TCF Bank 2014 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2014 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

It is hard to believe that it has been

30 years since I rst took over as

Chief Executive Ofcer at TCF. As I

begin my nal year leading the bank,

I often look back and nd myself

amazed at all the exceptional things

this company has accomplished. We

were the rst to launch totally free

checking, completed several

acquisitions and stock splits, acquired

new businesses, started businesses

from scratch, repositioned the

balance sheet and successfully

completed signicant business model

changes while reducing balance

sheet credit risk to meet a changing

regulatory landscape. These events

laid the groundwork for the success

we had in 2014 and have helped us

bring the future of TCF into focus.

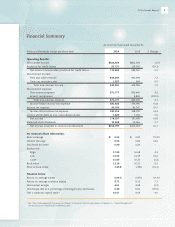

A Look at 2014

2014 was a very good year for us

despite continued headwinds as

the economy showed little, if any,

improvement until late in the year

and interest rates remained at

historic lows. We earned net income

of $174.2 million, or 94 cents per

share, up 14.8 percent and 14.6

percent, respectively, from 2013.

Return on average tangible common

equity increased from 9.58 percent

to 10.08 percent during the year,

while tangible book value per share

increased 10.1 percent to $9.72. We

maintained an industry-leading net

interest margin in 2014 of 4.61

percent, over 100 basis points greater

than our peer average. Our stock

price closed the year at $15.89 with a

three-year total stockholder return of

61.02 percent.

A signicant factor in our success

in 2014 was our loan and lease

origination engine. We originated

$13.5 billion of loans and leases

in 2014, up 12.2 percent from 2013.

As a result, total assets now consist

of 85 percent loans and leases.

These originations have largely

been driven by our national lending

businesses, including Leasing and

Equipment Finance, Inventory

Finance, Gateway One Lending &

Finance and our national junior lien

mortgage business. We recognized

several years ago that the banking

industry and regulatory environment

in America were evolving. To

compete, we needed to not only

succeed in our footprint businesses,

such as branch banking, retail

lending and commercial lending, but

we needed to be successful lending

nationally as well. As a result, we

developed a unique mix of lending

platforms that have allowed us to

generate originations at an

extremely efcient level.

Our loan origination capacity is

signicant for a number of reasons.

First, it creates revenue through

interest income as our unique

portfolio mix allows us to put

high-yielding, high-quality earning

assets on our balance sheet. Second,

within our lending platforms, we

have a niche lending strategy which

allows our portfolio to be well

diversied by type of credit,

geography, industry, product and

collateral type. Finally, our core loan

sale capability allows us to reduce

risk by actively managing loan

concentrations as well as generating

gains on sales and servicing fees.

Given the growth of our national

lending platforms, investors, rating

agencies and regulators have all

expressed concern about the future

credit quality of these businesses.

We believe our experienced manage-

ment teams and effective risk

mitigation strategies within these

businesses provide for consistent

performance moving forward.

We entered the inventory nance

business in 2008 and it is led by a

management team that averages

over 30 years of experience speci-

cally in this industry. Business is

generated through program

relationships with strong

Dear Stockholders:

William A. Cooper, Chairman of the Board & Chief Executive Ofcer