TCF Bank 2014 Annual Report Download

Download and view the complete annual report

Please find the complete 2014 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

the

future

TCF Financial Corporation | Annual Report 2014

in

focus

Table of contents

-

Page 1

the future in focus TCF Financial Corporation | Annual Report 2014 -

Page 2

...Education annual report on form 10-k 1 6 17 18 52 57 102 Business Risk Factors Selected Financial Data Management's Discussion and Analysis Consolidated Financial Statements Notes to Consolidated Financial Statements Other Financial Data corporate information A-1 A-2 A-4 A-4 A-7 Board of Directors... -

Page 3

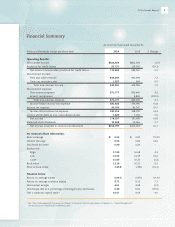

... Net income available to common stockholders Per Common Share Information: Basic earnings Diluted earnings Dividends declared Stock price: High Low Close Book value Price to book value Financial Ratios: Return on average assets Return on average common equity Net interest margin Net charge-offs as... -

Page 4

... on sales of consumer real estate loans, net 5% 13% Inventory finance 11% Auto finance Consumer real estate & other (first mortgages) 17% Consumer real estate (junior liens) 36% Deposit fees & service charges Servicing fee income 18% Commercial 16% Commercial 22% 12% Card revenue Leasing... -

Page 5

...Chief Executive Officer at TCF. As I begin my final year leading the bank, I often look back and find myself amazed at all the exceptional things this company has accomplished. We were the first to launch totally free checking, completed several acquisitions and stock splits, acquired new businesses... -

Page 6

... in 2014 and are both run by very experienced management teams. Our legacy lending businesses, commercial and retail lending, have also added national lending components in recent years. As part of our commercial business, we started TCF Capital Funding, an asset-based and cash flow lending business... -

Page 7

... product and service opportunities, including offering auto loans in the branches, credit cards, and additional online and mobile upgrades. These efforts are aimed at creating new and enhanced touch points with customers to ensure a long relationship with the bank. Banking regulation will continue... -

Page 8

... in 2014. In addition, we have been committed to building a financially stronger community through our financial education program. I am very fortunate to have had the opportunity to lead TCF for the last 30 years. I have enjoyed working closely with our Board of Directors, employees, various... -

Page 9

... many helpful comments that identified opportunities to improve our products, services and processes to be more convenient and transparent to our customers. We introduced a new residential mortgage product in TCF's retail branches to provide a convenient and personal approach to home financing. We... -

Page 10

... high school students, customers and employees benefited from the programs. Momentum continues to build for these programs and TCF has set a long-term goal of reaching two million teens and adults. Both the TCF Financial Scholars Program and the TCF Financial Learning Center make use of the unique... -

Page 11

FORM 10-K TCF Financial Corporation For the fiscal year ended December 31, 2014 -

Page 12

... 200 Lake Street East, Mail Code EX0-03-A, Wayzata, Minnesota 55391-1693 (Address of principal executive offices and zip code) Registrant's telephone number, including area code: 952-745-2760 Securities registered pursuant to Section 12(b) of the Act: (Title of each class) (Name of each exchange on... -

Page 13

... Item 12. Item 13. Item 14. Directors, Executive Officers and Corporate Governance Executive Compensation Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters Certain Relationships and Related Transactions, and Director Independence Principal Accountant Fees... -

Page 14

... and financing of home improvements. TCF's retail lending origination activity primarily consists of consumer real estate secured lending. It also includes originating loans secured by personal property and, to a very limited extent, unsecured personal loans. Consumer loans are made on a fixed-term... -

Page 15

...branch banking services is an integral component of TCF's business philosophy and a major strategy for generating additional non-interest income. TCF offers retail checking account customers low-cost, convenient access to funds at local merchants and ATMs through its debit card programs. TCF's debit... -

Page 16

... institutions selling money market mutual funds and corporate and government securities. TCF competes for the origination of loans with banks, mortgage bankers, mortgage brokers, consumer and commercial finance companies, credit unions, insurance companies and savings institutions. TCF also competes... -

Page 17

... distributed and current tax rates. Regulation of TCF and Affiliates and Insider Transactions TCF Financial is subject to Federal Reserve regulations, examinations and reporting requirements applicable to bank holding companies. Subsidiaries of bank holding companies, like TCF Bank, are subject to... -

Page 18

.... Available Information TCF's website, www.tcfbank.com, includes free access to Company news releases, investor presentations, conference calls to discuss published financial results, TCF's Annual Report, and periodic filings required by the United States Securities and Exchange Commission (''SEC... -

