TCF Bank 2014 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2014 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

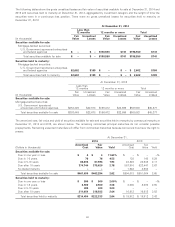

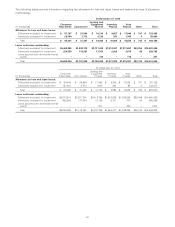

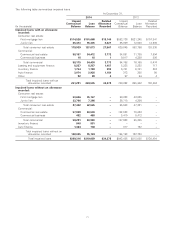

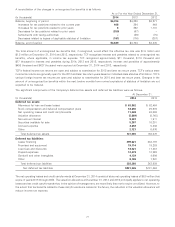

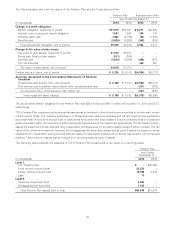

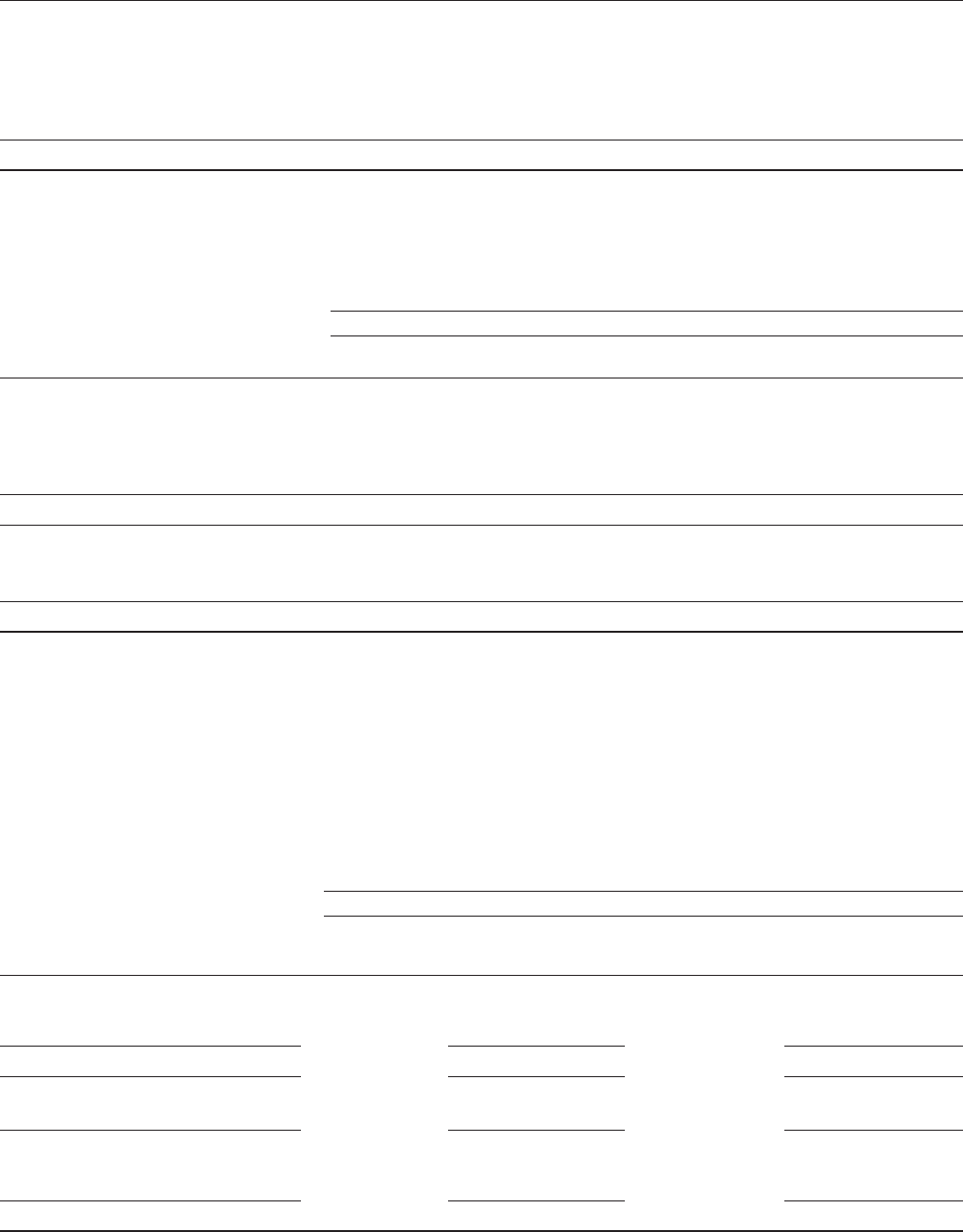

At December 31, 2014, the total future minimum rental payments for operating leases of premises and equipment are as

follows.

