TCF Bank 2014 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2014 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

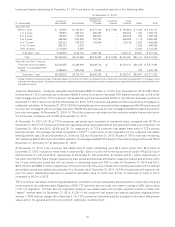

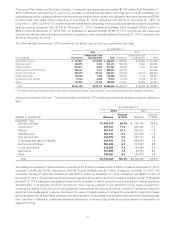

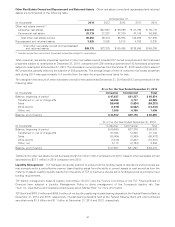

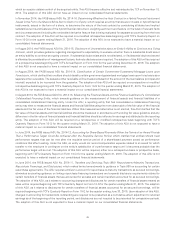

Changes in the amount of non-accrual loans and leases for the years ended December 31, 2014 and 2013 are summarized in the

following tables.

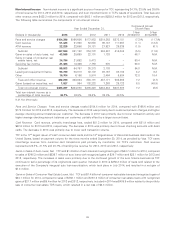

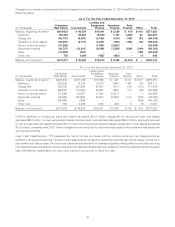

At or For the Year Ended December 31, 2014

Leasing and

Consumer Equipment Inventory Auto

(In thousands) Real Estate Commercial Finance Finance Finance Other Total

Balance, beginning of period $219,033 $ 40,539 $14,041 $ 2,529 $ 470 $ 410 $277,022

Additions 184,385 29,653 18,380 7,107 4,280 92 243,897

Charge-offs (55,107) (8,491) (5,040) (515) (100) (91) (69,344)

Transfers to other assets (62,281) (3,717) (3,027) (306) (135) (12) (69,478)

Return to accrual status (51,269) – (1,683) (2,852) – – (55,804)

Payments received (20,757) (33,401) (9,549) (3,398) (839) (209) (68,153)

Sales (41,458) (607) – – – (189) (42,254)

Other, net 725 1,059 (452) (483) – (1) 848

Balance, end of period $173,271 $ 25,035 $12,670 $ 2,082 $3,676 $ – $216,734

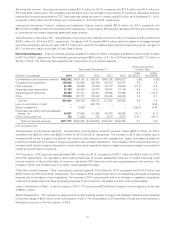

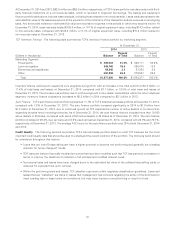

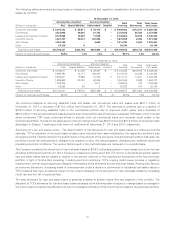

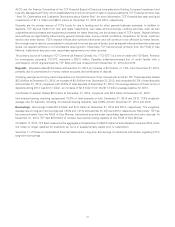

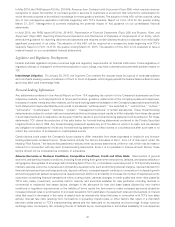

At or For the Year Ended December 31, 2013

Leasing and

Consumer Equipment Inventory Auto

(In thousands) Real Estate Commercial Finance Finance Finance Other Total

Balance, beginning of period $234,900 $127,746 $13,652 $ 1,487 $ 101 $1,571 $379,457

Additions 222,443 13,315 19,219 7,608 497 29 263,111

Charge-offs (38,283) (27,325) (5,461) (721) (10) (173) (71,973)

Transfers to other assets (66,267) (13,885) (2,252) (526) (10) (56) (82,996)

Return to accrual status (71,229) (9,057) (1,748) (3,321) – – (85,355)

Payments received (19,865) (53,985) (9,267) (2,292) (114) (503) (86,026)

Sales (43,434) (309) – – – (453) (44,196)

Other, net 768 4,039 (102) 294 6 (5) 5,000

Balance, end of period $219,033 $ 40,539 $14,041 $ 2,529 $ 470 $ 410 $277,022

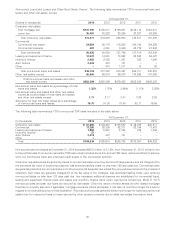

In 2014, additions to non-accrual loans and leases decreased $19.2 million, charge-offs of non-accrual loans and leases

decreased $2.6 million, non-accrual loans and leases that returned to accrual status decreased $29.6 million, payments received

on non-accrual loans and leases decreased $17.9 million and non-accrual loans and leases transferred to other assets decreased

$13.5 million, compared with 2013. These changes were primarily due to improved credit quality in the consumer real estate and

commercial portfolios.

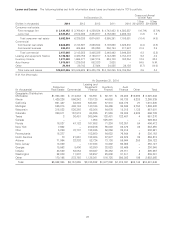

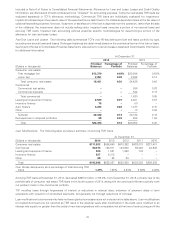

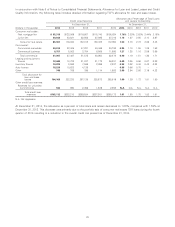

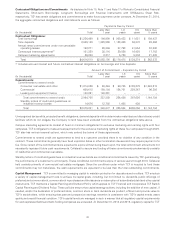

Loan Credit Classifications TCF assesses the risk of its loan and lease portfolio utilizing numerous risk characteristics as

outlined in the previous sections. The loan credit classifications represent an additional characteristic that is closely monitored in

the overall credit risk process. The loan credit classifications derived from standard regulatory rating definitions include: accruing

non-classified (pass and special mention) and accruing classified (substandard and doubtful). Accruing classified loans and leases

have well-defined weaknesses, but may never become non-accrual or result in a loss.

36