Page 19

... Codes of Ethics and information on all of TCF's securities are also available on this website. Stockholders may request these documents in print free of charge by contacting the Corporate Secretary at TCF Financial Corporation, 200 Lake Street East, Mail Code EX0-01-G, Wayzata, MN 55391-1693. Item... -

Page 20

...transactions, or to deliver products and services to its customers and otherwise to conduct its business. Replacing these third party vendors could also entail significant delay and expense. If any of TCF's financial, accounting or other data processing systems fail or if personal information of TCF... -

Page 21

... market conditions. TCF competes with other commercial banks, savings and loan associations, mutual savings banks, finance companies, mortgage banking companies, credit unions and investment companies. In addition, technology has lowered barriers to entry and made it possible for non-banks to offer... -

Page 22

...such as indirect auto lending, fair lending, account fees, loan servicing and other products and services provided to customers. Changes in regulations, regulatory policies and enforcement activity could subject TCF to reduced revenues, additional costs, limits on the types of financial services and... -

Page 23

... auto and consumer real estate businesses for a pre-tax gain of $78.8 million in 2014 including its inaugural consumer auto loan securitization of $256.3 million of loans during the third quarter of 2014 for a pre-tax gain of $7.4 million. Disruptions in the financial markets, changes to regulations... -

Page 24

... due diligence activities related to possible transactions with banks or other financial institutions. As a result, negotiations may take place and future mergers or acquisitions involving cash, debt or equity securities may occur at any time. Acquiring other banks, businesses or branches involves... -

Page 25

... Company from utilizing certain technologies. TCF is subject to environmental liability risk associated with lending activities. A significant portion of TCF's loan portfolio is secured by real property. In the ordinary course of business, TCF may foreclose on and take title to properties securing... -

Page 26

... branch offices are located in Illinois, Minnesota, Michigan, Colorado, Wisconsin, Arizona, South Dakota and Indiana. For more information on premises and equipment, see Note 7 of Notes to Consolidated Financial Statements, Premises and Equipment. Item 3. Legal Proceedings From time to time, TCF... -

Page 27

...Item 5. Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities TCF's common stock trades on the New York Stock Exchange under the symbol ''TCB.'' The following table sets forth the high and low prices and dividends declared for TCF's common stock... -

Page 28

... September 30, 2013, including: New York Community Bancorp, Inc.; First Republic Bank; Hudson City Bancorp, Inc.; First Niagara Financial Group, Inc.; Popular, Inc.; People's United Financial, Inc.; City National Corporation; BOK Financial Corporation; Synovus Financial Corp.; East West Bancorp, Inc... -

Page 29

... repurchase program(1) Employee transactions(2) - 4,603 - - - - - 4,603 Average Price Paid Per Share $ - 15.43 15.43 N.A. Not Applicable. (1) The current share repurchase authorization was approved by the Board of Directors on April 14, 2007 and was announced in a press release dated April 16... -

Page 30

... leases and other real estate owned to total loans and leases and other real estate owned Allowance for loan and lease losses to total loans and leases Net charge-offs as a percentage of average loans and leases (1) 2014 $ At or For the Year Ended December 31, 2013 2012 2011 2010 815,629 $ 802... -

Page 31

...Securities Held to Maturity and Securities Available for Sale Loans and Leases Credit Quality Other Real Estate Owned and Repossessed and Returned Assets Liquidity Management Deposits Borrowings Contractual Obligations and Commitments Capital Management Critical Accounting Policies Recent Accounting... -

Page 32

... Bank (''TCF Bank''), is headquartered in South Dakota. References herein to ''TCF Financial'' refer to TCF Financial Corporation on an unconsolidated basis. At December 31, 2014, TCF had 379 branches in Illinois, Minnesota, Michigan, Colorado, Wisconsin, Arizona, South Dakota and Indiana (TCF... -

Page 33

... foreclosed real estate properties as a result of improved real estate values. Funding TCF's funding is primarily derived from branch banking and wholesale borrowings, with a focus on building and maintaining quality customer relationships. Deposits are generated from consumers and small businesses... -

Page 34

... in fees and service charges due to customer behavior changes and higher average checking account balances per customer. The decrease in 2013 was primarily due to higher gains on sales of securities during 2012 related to the balance sheet repositioning, lower transaction activity and higher average... -

Page 35

... and Equity: Non-interest bearing deposits: Retail Small business Commercial and custodial Total non-interest bearing deposits Interest-bearing deposits: Checking Savings Money market Subtotal Certificates of deposit Total interest-bearing deposits Total deposits Borrowings: Short-term borrowings... -

