TCF Bank 2014 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2014 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

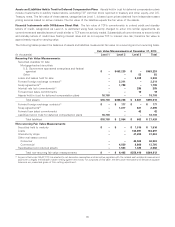

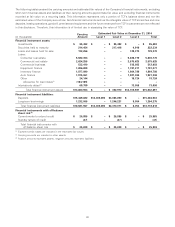

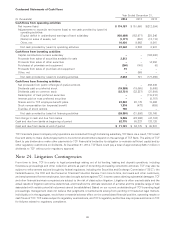

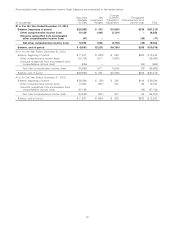

Condensed Statements of Cash Flows

Year Ended December 31,

(In thousands) 2014 2013 2012

Cash flows from operating activities:

Net income (loss) $ 174,187 $ 151,668 $(212,884)

Adjustments to reconcile net income (loss) to net cash provided by (used in)

operating activities:

(Equity) deficit in undistributed earnings of bank subsidiary (156,098) (152,977) 225,346

(Gains) on sales of assets, net (1,177) (350) (13,116)

Other, net 16,430 9,962 9,561

Net cash provided by (used in) operating activities 33,342 8,303 8,907

Cash flows from investing activities:

Capital contributions to bank subsidiary –– (192,000)

Proceeds from sales of securities available for sale 2,813 ––

Proceeds from sales of other securities –– 14,550

Purchases of premises and equipment (260) (148) (6)

Proceeds from sales of premises and equipment 91 ––

Other, net –869 –

Net cash provided by (used in) investing activities 2,644 721 (177,456)

Cash flows from financing activities:

Net proceeds from public offerings of preferred stock –– 263,240

Dividends paid on preferred stock (19,388) (19,065) (5,606)

Dividends paid on common stock (32,731) (32,227) (31,904)

Redemption of trust preferred securities –– (115,010)

Interest paid on trust preferred securities –– (8,757)

Shares sold to TCF employee benefit plans 23,083 20,179 19,462

Stock compensation tax (expense) benefit 1,316 (473) (659)

Exercise of stock options 740 ––

Net cash provided by (used in) financing activities (26,980) (31,586) 120,766

Net change in cash and due from banks 9,006 (22,562) (47,783)

Cash and due from banks at beginning of period 62,775 85,337 133,120

Cash and due from banks at end of period $ 71,781 $ 62,775 $ 85,337

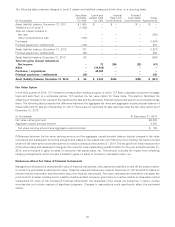

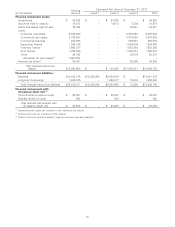

TCF Financial’s (parent company only) operations are conducted through its banking subsidiary, TCF Bank. As a result, TCF’s cash

flow and ability to make dividend payments to its common stockholders depend on the earnings of TCF Bank. The ability of TCF

Bank to pay dividends or make other payments to TCF Financial is limited by its obligation to maintain sufficient capital and by

other regulatory restrictions on dividends. At December 31, 2014, TCF Bank could pay a total of approximately $83.7 million in

dividends to TCF without prior regulatory approval.

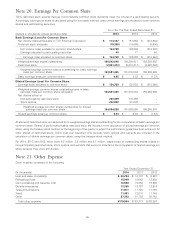

Note 24. Litigation Contingencies

From time to time, TCF is a party to legal proceedings arising out of its lending, leasing and deposit operations, including

foreclosure proceedings and other collection actions as part of its lending and leasing collections activities. TCF may also be

subject to enforcement actions brought by federal regulators, including the Securities and Exchange Commission (‘‘SEC’’), the

Federal Reserve, the OCC and the Consumer Financial Protection Bureau. From time to time, borrowers and other customers,

and employees and former employees, have also brought actions against TCF, in some cases claiming substantial damages. TCF

and other financial services companies are subject to the risk of class action litigation. Litigation is often unpredictable and the

actual results of litigation cannot be determined, and therefore the ultimate resolution of a matter and the possible range of loss

associated with certain potential outcomes cannot be established. Based on our current understanding of TCF’s pending legal

proceedings, management does not believe that judgments or settlements arising from pending or threatened legal matters,

individually or in the aggregate, would have a material adverse effect on the consolidated financial position, operating results or

cash flows of TCF. TCF is also subject to regulatory examinations, and TCF’s regulatory authorities may impose sanctions on TCF

for failures related to regulatory compliance.

99