TCF Bank 2014 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2014 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

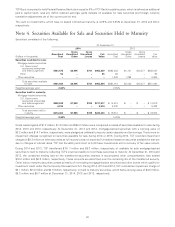

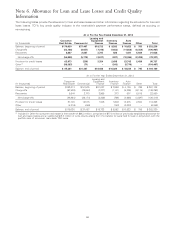

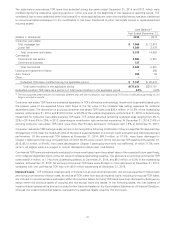

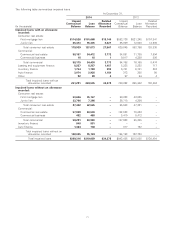

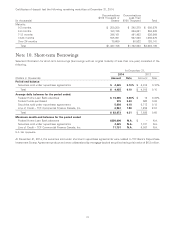

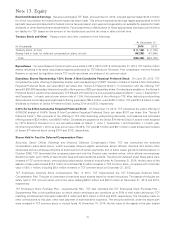

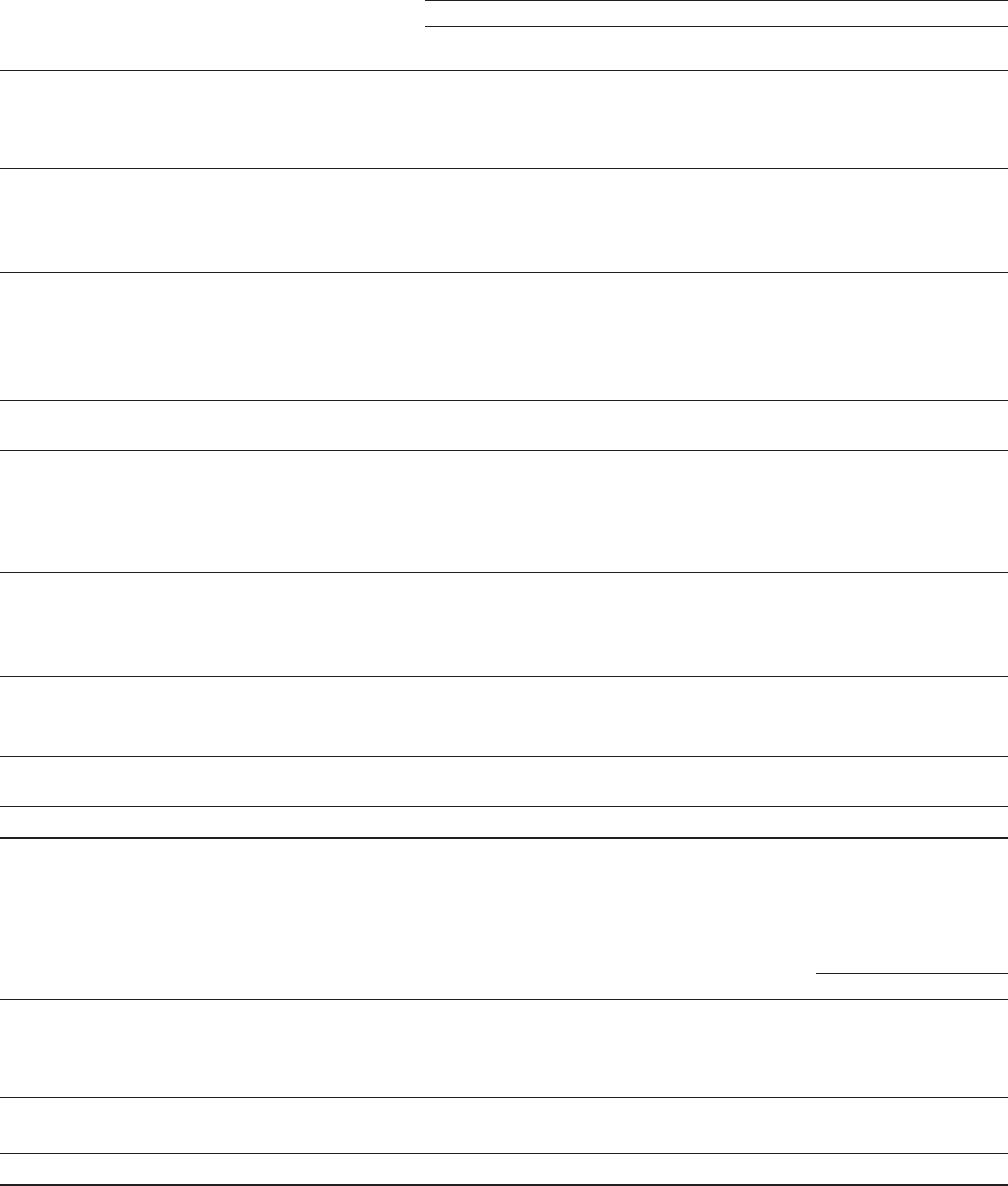

The average loan balance of impaired loans and interest income recognized on impaired loans during the years ended

December 31, 2014 and 2013 are included within the table below.

Year Ended December 31,

2014 2013

Average Loan Interest Income Average Loan Interest Income

(In thousands) Balance Recognized Balance Recognized

Impaired loans with an allowance recorded:

Consumer real estate:

First mortgage lien $311,458 $14,715 $481,292 $17,263

Junior lien 63,977 3,492 57,692 3,762

Total consumer real estate 375,435 18,207 538,984 21,025

Commercial:

Commercial real estate 63,099 2,349 99,177 3,193

Commercial business 2,199 – 10,060 70

Total commercial 65,298 2,349 109,237 3,263

Leasing and equipment finance 8,247 58 7,954 174

Inventory finance 4,249 97 4,114 158

Auto finance 1,617 – 154 2

Other 92 7 66 6

Total impaired loans with an allowance

recorded 454,938 20,718 660,509 24,628

Impaired loans without an allowance