Page 36

... and Equity: Non-interest bearing deposits: Retail Small business Commercial and custodial Total non-interest bearing deposits Interest-bearing deposits: Checking Savings Money market Subtotal Certificates of deposit Total interest-bearing deposits Total deposits Borrowings: Short-term borrowings... -

Page 37

... securities. The increase in 2013 was partially offset by downward pressure on yields across the lending businesses in this low interest rate environment, lower average balances of commercial fixed-rate loans due to run-off exceeding originations, and lower average balances of consumer real estate... -

Page 38

... classes. The increase in 2013 was primarily due to the balance sheet repositioning in 2012, partially offset by downward pressure on origination yields in the lending businesses due to the low interest rate environment, and a shift in commercial real estate from higher yielding fixed-rate loans... -

Page 39

.... TCF earns interchange revenue from customer card transactions paid primarily by merchants, not TCF's customers. Card revenue represented 22.5%, 21.5% and 20.7% of banking fee revenue for 2014, 2013 and 2012, respectively. Gains on Sales of Auto Loans, Net TCF sold $1.3 billion of auto loans and... -

Page 40

... loan and lease processing expense in the consumer real estate and auto finance businesses. Loss on Termination of Debt In the first quarter of 2012, TCF restructured $3.6 billion of long-term borrowings at a pre-tax loss of $550.7 million. Branch Realignment TCF executed a realignment of its retail... -

Page 41

... reduce borrowings, fund growth in loans and leases or for other corporate purposes. During 2014 and 2013, TCF transferred $191.7 million and $9.3 million, respectively, in available for sale mortgage-backed securities to held to maturity, reflecting TCF's intent to hold those securities to maturity... -

Page 42

...: Minnesota Illinois California Michigan Wisconsin Colorado Texas Canada Florida New York Ohio Pennsylvania North Carolina Arizona New Jersey Georgia Indiana Washington Other Total At December 31, 2014 Leasing and Consumer Equipment Inventory Auto Real Estate Commercial Finance Finance Finance... -

Page 43

.... TCF's closed-end consumer real estate loans require payments of principal and interest over a fixed term. At December 31, 2014 and 2013, 82.8% and 88.1%, respectively, of TCF's consumer real estate loans were in TCF's primary banking markets. The average Fair Isaac Corporation (''FICO(R)'') credit... -

Page 44

...following table summarizes TCF's commercial real estate loan portfolio by property and loan type. At December 31, 2014 (In thousands) Multi-family housing Retail services(1) Office buildings Warehouse/industrial buildings Health care facilities Hotels and motels Residential home builders Other Total... -

Page 45

... about 8,500 active dealers in 45 states as of December 31, 2013. The auto finance portfolio consisted of 25.4% new car loans and 74.6% used car loans at December 31, 2014, compared with 23.3% and 76.7%, respectively, at December 31, 2013. The average FICO score for the auto finance portfolio was... -

Page 46

... sale of consumer real estate TDR loans in the fourth quarter of 2014, along with the continued efforts to actively work out problem loans in the commercial portfolio. TCF modifies loans through forgiveness of interest or reductions in interest rates, extension of payment dates or term extensions... -

Page 47

...due on accruing consumer real estate TDR loans in 2014, yielding 3.3%, by modifying the loans to qualified customers instead of foreclosing on the property. Commercial loans that are 90 or more days past due and not well secured at the time of modification remain on non-accrual status. Regardless of... -

Page 48

... leases and inventory finance loans when reported as non-accrual. Most of TCF's non-accrual loans and past due loans are secured by real estate. Given the nature of these assets and the related mortgage foreclosure, property sale and, if applicable, mortgage insurance claims processes, it can take... -

Page 49

... Transfers to other assets Return to accrual status Payments received Sales Other, net Balance, end of period Consumer Real Estate $234,900 222,443 (38,283) (66,267) (71,229) (19,865) (43,434) 768 $219,033 At or For the Year Ended December 31, 2013 Leasing and Equipment Inventory Auto Commercial... -

Page 50

...$60.3 million in non-accrual loans and leases primarily due to the portfolio sale of consumer real estate TDR loans, which included some non-accrual TDR loans, continued efforts to actively work out commercial loans and improved credit quality in the commercial portfolio. Included in the table above... -

Page 51

... Commercial: Commercial real estate Commercial business Total commercial Leasing and equipment finance Inventory finance Auto finance Other Total allowance for loan and lease losses Other credit loss reserves: Reserves for unfunded commitments Total credit loss reserves N.A. Not Applicable. 2014... -

Page 52

... real estate Commercial business Total commercial Leasing and equipment finance Inventory finance Auto finance Other Total recoveries Net charge-offs Provision charged to operations Other(1) Balance, end of period Net charge-offs as a percentage of average loans and leases (1) 2014 $ 252,230 2010... -