(In thousands)

2015 $ 26,894

2016 29,592

2017 28,201

2018 26,355

2019 15,199

Thereafter 67,030

Total $193,271

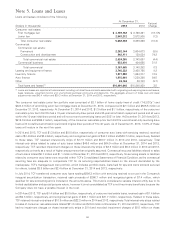

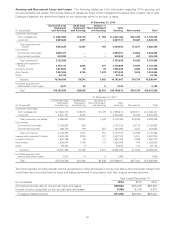

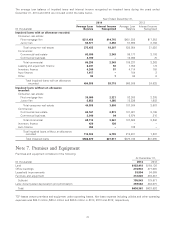

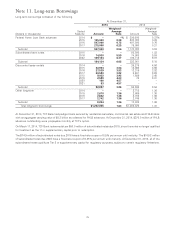

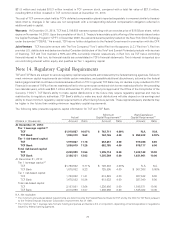

Note 8. Goodwill and Other Intangible Assets

Goodwill and other intangible assets consisted of the following.

At December 31,

2014 2013

Gross Accumulated Net Gross Accumulated Net

(In thousands) Amount Amortization Amount Amount Amortization Amount

Amortizable intangible assets:

Deposit base intangibles $ 3,049 $1,502 $ 1,547 $ 3,049 $1,105 $ 1,944

Customer base intangibles 2,730 1,377 1,353 2,730 996 1,734

Non-compete agreement 4,590 2,849 1,741 4,590 1,942 2,648

Tradename 300 300 – 300 300 –

Total $ 10,669 $6,028 $ 4,641 $ 10,669 $4,343 $ 6,326

Unamortizable intangible assets:

Goodwill related to funding segment $141,245 $141,245 $141,245 $141,245

Goodwill related to lending segment 84,395 84,395 84,395 84,395

Total $225,640 $225,640 $225,640 $225,640

Amortization expense for intangible assets of $1.7 million, $2.3 million and $1.5 million were recognized in 2014, 2013 and 2012,

respectively. Amortization expense for intangible assets is estimated to be $1.6 million for 2015, $1.4 million for 2016,

$0.5 million for 2017, $0.4 million for 2018 and $0.3 million for 2019. There was no impairment of goodwill or the intangible

assets in 2014, 2013 or 2012.

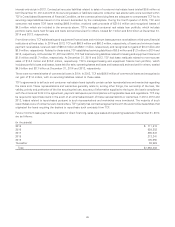

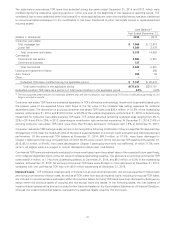

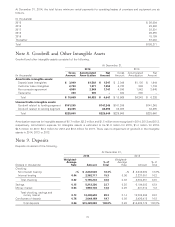

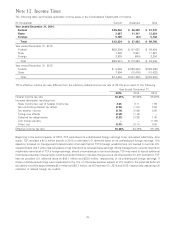

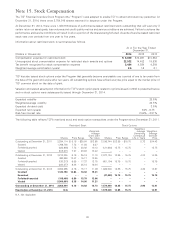

Note 9. Deposits

Deposits consisted of the following.

At December 31,

2014 2013

Weighted- Weighted-

Average % of Average % of

(Dollars in thousands) Rate Amount Total Rate Amount Total

Checking:

Non-interest bearing –% $ 2,832,526 18.3% –% $ 2,642,600 18.3%

Interest bearing 0.04 2,362,717 15.3 0.06 2,337,851 16.2

Total checking 0.02 5,195,243 33.6 0.03 4,980,451 34.5

Savings 0.15 5,212,320 33.7 0.20 6,194,003 42.9

Money market 0.54 1,993,130 13.0 0.29 831,910 5.8

Total checking, savings and

money market 0.13 12,400,693 80.3 0.14 12,006,364 83.2

Certificates of deposit 0.78 3,049,189 19.7 0.86 2,426,412 16.8

Total deposits 0.26 $15,449,882 100.0% 0.26 $14,432,776 100.0%

73