 and beyond.

With the overhang of our legacy

consumer real estate portfolio

decreased due to the TDR sale,

I am excited to begin 2015. A key

area where the TDR sale will help

us in 2015 is through a reduction in

regulatory and operational costs.

During the rst quarter of 2014, we

consolidated 46 underperforming

branches to further improve

efciencies as branch trafc has

slowed due to increased use of

online and mobile banking. Expense

efciencies will continue to be a key

focus in 2015.

We fund our asset growth primarily

with low-cost, core deposits. This is

a key part of our strategy we expect

to continue in 2015 and beyond.

Average total deposits have

increased for 17 consecutive quarters

at TCF and had an average interest

cost of just 0.26 percent in 2014. All

in all, the total cost for us to acquire

deposits is our fee income less

interest and operating expenses,

which was 1.71 percent in 2014, lower

than a ve-year FHLB borrowing rate.

In addition, 89 percent of our

deposits are FDIC-insured, making

them very sticky even in an economic

downturn. We have a track record

of being able to raise deposits as

needed to fund our ongoing loan and

lease originations.

For us to continue to attract high-

quality deposits, we must remain

competitive from a product and

service standpoint. We have made

several enhancements and will

continue to do so moving forward.

These have included image-enabled

ATMs, upgrades to our online and

mobile channels and participation in

Apple PayTM. We also began offering

rst lien mortgages again in the

branches on a correspondent basis.

We are reviewing additional product

and service opportunities, including

offering auto loans in the branches,

credit cards, and additional online and

mobile upgrades. These efforts are

aimed at creating new and enhanced

touch points with customers to ensure

a long relationship with the bank.

Banking regulation will continue

to be a focus in 2015. While it is

too early to predict the impact of

new rules, we have been proactive

in taking steps to align our products

with industry best practices. We

were one of the rst banks to adopt

deposit account disclosures based

on the Pew Charitable Trust Model

and eliminated high-to-low sort

order years ago. In addition, the

diversication of our revenue away

from banking fees will help to

minimize the impact we see from

future regulatory changes related to

fees. With the increase in gains on

loan sales and servicing revenue,

banking fees made up just 53

percent of total non-interest income

5

2014 Annual Report