Page 53

... (''ALCO'') and the Finance Committee of the TCF Financial Board of Directors have adopted a Liquidity Management Policy to direct management of the Company's liquidity risk. See ''Item 7A. Quantitative and Qualitative Disclosures about Market Risk'' for more information. TCF Bank had $767.0 million... -

Page 54

.... Lending activities, such as loan originations and purchases and equipment purchases for lease financing, are the primary uses of TCF's funds. Deposit inflows and outflows are significantly influenced by general interest rates, money market conditions, competition for funds, customer service and... -

Page 55

... credit facilities which do not obligate the Company to lend have been excluded from the contractual obligations table above. Campus marketing agreements consist of fixed or minimum obligations for exclusive marketing and naming rights with four campuses. TCF is obligated to make annual payments... -

Page 56

...ratio. These non-GAAP financial measures are viewed by management as useful indicators of capital levels available to withstand unexpected market or economic conditions and also provide investors, regulators and other users with information to be viewed in relation to other banking institutions. 43 -

Page 57

... beginning with TCF's Quarterly Report on Form 10-Q for the quarter ending March 31, 2016. The adoption of this ASU is not expected to have a material impact on our consolidated financial statements. In November 2014, the FASB issued ASU No. 2014-17, Business Combinations: Pushdown Accounting, which... -

Page 58

... with TCF's Annual Report on Form 10-K for the year ending December 31, 2016. The adoption of this ASU is not expected to have a material impact on our consolidated financial statements. In August 2014, the FASB issued ASU No. 2014-14, Classification of Certain Government-Guaranteed Mortgage Loans... -

Page 59

..., which largely upheld the Federal Reserve Board's rules governing debit card interchange fees. Forward-Looking Information Any statements contained in this Annual Report on Form 10-K regarding the outlook for the Company's businesses and their respective markets, such as projections of future... -

Page 60

... impact TCF's deposit, lending, loan collection and other business activities such as mortgage foreclosure moratorium laws, further regulation of financial institution campus banking programs, use by municipalities of eminent domain on property securing troubled residential mortgage loans, or... -

Page 61

... Home Loan Mortgage Corporation or the Government National Mortgage Association as of December 31, 2014. Interest Rate Risk ALCO and the Finance Committee of TCF Financial's Board of Directors have adopted interest rate risk policy limits which are incorporated into the Company's investment policy... -

Page 62

... TCF Financial's Board of Directors have adopted a Holding Company Investment and Liquidity Management Policy, which establishes a minimum target amount of cash or liquid investments TCF Financial will hold. TCF Financial's primary source of cash flow is capital distributions from TCF Bank. TCF Bank... -

Page 63

... and commercial real estate loans. The FHLB relies upon its own internal credit analysis of TCF when determining TCF's secured borrowing capacity. In addition to the above, TCF maintains other sources of unsecured and uncommitted borrowing capacity, including overnight federal funds purchased lines... -

Page 64

Item 8. Financial Statements and Supplementary Data 21JUL200414412105 Report of Independent Registered Public Accounting Firm The Board of Directors and Stockholders TCF Financial Corporation: We have audited the accompanying consolidated statements of financial condition of TCF Financial ... -

Page 65

...: Cash and due from banks Investments Securities held to maturity Securities available for sale Loans and leases held for sale Loans and leases: Consumer real estate: First mortgage lien Junior lien Total consumer real estate Commercial Leasing and equipment finance Inventory finance Auto finance... -

Page 66

... for credit losses Non-interest income: Fees and service charges Card revenue ATM revenue Subtotal Gains on sales of auto loans, net Gains on sales of consumer real estate loans, net Servicing fee income Subtotal Leasing and equipment finance Other Fees and other revenue Gains (losses) on securities... -

Page 67

Consolidated Statements of Comprehensive Income (In thousands) Net income (loss) attributable to TCF Financial Corporation Other comprehensive income (loss): Securities available for sale: Unrealized gains (losses) arising during the period Reclassification of net (gains) losses to net income (loss)... -

Page 68

... 31, 2013 Net income attributable to TCF Financial Corporation Other comprehensive income (loss) Net investment by (distribution to) non-controlling interest Dividends on preferred stock Dividends on common stock Grants of restricted stock Common shares purchased by TCF employee benefit plans... -

Page 69

... on securities Purchases of Federal Home Loan Bank stock Redemption of Federal Home Loan Bank stock Proceeds from sales of real estate owned Purchases of premises and equipment Other, net Net cash provided by (used in) investing activities Cash flows from financing activities: Net change in deposits... -