recorded:

Consumer real estate:

First mortgage lien 39,086 2,321 92,268 2,305

Junior lien 5,852 1,285 15,236 1,682

Total consumer real estate 44,938 3,606 107,504 3,987

Commercial:

Commercial real estate 65,167 2,973 101,921 3,165

Commercial business 2,946 94 5,674 215

Total commercial 68,113 3,067 107,595 3,380

Inventory finance 426 126 ––

Auto finance 455 – 132 –

Total impaired loans without an allowance

recorded 113,932 6,799 215,231 7,367

Total impaired loans $568,870 $27,517 $875,740 $31,995

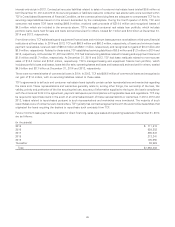

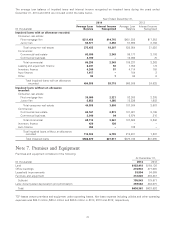

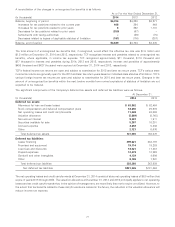

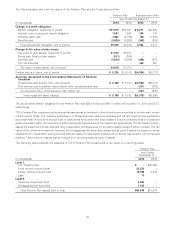

Note 7. Premises and Equipment

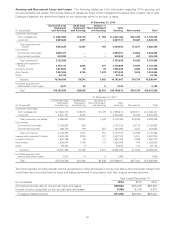

Premises and equipment consisted of the following.

At December 31,

(In thousands) 2014 2013

Land $152,418 $154,136

Office buildings 276,943 277,085

Leasehold improvements 53,954 54,069

Furniture and equipment 312,628 294,387

Subtotal 795,943 779,677

Less: Accumulated depreciation and amortization 359,582 342,075

Total $436,361 $437,602

TCF leases certain premises and equipment under operating leases. Net lease expense including utilities and other operating

expenses was $34.0 million, $35.4 million and $35.5 million in 2014, 2013 and 2012, respectively.

72