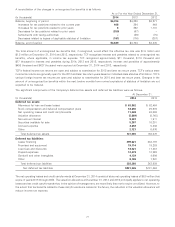

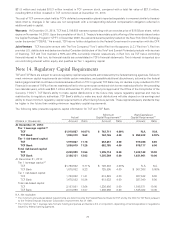

TCF Bank 2014 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2014 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

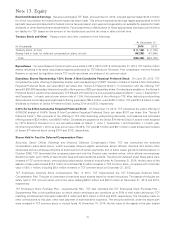

Note 13. Equity

Restricted Retained Earnings Retained earnings at TCF Bank, at December 31, 2014, included approximately $134.4 million

for which no provision for federal income taxes has been made. This amount represents earnings legally appropriated to thrift

bad debt reserves and deducted for federal income tax purposes in prior years and is generally not available for payment of cash

dividends or other distributions to stockholders. Future payments or distributions of these appropriated earnings could invoke a

tax liability for TCF based on the amount of the distributions and the tax rates in effect at that time.

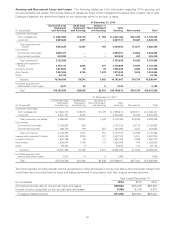

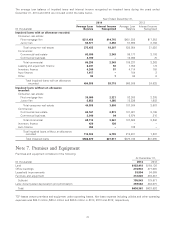

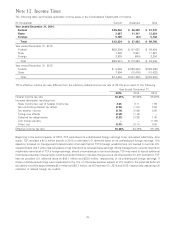

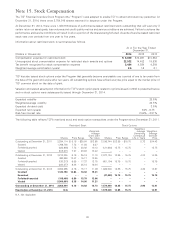

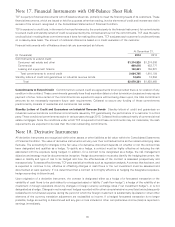

Treasury Stock and Other Treasury stock and other consisted of the following.

At December 31,

(In thousands) 2014 2013

Treasury stock, at cost $ (1,102) $ (1,102)

Shares held in trust for deferred compensation plans, at cost (48,298) (41,096)

Total $(49,400) $(42,198)

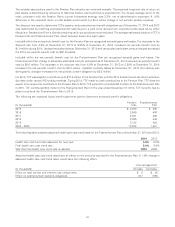

Repurchases No repurchases of common stock were made in 2014, 2013 or 2012. At December 31, 2014, TCF had 5.4 million

shares remaining in its stock repurchase programs authorized by TCF’s Board of Directors. Prior consultation with the Federal

Reserve is required by regulation before TCF could repurchase any shares of its common stock.

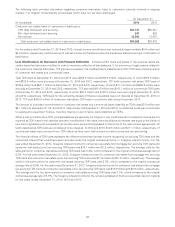

Depositary Shares Representing 7.50% Series A Non-Cumulative Perpetual Preferred Stock On June 25, 2012, TCF

completed the public offering of depositary shares, each representing a 1/1000th interest in a share of Series A Non-Cumulative

Perpetual Preferred Stock, par value $0.01 per share (the ‘‘Series A Preferred Stock’’). In connection with the offering, TCF

issued 6,900,000 depositary shares at a public offering price of $25 per depositary share. Dividends are payable on the Series A

Preferred Stock if, as and when declared by TCF’s Board of Directors on a non-cumulative basis on March 1, June 1, September 1

and December 1 of each year at a per annum rate of 7.5%. Net proceeds of the offering to TCF, after deducting underwriting

discounts and commissions and estimated offering expenses of $5.8 million, were $166.7 million. TCF paid $12.9 million in cash

dividends to holders of Series A Preferred Stock during 2014 and 2013, respectively.

6.45% Series B Non-Cumulative Perpetual Preferred Stock On December 19, 2012, TCF completed the public offering of

4,000,000 shares of 6.45% Series B Non-Cumulative Perpetual Preferred Stock par value $0.01 per share (the ‘‘Series B

Preferred Stock’’). Net proceeds of the offering to TCF, after deducting underwriting discounts, commissions and estimated

offering costs of $3.5 million, were $96.5 million. Dividends are payable on the Series B Preferred Stock if, as and when declared

by TCF’s Board of Directors on a non-cumulative basis on March 1, June 1, September 1 and December 1 of each year,

commencing on March 1, 2013, at a per annum rate of 6.45%. TCF paid $6.5 million and $6.1 million in cash dividends to holders

of Series B Preferred stock during 2014 and 2013, respectively.

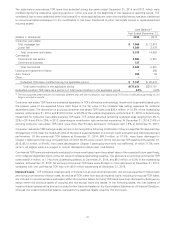

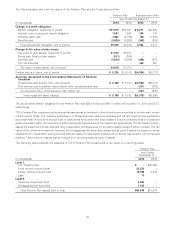

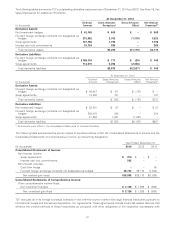

Shares Held in Trust for Deferred Compensation Plans

Executive, Senior Officer, Winthrop and Directors Deferred Compensation Plans TCF has maintained the deferred

compensation plans listed above, which previously allowed eligible executives, senior officers, directors and certain other

employees and non-employee directors to defer a portion of certain payments, and, in some cases, grants of restricted stock. In

October 2008, TCF terminated the employee plans and only the Director plan remains active, which allows non-employee

directors to defer up to 100% of their director fees and restricted stock awards. The amounts deferred under these plans were

invested in TCF common stock, other publicly traded stocks, bonds or mutual funds. At December 31, 2014, the fair value of the

assets in these plans totaled $13.8 million and included $8.6 million invested in TCF common stock, compared with a total fair

value of $15.1 million, including $9.4 million invested in TCF common stock at December 31, 2013.

TCF Employees Deferred Stock Compensation Plan In 2011, TCF implemented the TCF Employees Deferred Stock

Compensation Plan. This plan is comprised of restricted stock awards issued to certain executives. The assets of this plan are

solely held in TCF common stock with a fair value totaling $33.2 million and $30.2 million at December 31, 2014 and 2013,

respectively.

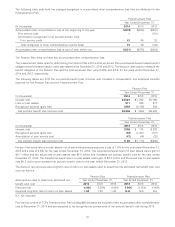

TCF Employees Stock Purchase Plan – Supplemental Plan TCF also maintains the TCF Employees Stock Purchase Plan –

Supplemental Plan, a non-qualified plan, to which certain employees can contribute up to 50% of their salary and bonus. TCF

matching contributions to this plan totaled $1.5 million and $0.8 million in 2014 and 2013, respectively. The Company made no

other contributions to this plan, other than payment of administrative expenses. The amounts deferred under the above plan

were invested in TCF common stock or mutual funds. At December 31, 2014, the fair value of the assets in the plan totaled

78