Page 70

... bank holding company based in Wayzata, Minnesota. Unless otherwise indicated, references herein to ''TCF'' include its direct and indirect subsidiaries. Its principal subsidiary, TCF National Bank (''TCF Bank''), is headquartered in South Dakota. References herein to ''TCF Financial'' refer to TCF... -

Page 71

... minimum lease payments as a credit risk reduction tool to third-party financial institutions at fixed rates on a non-recourse basis with its underlying equipment as collateral. For those transactions which achieve sale treatment, the related lease cash flow stream and the non-recourse financing... -

Page 72

... from closing of the statute of limitations on tax returns, new legislation, clarification of existing legislation through government pronouncements, judicial action and through the examination process. TCF's policy is to report interest and penalties, if any, related to unrecognized tax benefits in... -

Page 73

...fixed or variable rates. For those transactions which achieve sale treatment, the underlying loan is not recognized on TCF's Consolidated Statements of Financial Condition. The Company sells these loans at par value and generally retains an interest in the future cash flows of borrower loan payments... -

Page 74

... loans and consumer real estate loans. Cash payments received on loans serviced for third parties are held in separate accounts until remitted. TCF also retains cash balances for potential loss recourse on certain sold auto loans as well as cash for collateral on certain borrowings, foreign exchange... -

Page 75

...on securities available for sale are due to changes in interest rates. TCF has the ability and intent to hold these investments until a recovery of fair value occurs. During 2014 and 2013, TCF transferred $191.7 million and $9.3 million, respectively, of available for sale mortgage-backed securities... -

Page 76

... 31, 2013 Less than 12 months Fair Unrealized Value Losses 12 months or more Fair Unrealized Value Losses Total Unrealized Losses (In thousands) Securities available for sale: Mortgage-backed securities: U.S. Government sponsored enterprises and federal agencies Total securities available for sale... -

Page 77

... five years. In 2014 and 2013, TCF sold $1.3 billion and $0.8 billion, respectively, of consumer auto loans with servicing retained, received cash of $1.4 billion and $0.8 billion, respectively, and recognized net gains of $44.7 million and $29.7 million, respectively. Related to these sales, TCF... -

Page 78

...for sale and loans sold and serviced for others, totaled $7.1 billion and $7.0 billion at December 31, 2014 and 2013, respectively. From time to time, TCF sells leasing and equipment finance loans and minimum lease payment receivables to third-party financial institutions at fixed rates. In 2014 and... -

Page 79

...other information regarding the allowance for loan and lease losses. TCF's key credit quality indicator is the receivable's payment performance status, defined as accruing or non-accruing. At or For the Year Ended December 31, 2014 Leasing and Consumer Equipment Inventory Auto Real Estate Commercial... -

Page 80

... (In thousands) Allowance for loan and lease losses: Collectively evaluated for impairment Individually evaluated for impairment Total Consumer Real Estate $ 54,449 121,581 Commercial $ $ 28,994 8,473 37,467 At December 31, 2013 Leasing and Equipment Inventory Finance Finance $ $ 17,093 1,640 18... -

Page 81

...16,401,646 (In thousands) Consumer real estate: First mortgage lien Junior lien Total consumer real estate Commercial: Commercial real estate Commercial business Total commercial Leasing and equipment finance Inventory finance Auto finance Other Subtotal Portfolios acquired with deteriorated credit... -

Page 82

... collection of loan balances. If, for economic or legal reasons related to the customer's financial difficulties, TCF grants a concession, the modified loan is classified as a TDR. TDR loans consist primarily of consumer real estate and commercial loans. Total TDR loans at December 31, 2014 and 2013... -

Page 83

...it becomes 90 or more days delinquent under the modified terms, has been transferred to non-accrual status subsequent to the modification or has been transferred to other real estate owned or repossessed and returned assets. Loan Balance(1) Year Ended December 31, 2014 2013 $ 1,969 1,364 3,333 3,895... -

Page 84

... real estate Commercial: Commercial real estate Commercial business Total commercial Inventory finance Auto finance Total impaired loans without an allowance recorded Total impaired loans Unpaid Contractual Balance Loan Balance Related Allowance Recorded Unpaid Contractual Balance 2013 Loan Balance... -

Page 85

...: Consumer real estate: First mortgage lien Junior lien Total consumer real estate Commercial: Commercial real estate Commercial business Total commercial Inventory finance Auto finance Total impaired loans without an allowance recorded Total impaired loans Average Loan Balance 2013 Interest... -

Page 86

... consisted of the following. At December 31, 2014 (Dollars in thousands) Checking: Non-interest bearing Interest bearing Total checking Savings Money market Total checking, savings and money market Certificates of deposit Total deposits WeightedAverage Rate -% 0.04 0.02 0.15 0.54 0.13 0.78 0.26... -

Page 87

... Home Loan Bank advances Securities sold under repurchase agreements Line of Credit - TCF Commercial Finance Canada, Inc. N.A. Not Applicable. $ 74,385 375 5,956 2,957 $ 83,673 $250,000 4,425 11,751 $ $ At December 31, 2014, the securities sold under short-term repurchase agreements were related... -

Page 88

... 2015 2016 2017 Subtotal Subordinated bank notes Subtotal Discounted lease rentals Subtotal Other long-term Subtotal Total long-term borrowings At December 31, 2014, TCF Bank had pledged loans secured by residential real estate, commercial real estate and FHLB stock with an aggregate carrying... -

Page 89

... indefinitely. As a result, TCF recorded a $1.2 million benefit in 2013 to eliminate U.S. deferred taxes on its undistributed foreign earnings. This assertion is based on management's determination that cash held in TCF's foreign jurisdictions is not needed to fund its U.S. operations and that... -

Page 90

... compensation and deferred compensation plans Net operating losses and credit carryforwards Valuation allowance Non-accrual interest Securities available for sale Accrued expense Other Total deferred tax assets Deferred tax liabilities: Lease financing Premises and equipment Loan fees and discounts... -

Page 91

...year, commencing on March 1, 2013, at a per annum rate of 6.45%. TCF paid $6.5 million and $6.1 million in cash dividends to holders of Series B Preferred stock during 2014 and 2013, respectively. Shares Held in Trust for Deferred Compensation Plans Executive, Senior Officer, Winthrop and Directors... -

Page 92

... Board for TCF and by the OCC for TCF Bank pursuant to the Federal Deposit Insurance Corporation Improvement Act of 1991. (2) The minimum Tier 1 leverage ratio for bank holding companies and banks is 3.0 or 4.0 percent, depending on factors specified in regulations issued by federal banking agencies... -

Page 93

... assumption information for TCF's stock option plans related to options issued in 2008 is presented below and no stock options were subsequently issued through December 31, 2014. Expected volatility Weighted-average volatility Expected dividend yield Expected term (years) Risk-free interest rate 28... -

Page 94

...''), a qualified 401(k) and employee stock ownership plan, generally allows participants to make contributions of up to 50% of their covered compensation on a tax-deferred basis, subject to the annual covered compensation limitation imposed by the Internal Revenue Service (''IRS''). TCF matches the... -

Page 95

... Plan Year Ended December 31, 2014 2013 $ - 22,532 16,088 71 4,961 1,026 $44,678 $47,999 - 3,019 - - - $51,018 (In thousands) Level 1: U.S. Treasury bills Fixed income mutual funds Money market mutual funds Cash Level 2: Collective investment fund Mortgage-backed securities Total Pension Plan... -

Page 96

... Postretirement Plan Year Ended December 31, 2014 2013 2012 4.00% 2.75% 4.00% N.A. N.A. N.A. Assumptions used to determine estimated net benefit plan cost Discount rate Expected long-term rate of return on plan assets N.A. Not Applicable. Prior service credits of TCF's Postretirement Plan totaling... -

Page 97

... used in the Pension Plan valuation are reviewed annually. The expected long-term rate of return on plan assets is determined by reference to historical market returns and future expectations. The 10-year average return of the index consistent with the Pension Plan's current investment strategy was... -

Page 98

... of a customer to a third party. These conditional commitments expire in various years through 2018. Collateral held consists primarily of commercial real estate mortgages. Since the conditions under which TCF is required to fund these commitments may not materialize, the cash requirements are... -

Page 99

... foreign exchange contracts are reflected in non-interest expense. TCF enters into interest rate lock commitments in conjunction with certain consumer real estate loans. These interest rate lock commitments are agreements to extend credit under certain specified terms and conditions at fixed rates... -

Page 100

... $ 1,625 $ 1,625 $ (630) $ (630) TCF executes all of its foreign exchange contracts in the over-the-counter market with large financial institutions pursuant to International Swaps and Derivatives Association, Inc. agreements. These agreements include credit risk-related features that enhance the... -

Page 101

... markets. Management reviews the prices obtained from independent asset pricing services for unusual fluctuations and comparisons to current market trading activity. The fair value of other securities, categorized as Level 1, is determined using quoted prices from the New York Stock Exchange. Loans... -

Page 102

... real estate and auto finance loans. The fair value of the collateral is determined based on internal estimates and assessments provided by third-party appraisers. Forward Foreign Exchange Contracts TCF's forward foreign exchange contracts are currency contracts executed in over-the-counter markets... -

Page 103

...: Mortgage-backed securities: U.S. Government sponsored enterprises and federal agencies Other Loans and leases held for sale Forward foreign exchange contracts(1) Swap agreements(1) Interest rate lock commitments(1) Forward loan sales commitments Assets held in trust for deferred compensation plans... -

Page 104

...: Securities available for sale: Mortgage-backed securities: U.S. Government sponsored enterprises and federal agencies Other Other securities Forward foreign exchange contracts(1) Swap agreements(1) Assets held in trust for deferred compensation plans Total assets Forward foreign exchange contracts... -

Page 105

... or on nonaccrual status at December 31, 2014. The net gain from initial measurement of the above loans and subsequent changes in fair value for loans outstanding was $0.9 million for the year ended December 31, 2014, and is included in gains on sales of consumer real estate loans, net. This amount... -

Page 106

... sale Loans: Consumer real estate Commercial real estate Commercial business Equipment finance Inventory finance Auto finance Other Allowance for loan losses(1) Interest-only strips(2) Total financial instrument assets Financial instrument liabilities: Deposits Long-term borrowings Total financial... -

Page 107

... sale Loans: Consumer real estate Commercial real estate Commercial business Equipment finance Inventory finance Auto finance Other Allowance for loan losses(1) Interest-only strips(2) Total financial instrument assets Financial instrument liabilities: Deposits Long-term borrowings Total financial... -

Page 108

... (loss) attributable to TCF Financial Corporation Preferred stock dividends Net income (loss) available to common stockholders Earnings allocated to participating securities Earnings (loss) allocated to common stock Weighted-average shares outstanding Restricted stock Weighted-average common shares... -

Page 109

... as reportable segments. Lending includes consumer real estate, commercial real estate and business lending, leasing and equipment finance, inventory finance and auto finance. Funding includes branch banking and treasury services. Support Services includes Holding Company and corporate functions... -

Page 110

... and losses. Note 23. Parent Company Financial Information TCF Financial's (parent company only) condensed statements of financial condition as of December 31, 2014 and 2013 and the condensed statements of income and cash flows for the years ended December 31, 2014, 2013 and 2012 are as follows... -

Page 111

Condensed Statements of Income Year Ended December 31, 2014 2013 2012 ...TCF Bank Affiliate service fees Other Total non-interest income Non-interest expense: Compensation and employee benefits Occupancy and equipment Other Total non-interest expense Income (loss) before income tax benefit and equity... -

Page 112

...its lending, leasing and deposit operations, including foreclosure proceedings and other collection actions as part of its lending and leasing collections activities. TCF may also be subject to enforcement actions brought by federal regulators, including the Securities and Exchange Commission (''SEC... -

Page 113

... related to securities available for sale were recorded in gains (losses) on securities, net in the Consolidated Statements of Income. The tax effect of these reclassifications was recorded in income tax expense (benefit) in the Consolidated Statements of Income. See Note 16, Employee Benefit Plans... -

Page 114

... below. Securities Available for Sale $(26,983) 18,139 (47) 18,092 $ (8,891) $ 11,677 (38,124) (536) (38,660) $(26,983) $ 56,269 12,542 (57,134) (44,592) $ 11,677 Net Investment Hedges $ 591 1,945 - 1,945 $2,536 $ (420) 1,011 - 1,011 $ 591 $ (29) (391) - (391) $ (420) $ Foreign Currency Translation... -

Page 115

... to non-controlling interest Preferred stock dividends Net income available to common stockholders Per common share: Basic earnings Diluted earnings Dec. 31, 2014 Sep. 30, 2014 Jun. 30, 2014 Three Months Ended Mar. 31, Dec. 31, Sep. 30, 2014 2013 2013 Jun. 30, 2013 Mar. 31, 2013 $204,074 $204,180... -

Page 116

... 31, 2014. Disclosure controls and procedures are designed to ensure that information required to be disclosed by TCF in reports filed or submitted under the Exchange Act is recorded, processed, summarized and reported within the time periods specified in the SEC's rules and forms. Disclosure... -

Page 117

...the financial statements. Management, with the participation of the Chief Executive Officer (Principal Executive Officer) and Chief Financial Officer (Principal Financial Officer), completed an assessment of TCF's internal control over financial reporting as of December 31, 2014. This assessment was... -

Page 118

... of the Public Company Accounting Oversight Board (United States), the consolidated statements of financial condition of TCF Financial Corporation and subsidiaries as of December 31, 2014 and 2013, and the related consolidated statements of income, comprehensive income, equity, and cash flows for... -

Page 119

... to all officers (including the PEO, PFO and PAO), directors and employees of TCF (the ''Code of Ethics''). The Code of Ethics and Senior Financial Management Code of Ethics are both available for review at TCF's website at www.tcfbank.com by clicking on ''About TCF'' and then ''About TCF Corporate... -

Page 120

... and PAO of the Code of Ethics or Senior Financial Management Code of Ethics will also be posted on this site. Item 11. Executive Compensation Information regarding compensation of directors and executive officers of TCF is set forth in the following sections of TCF's 2015 Proxy and is incorporated... -

Page 121

... Cash Flows for each of the years in the three-year period ended December 31, 2014 Notes to Consolidated Financial Statements Other Financial Data Management's Report on Internal Control Over Financial Reporting Report of Independent Registered Public Accounting Firm 2. Financial Statement Schedules... -

Page 122

... duly authorized. TCF Financial Corporation Registrant By: /s/ WILLIAM A. COOPER William A. Cooper Chairman and Chief Executive Officer Dated: February 23, 2015 Pursuant to the requirements of the Securities Exchange Act of 1934, this report has been signed below by the following persons on behalf... -

Page 123

... to long-term debt will be furnished to the Securities and Exchange Commission upon request. TCF Financial Incentive Stock Program, as amended and restated April 24, 2013 [incorporated by reference to Exhibit 10.1 to TCF Financial Corporation's Current Report on Form 8-K filed April 30, 2013 (No... -

Page 124

...Based Compensation Policy for Covered Executive Officers, as approved effective January 1, 2013 [incorporated by reference to Exhibit 10.2 to TCF Financial Corporation's Current Report on Form 8-K filed April 30, 2013 (No. 13797581)] Form of 2014 Management Incentive Plan - Executive, as executed by... -

Page 125

... TCF Employees Deferred Stock Compensation Plan [incorporated by reference to Exhibit 10(v) to TCF Financial Corporation's Current Report on Form 8-K filed February 18, 2011 (No. 11625311)] Consolidated Ratios of Earnings to Fixed Charges for years ended December 31, 2014, 2013, 2012, 2011, and 2010... -

Page 126

... of Earnings to Fixed Charges and Preferred Stock Dividends for years ended December 31, 2014, 2013, 2012, 2011, and 2010 Subsidiaries of TCF Financial Corporation (as of December 31, 2014) Consent of KPMG LLP dated February 23, 2015 Certification of the Chief Executive Officer Pursuant to Section... -

Page 127

Corporate Information -

Page 128

... Zona 1,2,4,5,6,7 Retired Vice Chairman, U.S. Bancorp Director since 2011 Advisory Committee - TCF Employees Stock Purchase Plan 2 Audit Committee 1 3 4 BSA and Compliance Committee Compensation, Nominating and Corporate Governance Committee Executive Committee Finance Committee 7 Risk Committee... -

Page 129

... Senior Vice President and Director of Talent Management Gloria J. Charley Retail Lending Managing Director Mark W. Rohde TCF Equipment Finance President and Chief Executive Officer William S. Henak TCF Commercial Finance Canada, Inc. President Peter D. Kelley Executive Vice Presidents Robert... -

Page 130

... Finance, Corporate Development & Administration Executive Vice President and Chief Financial Officer Michael S. Jones Enterprise Risk Management Chief Risk Officer James M. Costa Funding & Information Technology Vice Chairman and Executive Vice President Craig R. Dahl Executive Vice Presidents... -

Page 131

...) Executive Offices TCF Financial Corporation 200 Lake Street East Mail Code: EX0-03-A Wayzata, MN 55391-1693 (952) 745-2760 Stockholder Information Michigan Traditional Branches Metro Detroit Area (51) Trading of Common Stock The common stock of TCF Financial Corporation is listed on the New York... -

Page 132

... are nonGAAP ï¬nancial measures and are viewed by management as useful indicators of capital levels available to withstand unexpected market or economic conditions, and also provide investors, regulators, and other users with information to be viewed in relation to other banking institutions. -

Page 133

... free access to TCF investor information, news releases, investor presentations, quarterly conference calls, annual reports and SEC filings. Information may also be obtained, free of charge, from: TCF Financial Corporation Corporate Communications 200 Lake Street East Mail Code: EX0-01-C Wayzata, MN... -

Page 134

...capitalized, principled bank that gathers core deposits and lends under the fundamental concept of diversification that enables us to consistently achieve superior returns for our employees, customers Values Be NIMBLE Be PRUDENT Lead with INTEGRITY Build RELATIONSHIPS Create OPPORTUNITIES Win as... -

Page 135

TCF Financial Corporation 200 Lake Street East, Wayzata, MN 55391-1693 tcfbank.com TCFIR9359